Citigroup (NYSE:C) continues to tempt and tease longer term investors, as the consilidation phase of price action which began at the start of the year shows no sign of abating just yet with some key levels now building.

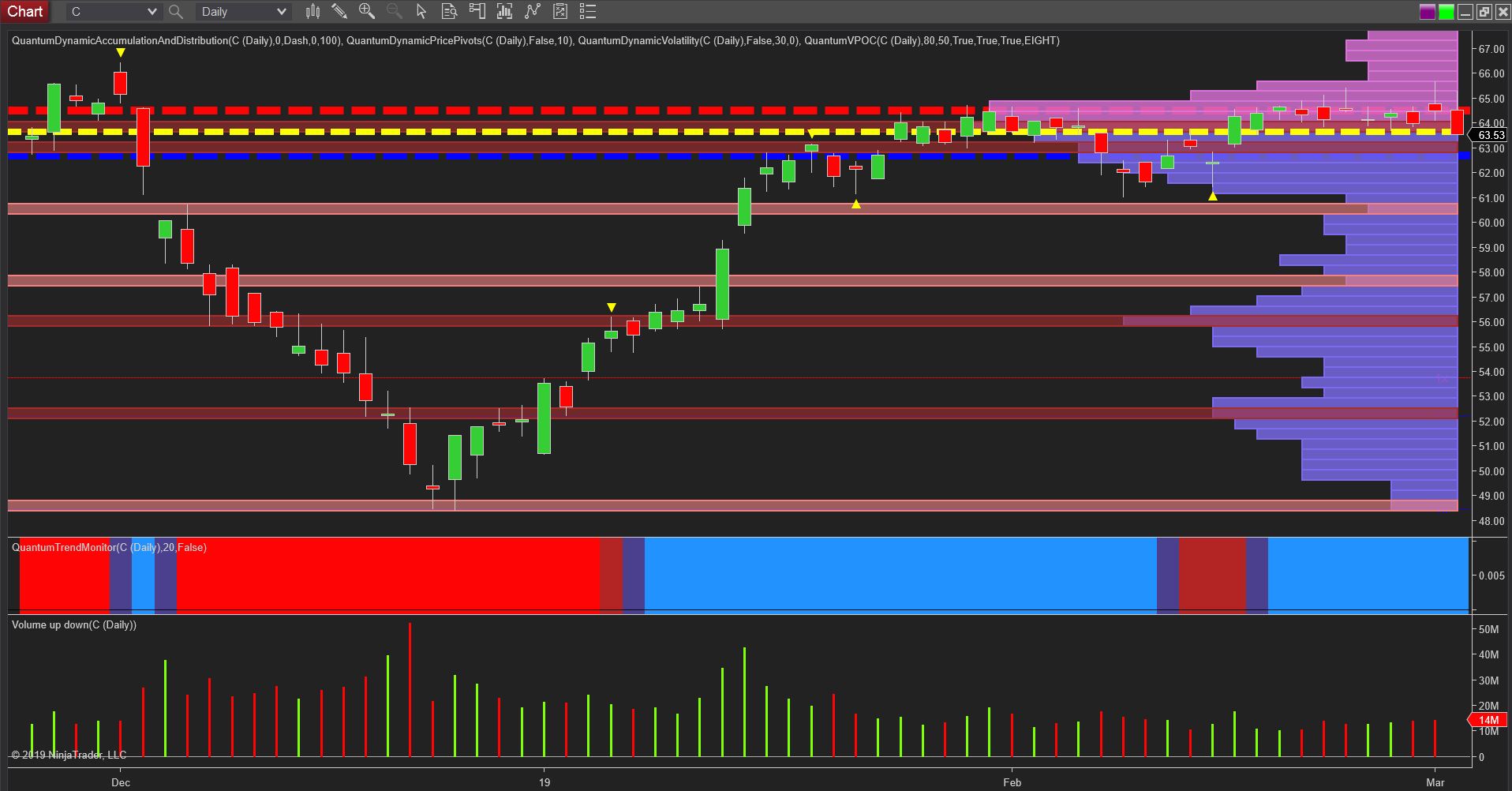

The latter part of 2018 was one to forget for financials in general with December seeing the stock price for Citigroup fall from the highs of $66.46 per share to touch a low of $48.48 before the buyers stepped in once more. Since then the price has recovered strongly to currently trade at $63.70 at time of writing. However, several key levels are now in place and likely to define the future for the stock. First we have the volume point of control which is anchored in the $63.70 area with volume building as price agreement continues as denoted with the yellow dash line. Then above and below we have two strong regions of price resistance and support. The resistance area is shown by the red dashed line in the $64.50 area on the accumulation and distribution indicator, and which has been tested repeatedly over the last few weeks.

Equally to the downside a strong platform of support has also been built and denoted with the blue dashed line in the $62.80 area – so a very tight price channel. Patience is now required as we wait for bearish or bullish sentiment to be established and supported by volume on the breakaway. The trend monitor continues to remain firmly bullish, and for any move higher, the $65.50 level needs to be breached with good volume. Note also how the volumes have attenuated for both buyers and sellers since the start of the year, and for any move higher we need to see rising volume and rising price to confirm the move.