Cincinnati Bell Inc. (NYSE:CBB) reported mixed financial numbers in the second quarter of 2017. While the top line surpassed the Zacks Consensus Estimate, the bottom line fell below the same.

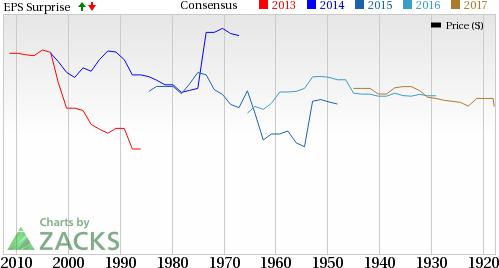

On a GAAP basis, quarterly net loss came in at $0.5 million or a loss of a penny per share compared with a net income of $75 million or $1.78 per share in the year-ago quarter. However, quarterly adjusted (excluding special items) earnings per share were 7 cents, which missed the Zacks Consensus Estimate by a penny.

Quarterly total revenue of $294 million was down 2% year over year beating the Zacks Consensus Estimate of $290 million.

Operating income was $20.9 million compared with $27.4 million in the year-ago quarter. Meanwhile, adjusted EBITDA (earnings before interest, depreciation and amortization) increased 8.2% year over year to $77.2 million in the reported quarter. Adjusted EBITDA margin was 26%, flat year over year.

Cash Flow

In second-quarter 2017, Cincinnati Bell generated $69 million of cash from operating activities compared with $32.2 million in the prior-year quarter. Quarterly free cash flow was $20.8 million compared with a negative $24.6 million in the year-ago quarter.

Liquidity

Cincinnati Bell ended the second quarter of 2017 with cash and cash equivalents of $58.2 million compared with $9.7 million at the end of 2016. Total debt at second quarter-end was $1,126.9 million compared with $1,206.6 million at the end of 2016.

Segmental Results

Entertainment and Communications revenues rose 5% year over year to $201.4 million owing to a 20% rise in consumer video and 40% rise in business video revenues. The increase was partially neutralized by a 33% decline in services & other revenues.

IT Services and Hardware revenues decreased 13% year over year to $96 million. The downside was due to a 35% decline in Management and Monitoring revenues, 20% decline in Professional services revenues, partially mitigated by a 39% rise in unified communications revenues.

Subscribers Statistics

At the end of the second quarter of 2017, Cincinnati Bell had 0.1919 million residential voice lines, down 4.7% year over year and 0.3235 million business voice lines, up 0.3% year over year. Long distance lines were 0.3043 million, down 4.1%. DSL internet subscribers were 0.093 million, down 11.9%. Fioptics internet customers were 0.2141 million, up 8.4%. Fioptics video subscribers were 0.1428 million, up 3.8% year over year.

Outlook

In 2017, Cincinnati Bell expects revenues and adjusted EBITDA of approximately $1.2 billion and $295 million (+/- 2%), respectively.

Cincinnati Bell has a Zacks Rank #4 (Sell). The company is transforming itself from a legacy copper-based telecom operator to an IT company with contemporary fiber assets, offering flexible data, video, voice and IP solutions to both consumers and business customers. Better-ranked companies in this league are CenturyLink Inc. (NYSE:CTL) , Level 3 Communications Inc. (NYSE:LVLT) and Frontier Communications Corp. (NASDAQ:FTR) . All three stocks currently carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Level 3 Communications, Inc. (LVLT): Free Stock Analysis Report

Cincinnati Bell Inc (CBB): Free Stock Analysis Report

CenturyLink, Inc. (CTL): Free Stock Analysis Report

Frontier Communications Corporation (FTR): Free Stock Analysis Report

Original post

Zacks Investment Research