At the Morgan Stanley (NYSE:MS) Financials Conference in New York on Wednesday, Citigroup’s (NYSE:C) chief financial officer, John Gerspach, announced the company’s latest outlook for the second quarter. The bank expects second-quarter 2018 trading revenues to be “flattish” year over year.

Notably, equities business is expected to be strong, whereas disappointment will likely be experienced in fixed income business.

"From a trading revenue point of view, at the end of the first quarter, what we've indicated was that we would expect a normal seasonal slowdown in the second quarter. I'd say that, that is exactly what we're seeing right now in the results. That should mean then that we'll basically have flattish trading revenues," Gerspach said at the conference.

On the cost front, more cost savings are anticipated in consumer banking operations in 2019 and 2020, as compared with the projections outlined in July 2017 at the bank's investor meeting. "In consumer, there is likely to be some upside," Gerspach added.

"More and more customers, they really want to interact with us digitally from mobile platforms," which reduces the cost to serve accounts,” he noted.

Two weeks ago, echoing similar sentiments, at the 2018 Deutsche Bank (DE:DBKGn) Eighth Annual Global Financial Services Conference in New York, top executives of Bank of America (NYSE:C) and JPMorgan (NYSE:JPM) hinted at the companies’ bleak Q2 outlook.

At the conference, Brian Moynihan — chief executive officer at BofA — stated that the company’s trading income is projected to be flat year over year in the second quarter, however, things might turn around, depending on activities in June.

At the same conference, Daniel Pinto, JPMorgan’s head of corporate and investment banking mentioned, “Overall, markets revenue as we see it today will be flat year on year.” “The core activities will be up let's say mid single digits. Then we have a series of one-offs that overall take that back down to flat,” Pinto had noted.

Our Viewpoint

An improving economic backdrop and optimism surrounding the interest-rate hike, easing of regulations and the tax reform are supporting banks’ financials. Though banks are expected to remain under pressure due to lackluster fixed-income trading activities in the near term, cost-containment efforts are noticeable.

Nonetheless, banks are skeptical for the current quarter on global market turmoil and uncertainty of markets.

Currently, Citigroup carries a Zack Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

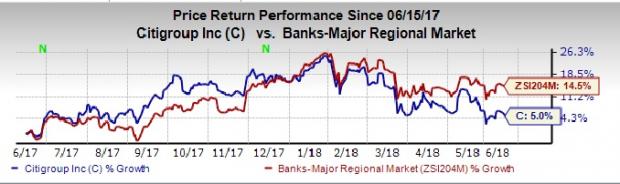

Shares of Citigroup have gained around 5% over the past six months compared with the increase of 14.5% recorded by the industry.

A better-ranked finance company — Fifth Third Bancorp (NASDAQ:FITB) — with a Zacks Rank #1 (Strong Buy) is worth considering. In the past 60 days, the bank’s 2018 earnings estimates moved 6.4% upward. Also, its share price jumped 22.3% in the past year.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

Fifth Third Bancorp (FITB): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

Bank of America Corporation (NYSE:BAC): Free Stock Analysis Report

Original post

Zacks Investment Research