Cincinnati Bell Inc. (NYSE:CBB) reported disappointing financial numbers in the fourth quarter of 2017 wherein both the top and bottom line missed the Zacks Consensus Estimate.

On a GAAP basis, quarterly net loss came in at $18.8 million or a loss of 45 cents per share, wider than the net loss of $3.9 million or a loss of 9 cents per share in the year-ago quarter. Further, quarterly adjusted (excluding special items) loss per share was 18 cents, in contrast to the Zacks Consensus Estimate of earnings of 6 cents.

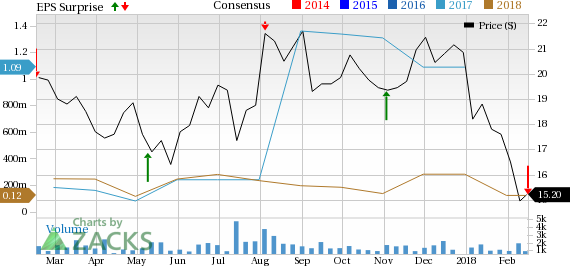

Cincinnati Bell Inc Price, Consensus and EPS Surprise

Quarterly total revenues of $427.1 million were up a whopping 50% year over year. However, the figure lagged the Zacks Consensus Estimate of $466.5 million.

Operating income was $9.8 million compared with $10.5 million in the year-ago quarter. Adjusted EBITDA (earnings before interest, depreciation and amortization) increased 5.7% year over year to $78.4 million in the reported quarter. However, adjusted EBITDA margin was 18% compared with 26% in the year-ago quarter.

Cash Flow

In fourth-quarter 2017, Cincinnati Bell generated $46.6 million of cash from operating activities compared with $27.4 million in the prior-year quarter. Quarterly free cash flow was a negative $15.7 million compared with a negative $70.2 million in the year-ago quarter.

Liquidity

Cincinnati Bell ended 2017 with cash and cash equivalents of $396.5 million compared with $9.7 million at the end of 2016. Total debt at the end of 2017 was $1,747.7 million compared with $1,206.6 million at the end of 2016.

Segmental Results

Entertainment and Communications revenues increased 2% year over year to $197 million owing to a 22% rise in business voice and 17% rise in consumer data revenues. The increase was partially neutralized by a 12% decline in services & other Carrier revenues.

IT Services and Hardware revenues increased a massive 144.3% year over year to $233.3 million. The upside can be attributed to a 98% rise in Professional Services revenues, 38% increase in Unified Communications revenues, partially offest by a 30% drop in Management and Monitoring revenues.

Subscribers Statistics

At the end of 2017, Cincinnati Bell had 0.1837 million residential voice lines, down 8.7% year over year and 0.3331 million business voice lines, up 3.3% year over year. Long distance lines were 0.2936 million, down 7.5%. DSL Internet subscribers were 0.0821 million, down 22.3%. Fioptics Internet customers were 0.2266 million, up 14.7%. Fioptics video subscribers were 0.1465 million, up 6.5% year over year.

Outlook

In 2018, Cincinnati Bell expects revenues to be in the range of $1.200 - $1.275 million and adjusted EBITDA will be within the range of $320 - $330 million.

Zacks Rank

Cincinnati Bell is aregional telecom operator like Windstream Holdings Inc. (NASDAQ:WIN) , Frontier Communications Corp. (NASDAQ:FTR) and CenturyLink Inc. (NYSE:CTL) . The company carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Cincinnati Bell Inc (CBB): Free Stock Analysis Report

CenturyLink, Inc. (CTL): Free Stock Analysis Report

Windstream Holdings, Inc. (WIN): Free Stock Analysis Report

Frontier Communications Corporation (FTR): Free Stock Analysis Report

Original post

Zacks Investment Research