Circadian’s FY13 results show steady progress in developing its portfolio of cancer, ophthalmic and diagnostic projects. The Ceres cancer subsidiary’s VGX-100 completes its Phase I dose ranging and safety trial in mid Q4. This should enable a planned lymphoedema study to start in Q114. The ophthalmic subsidiary, Opthea, is seeking investment for VGX-300 in wet age-related macular degeneration (AMD) with trials perhaps from 2015. Cash on 30 June was A$11m. Management has indicated that a A$5-8m FY14 cash burn is planned; the outcome depends on tax refunds.

Targeting VEGF-C in cancer and ophthalmology

Ceres Oncology (Circadian’s cancer company) is developing VGX-100, a monoclonal antibody against VEGF-C. Final Phase I dose escalation data is due in mid Q4. Ceres plans to start a secondary lymphoedema trial in H114. This indication has a fast interim read-out by mid 2014 (with a follow-up phase) and can be run by Circadian. It might pave the way for a mid 2014 trial in Glioblastoma (GBM) and from late 2014 in ovarian cancer. Opthea (the ophthalmic subsidiary) is focused on VGX-300, for AMD. The AMD market grew to US$2.6bn in 2012. However, VGX-300 needs funding and Phase II trials are unlikely before 2015. In diagnostics, the FDA may grant approval to the VEGF-D diagnostic test in 2014. A software algorithm for genetic cancer diagnosis is in beta stage testing.

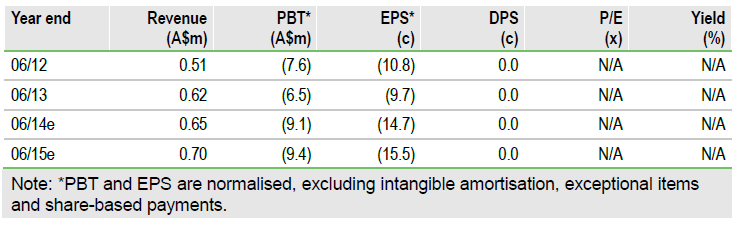

FY 13 financials and FY14 outlook

Full year figures to 30 June showed royalties and fees of A$0.62m, up 21%, with a A$1.56m tax rebate reported. Operating cash use was A$8.2m with net cash use of A$5.4m after interest, other income and a cash tax refund of A$1.3m. Circadian also sold A$0.6m of shares held as investments. The June cash position was A$11.0m. The net FY14 cash burn is projected by management at A$5-8m giving Circadian over 12 months of funding. The range depends on trial costs and the extent of any further tax rebates. Cash is sufficient into FY15 and can fund the VGX-100 lymphoedema Phase II study.

Valuation: Deals and funding

The unchanged valuation assumes a mid-2014 deal on VGX-100 with no dilutive external funding. Opthea has been valued on the basis of a 2014 deal at 50% probability with a 25% external investor equity stake. This gives a total NPV of A$1.93 share, but investors need to be aware that the risk of additional dilution (amount, price and timing) is hard to quantify as either Circadian overall or its individual subsidiaries might be funded. Diagnostic sales might become significant during FY14.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Circadian Technologies

Awaiting deals and funding

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.