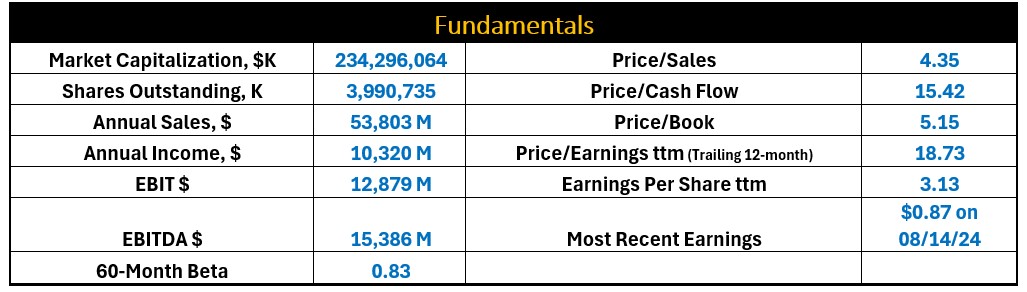

Cisco Systems (NASDAQ:CSCO), Inc. engages in the design, manufacture, and sale of Internet Protocol-based networking products and services related to the communications and information technology industry.

The firm operates through the following geographical segments: the Americas, EMEA, and APJC. Its products include the following categories: Secure, Agile Networks, Internet for the Future, Collaboration, End-to-End Security, Optimized Application Experiences, and Other Products.

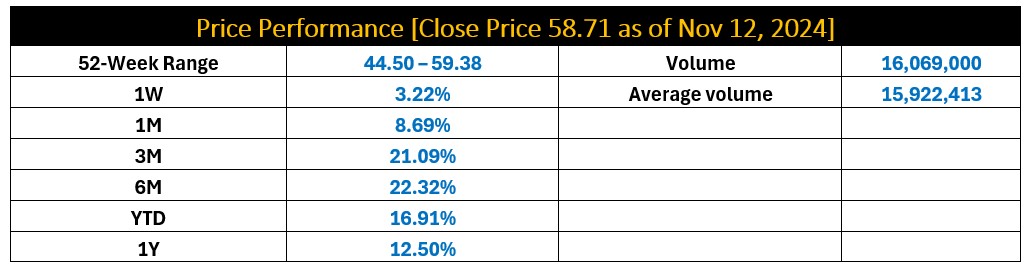

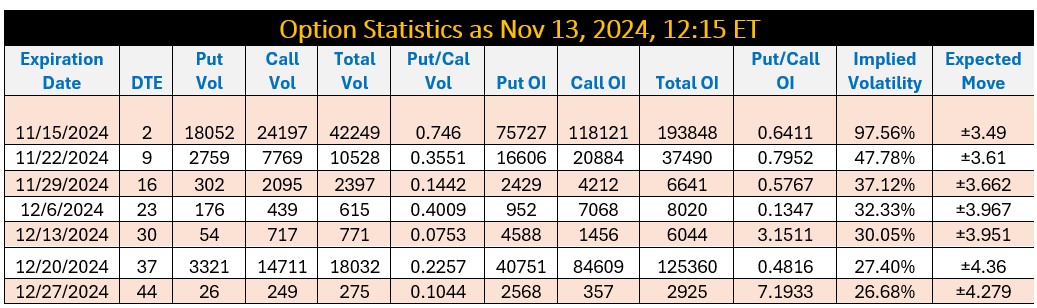

CSCO Q3 2024 reports earnings at 4:05 pm Tuesday, Nov 13, 2024

Key Highlights:

- Cisco’s subscription revenues are more than half of its total revenues.

- Splunk (NASDAQ:SPLK) acquisition enhances its recurring revenue base.

- Investors will be focusing on recovery in networking in enterprise & SP markets, AI orders, Splunk integration and security transformation.

Technical Analysis Perspective:

- CSCO penetrated symmetrical triangle formation last month to begin a sharp rally.

- Symmetrical triangle forms five legs within, shown on the following chart as 1, 2, 3, 4 & fifth is the breakout point.

- A rise to 62.50 to 64 is on the way as long as 54/53 support remains intact post earnings.

- Long-term target of the triangle breakout is sitting between 80 – 85 in the next few months.

- Stock may dip to 54/53 before moving higher on any earning surprise.

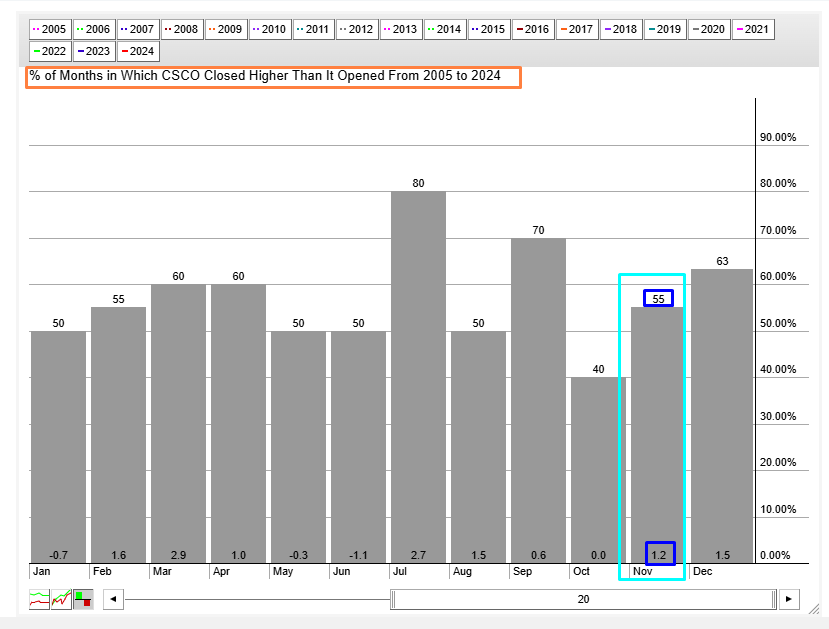

- CSCO 18 years seasonality suggests that it closes 1.2% higher in November 55% of the time.

Conclusion:

November 13 earnings are a good catalyst for more rallies in CSCO targeting 62.50 to 64 level in the short term provided 54/53 support remains intact on daily close basis post earnings.