Circle (CIRC.L:LSE) is a disruptive new entrant in the UK healthcare market, seeking to benefit from both additional NHS operating contracts and new private hospitals. It brings a partnership-style operating model and efficient, appealing, newly built facilities, supported by committed consultant volumes, to challenge an existing oligopoly in local markets. Expanding the number of Circle hospitals to drive profit growth will be greatly assisted if the cost of the third-party financing for new hospitals (and the rent that Circle pays) falls. A growing operational track record will help, but there is also a potential inefficiency in the real estate market to be corrected.

New model for independent and NHS market

In February 2012, Circle became the first private sector operator of an NHS hospital at Hinchingbrooke. The operating deficit has been substantially reduced (from an underlying c £10m to c £3.7m during the first year) while care quality measures have improved. With many NHS trusts struggling financially, Circle sees further opportunity in supporting the efficient provision of NHS treatment, targeting improved clinical outcomes at lower cost, as well as growing its differentiated new offering in the independent market. Circle is now the preferred bidder for a renewed five-year contract at its existing Nottingham NHS Treatment Centre.

Hospital build is key

Circle’s NHS contracts provide additional profits, scale and diversification, but we believe the further roll-out of independent hospitals offers the greatest potential for value creation (see page 14). Circle’s growing track record should support the convergence of real estate funding costs on those of established operators, making this possible. We would also expect real estate investors to develop structures (eg specialist funds) to exploit the pricing differential that exists between the UK and other established markets (eg US), as well as the pricing differential between Circle’s newly built and efficient hospital assets and those of established operators. Circle notes an increasing appetite in the financing markets for the planned CircleManchester hospital.

Valuation

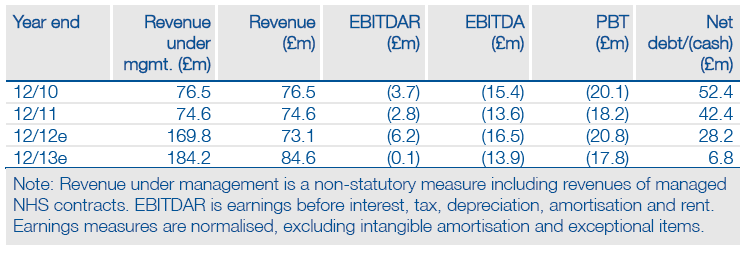

The start-up phase is difficult to value, but more hospitals with lower rents increases the valuation significantly. Assuming a 6.0% rental yield, similar to the funding costs of peers, we estimate each new hospital adds c 19p per share (net of the 50% minority) and that a fair value of £2.0, after central costs, requires c 10 independent hospitals (two in current forecasts), alongside the two existing NHS operating contracts.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Circle: A New model For Independent And NHS Markets

Published 03/10/2013, 04:40 AM

Updated 07/09/2023, 06:31 AM

Circle: A New model For Independent And NHS Markets

To build or not to build?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.