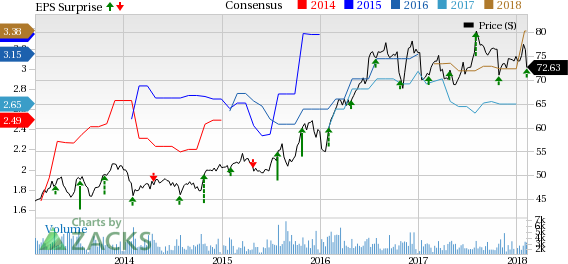

Cincinnati Financial Corporation (NASDAQ:CINF) reported fourth-quarter 2017 operating income of 93 cents per share, beating the Zacks Consensus Estimate of 86 cents by 8.1%. Also, the bottom line improved 24% year over year, mainly on higher revenues and a solid segmental performance.

Including net realized investment loss of 4 cents per share and effects of the U.S. tax reform legislation of $2.99, the company’s net income skyrocketed 546.7% year over year to $3.88.

Full-Year Highlights

For 2017, Cincinnati Financial reported operating income per share of $2.74, surpassing the Zacks Consensus Estimate by 3.4% but deteriorating 10.7% year over year.

Total operating revenues of $5.6 billion grew 4.9% year over year.

Operational Update

Total operating revenues in the quarter were $1.4 billion, up 5.2% year over year. The top-line growth was driven by 5.5% higher premiums earned and a 1.9% rise in investment income.

Total benefits and expenses of Cincinnati Financial increased 2.5% year over year to $1.2 billion, primarily due to higher underwriting, acquisition and insurance expenses.

Combined ratio — a measure of underwriting profitability — improved 330 basis points (bps) year over year to 92.9%.

Cincinnati Financial had 1,702 agency relationships as of Dec 31, 2017 compared with 1,614 as of Dec 31, 2016.

Quarterly Segment Update

Commercial Lines Insurance: Total revenues of $798 million grew 2.2% year over year. This upside was primarily driven by an increase in premiums earned. The company delivered an underwriting profit of $58 million, having soared 61.1% from the year-ago quarter. Combined ratio also improved 280 bps year over year to 92.9%.

Personal Lines Insurance: Total revenues of $321 million rose 7.7% year over year owing to a noticeable increase in premiums earned. The segment incurred an underwriting profit of $16 million, comparing favorably with the year-ago loss of $12 million. Moreover, combined ratio improved 890 bps year over year to 95.5%.

Excess and Surplus Lines Insurance: Total revenues of $56 million increased 19.1% year over year, driven by higher premiums earned. The segment’s underwriting profit slumped 45% year over year to $11 million. Also, combined ratio deteriorated 2110 bps year over year to 79.8%.

Life Insurance: Total revenues of $100 million improved 4.2% year over year. Total benefits and expenses increased 16.7% year over year to $84 million.

Financial Update

As of Dec 31, 2017, Cincinnati Financial had assets worth $21.8 billion, up 7.1% from the 2016-end level.

Cincinnati Financial’s debt-to-capital ratio was 9.0% as of Dec 31, 2017, reflecting a slight improvement from 10.3% at the end of 2016.

As of Dec 31, 2017, Cincinnati Financial’s book value per share was $50.29, up 17.1% from Dec 31, 2016.

Zacks Rank

Cincinnati Financial holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other P&C Insurers

Among other players from the same space having reported fourth-quarter earnings so far, the bottom line of The Progressive Corporation (NYSE:PGR) , The Travelers Companies, Inc. (NYSE:TRV) and RLI Corp. (NYSE:RLI) outpaced the respective Zacks Consensus Estimate.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

RLI Corp. (RLI): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

Cincinnati Financial Corporation (CINF): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Original post

Zacks Investment Research