Cincinnati Bell Inc. (NYSE:CBB) is a leading regional diversified telecom and technology service provider to both residential and business customers. The company operates through three segments: Wireline, IT Services & Hardware and Wireless.

Cincinnati Bell continues to experience erosion in high-margin local access lines. Expansion and maintenance of its networks require significant capital expenditures. Intense competition in the company’s operational region can be a drag on the company’s pricing power, thereby inducing downward pressure on its margins.

Moreover, in third-quarter 2017, the company’s performance in certain operting metrics was quite disappointing. We expect the company to recover from these factors in the to-be-reported quarter.

However, we appreciate Cincinnati Bell’s efforts to transform itself from a telecom company into a technology company with fiber assets offering flexible data, video, voice and IP solutions to consumers and business clients.

Cincinnati Bell currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. The company has generated a positive average earnings surprise of a whopping 61.46% in the previous four quarters. We have highlighted some of the key stats from this just-revealed announcement below:

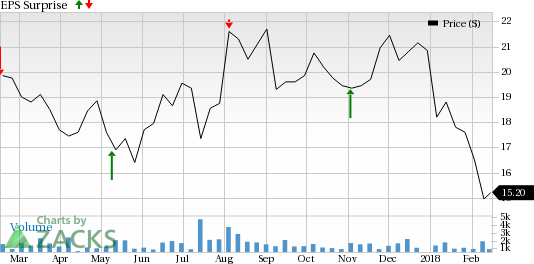

Earnings: Cincinnati Bell lags Q4 2017 earnings. Our consensus estimate called for adjusted earnings per share of 6 cents while the company reported adjusted loss per share (EPS) of 18 cents. Investors should note that these figures take out stock option expenses.

Revenue: Cincinnati Bell reported total revenues of $427.1 million missing our consensus estimate of $466.5 million.

Key States to Note: At the end of 2017, Cincinnati Bell had 0.1837 million residential voice lines, down 8.7% year over year and 0.3331 million business voice lines, up 3.3% year over year. Long distance lines were 0.2936 million, down 7.5%. DSL Internet subscribers were 0.0821 million, down 22.3%. Fioptics Internet customers were 0.2266 million, up 14.7%. Fioptics video subscribers were 0.1465 million, up 6.5% year over year.

Cincinnati Bell Inc Price and EPS Surprise

Check back later for our full write up on this Cincinnati Bell earnings report later!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Cincinnati Bell Inc (CBB): Free Stock Analysis Report

Original post