Cisco Systems, Inc. (NASDAQ:CSCO) just released its fourth-quarter and full-fiscal year 2017 financial results, posting earnings of $0.55 per share and revenues of $12.13 billion. Currently, Cisco is a Zacks Rank #3 (Hold), and is down 2.60% to $31.50 per share in after-hours trading shortly after its earnings report was released.

Cisco Systems, Inc. (CSCO):

Met earnings estimates. The company posted earnings of $0.55 per share (which excludes $0.07 from non-recurring items), matching the Zacks Consensus Estimate of $0.55 per share,

Met revenue estimates. The company saw revenue figures of $12.13 billion billion, meeting our consensus estimate of $12.13 billion.

Cisco reported that its total fourth-quarter revenues were down 4% year-over-year, while product revenue dipped by 5% from the year-ago period. The company’s revenues in North and South America dropped by 6%.

Cisco’s quarterly earnings fell by 3% year-over-year. The company’s quarterly operating cash flow rose 5% from the year-ago period to $4 billion.

The San Jose, California-based company reported full-year fiscal 2017 revenue of $48 billion, which marked a decrease of 2% from fiscal 2016.

Cisco’s reported full-year fiscal 2017 GAAP earnings $1.90, which is flat from full-year fiscal 2016. On a non-GAAP basis the company’s earnings rose 1% to $2.39 a share.

Cisco projects that its first-quarter 2018 revenues will decline between 1% and 3% year-over-year. The company expects GAAP earnings of $0.48 a share to $0.53 a share and Non-GAAP ESP of $0.59 to $0.61.

"We had another strong quarter and a transformative year,” CEO Chuck Robbins said in a statement.

“We made tremendous progress transitioning our business to more software and recurring revenue and delivered on our commitment to accelerate innovation in our core and across the portfolio," "The network has never been more critical to business success and we are building the network of the future."

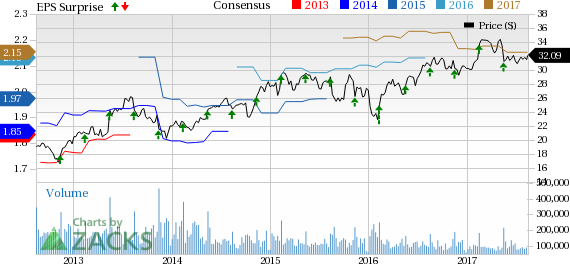

Here’s a graph that looks at Cisco’s Price, Consensus and EPS Surprise history:

Cisco Systems, Inc. is the worldwide leader in networking for the Internet. Cisco's Internet Protocol-based networking solutions are the foundation of the Internet and most corporate, education, and government networks around the world. Cisco provides the broadest line of solutions for transporting data, voice and video within buildings, across campuses, or around the world.

Check back later for our full analysis on Cisco’s earnings report!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

Original post

Zacks Investment Research