Networking equipment giant Cisco Systems (NASDAQ:CSCO) posted solid fiscal Q1 numbers late today, but its surprsingly weak forecast sent shares significantly lower.

The San Jose-based company reported Q1 adjusted net income of $0.61 per share, beating out analysts’ $0.59 estimate by two cents. Revenues fell 2.6% from last year to $12.35 billion, also edging out Wall Street’s view of $12.33 billion.Cisco noted that product revenue was down 1% in the latest period, which was more than offset by a 7% rise in service revenue. Geographically, revenue in the Americas fell 1%, EMEA was flat, and APJC rose 6%.Product revenue performance was led by Security and NGN Routing which increased 11% and 6%, respectively. Switching decreased 7%, Collaboration and Data Center each decreased 3%, and Wireless and Service Provider Video each decreased 2%.Deferred revenue rose 12% to $17 billion, helped mainly by subscription-based and software offerings. Deferred service revenue also saw strong growth, up 8%. Non-GAAP total gross margin was 65.2%, up from 64.5% in the first quarter of fiscal 2016.Looking ahead, Cisco issued weaker-than-expected second quarter earnings guidance of $0.55 to $0.57 per share, which would miss Wall Street’s $0.59 estimate. Q2 revenues are expected to fall 2% to 4% to a range of $11.27 to $11.51 billion. That would also fall very short of analyst expectations of $12.15 billion.The company commented via press release:

“We had a good quarter despite a challenging global business environment and we performed well in our priority areas… We executed well in Q1 delivering profitable growth, and saw strong adoption of our subscription-based and software offerings as we transition our business to a more recurring revenue model.”

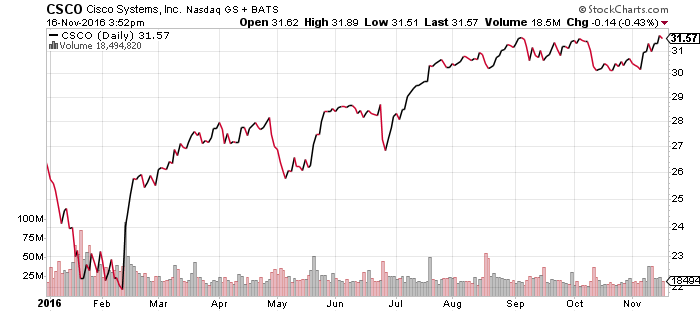

Cisco shares fell $1.47 (-4.66%) to $30.10 in after-hours Wednesday trading. Prior to today’s report, CSCO had gained 16.31% year-to-date.