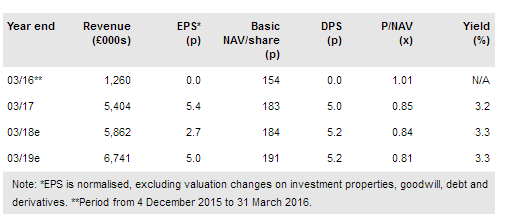

Circle Property PLC (LON:CRC) is an investor in regional UK commercial real estate, founded in 2002 and quoted on AIM since February 2016. It focuses on obtaining assets with good underlying characteristics at attractive prices, whose value can be increased through refurbishment, changes of use and other active asset management initiatives. The experienced executive team takes a hands-on approach and develops an individual management plan for each asset, minimising voids and maximising income and value. The current portfolio of £93m generates annual rents of £5.7m, supporting a c 3% prospective dividend yield, and gave an 18.1% NAV return in FY17.

Finding overlooked value…

The management team seeks to acquire properties with short lease terms remaining, and therefore at low valuations, but which have the potential either for re-leasing on more attractive terms or refurbishment and then re-leasing. In this way it has established a portfolio with a weighted average unexpired lease term of more than seven years, producing recurring rents of £5.7m, and which is valued at £93m having been acquired and improved for a total cost of only £69m. The biggest asset in the portfolio, by value, area and income, is a campus of office buildings and a conference centre near Milton Keynes, which was acquired for £11m in 2013 but is now valued at £32m, demonstrating Circle’s ability to identify and add value.

To read the entire report Please click on the pdf File Below: