As a general rule, the most successful man in life is the man who has the best information

Cielo Waste Solutions (CSE:CMC) is delivering on its promise to build its first commercial-grade renewable diesel refinery. Construction is well underway at its High River facility – proving that its proprietary technology will be able to convert multiple different waste feed-stocks, including landfill waste, into high-grade, renewable diesel has moved the company from demonstration to commercial stage.

Vancouver-based Cielo has extended its private placement offering of units, to accommodate additional subscribers. The private placement has so far raised $2,283,236 for moving its development forward. A private lender has also signed a Term Sheet with Cielo extending the Company a $3.5 million line of credit. Currently, Cielo and the company are working thru the paperwork to get the credit facility finalized. The 356-litre-an hour continuous flow refinery that Cielo is currently building is a retrofit of a 50-litre-an-hour batch process demonstration plant, which the company and its license provider have been using as a test facility.

“We continue to make significant progress retrofitting our demonstration plant into our first commercial waste to energy refinery that is being constructed on our High River property. Closing this tranche of funding brings us that much closer to being in a position to commission our first refinery that is engineered to produce high-grade renewable diesel.” Cielo President and CEO Don Allan said in their Sept. 22 Press Release.

Once the first refinery is operational, Cielo anticipates it will start the initial work on a second plant at High River which will be built to produce renewable diesel at a rate of 1,800 litres an hour, a 500% increase from the Company's proof of concept retrofitted demonstration plant. The third phase will be an expansion to an identified property in close proximity to the Edmonton Waste Management Centre, where up to 20 additional mini-refineries can be built.

Allan embarked on a journey to produce renewable diesel several years ago when he was asked to figure out a way to make an ammonia plant in High Prairie, Alberta, economical. At the time the plant was buying feedstock gas at around triple its break-even point. Allan hit upon the idea of retrofitting the ammonia plant using a hydrogen reformer to upgrade10,000 BPD of 8-10 API oil to 18 API oil per day, thereby allowing the region's heavy oil to move to market via a nearby pipeline. But after two years of due diligence the ROI was predicted to be very low - the capex was climbing and the project no longer made sense - so Allan decided to try something else. He and a group of engineers looked at about 200 different refining technologies, and eventually pared those down to 20. Among them was a technology that used a catalyst to turn landfill garbage into diesel fuel.

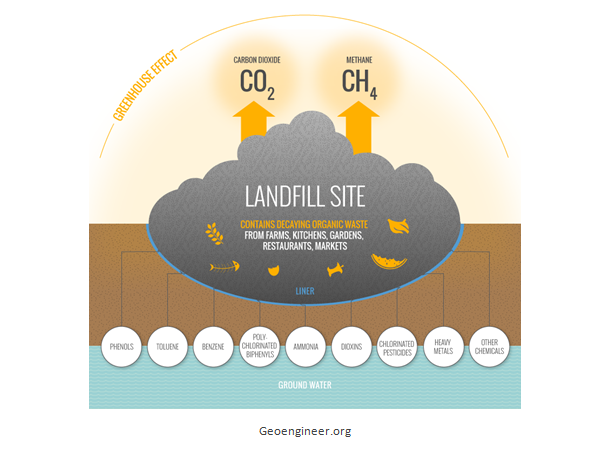

Cielo's renewable or “green” diesel can be made by blending any fibrous material with a proprietary catalyst and then heating it thru its patent pending process. Eligible feedstock materials include landfill waste, all types of plastics, organics like table scraps or lawn clippings, cardboard, wood-waste and tires.

“We can walk into a landfill, and work with operators that have a recycling component built into their operation. They’ll take out the stuff that they can make money on like the metals, the copper, the glass, the plastics, the rocks and the dirt, leaving us everything else to process into high grade renewable diesel. We can actually quantify that we can get rid of over 80% of what’s currently going into landfills,” said Allan.

For sawdust or hog fuel, the material just needs to be chipped down to a two-inch-sized particle, then it’s ground into a fine powder.

“The catalyst is the key to this whole thing. Our competition’s technology can take 6 to 12 hours to turn their feedstock into diesel. Ours is instantaneous. It can happen within 12 to 18 seconds, so it happens right in front of your eyes.”

While other companies make biodiesel in Canada, their product is limited by its water content. In cold climates diesel mixed with water freezes, clogging up the fuel lines of equipment that use it, rendering the equipment, like tractors and highway vehicles, useless. Cielo’s technology gets rid of the water entirely, which means that its product can be used year-round in Canada, or other cold weather countries, versus traditional biodiesel which can typically only be used during months when the temperature is above -10C.

Two other competitive advantages are key. Cielo can purchase their waste feedstocks for around $0.04 a liter versus $0.65 to $1.35 that other biodiesel refineries pay for their inputs which include canola, soybeans, animal tallow or discarded cooking grease from restaurants. Furthermore, as progression continues Cielo may have the opportunity to charge a tipping fee for their feedstock (another source of potential revenue).

Also, unlike competing technologies that use plastics to make biodiesel, Cielo's technology is able to use “dirty” plastics whereas other technologies reject contaminated plastics which could be as benign as a cigarette butt in a plastic drinking bottle. Most of those technologies can only use two types of plastics out of the seven types manufactured today; Cielo can use all seven plastics.

For its product Cielo is targeting Alberta gasoline and diesel refiners, of which there are currently about half a dozen. But the Company has much higher ambitions than that. The game-plan is to replace as much biodiesel as possible that is currently imported into Canada, about 650 million liters a year, with its high-grade renewable fuel, thereby providing refineries with the means to meet Canada's Renewable Fuels Regulations, which require fuel producers and importers to have an average renewable diesel fuel content of between 2% and 6% depending on the province.

Beyond Canada, Cielo will target refineries around the world, with the goal of offsetting landfills and other wastes with “green” renewable high grade diesel.

Michael Yeung, Cielo’s VP of Bus. Dev. & Capital Markets, recently went into detail with Ahead of the Herd on Cielo’s investment thesis, noting that while some investors think of Cielo as a resource company (its roots are in the oil patch), the reality is that Cielo is a technology company. The primary difference being that resource companies are evaluated on the basis of how effectively they are able to calculate and mine, or drill, a depleting resource, whereas Cielo’s resource is not only not depleting, it’s virtually unlimited and growing. “As a result of the hurricane in Houston alone there’s projected to be an additional 15 million tons of extra garbage that needs to be disposed of. That represents the potential of another sixty 2,000-liter/hr refineries that Cielo could build there and operate for 10 years without running out of feedstock,” said Yeung. “The key is that our resource is based on waste, which isn’t depleting or limited but growing every year. The projection is that waste (garbage) over the next seven to 10 years our supply of garbage will double.”

Yeung gave the example of recent natural disasters such as flooding in Texas and hurricanes in the Caribbean and southern United States as only adding to the 90,000 pounds of trash the average North American will throw away in his or her lifetime. “What we're saying is that we hold the key to take that garbage. Society doesn’t have a solution for it currently. With more and more natural disasters happening around the world, we get more and more garbage.”

Still, while Cielo is clearly providing an interesting and novel way to deal with the problem of landfills by essentially refining landfill contents into fuel, investors need a way to evaluate the company, in order to make an investment decision. Like a resource company, Cielo has yet to produce a revenue stream, although Yeung predicts that is likely to happen “within months,” not years. But unlike a mining or oil and gas-co, Cielo operates more like a tech company in that the technology is new, and its effects on the market are still unknown, so traditional valuations don’t apply.

The usual cash-flow multiple model of comparing one company’s cash flow to market value multiple against another doesn’t work; firstly, because there are no comparable companies, and secondly, as of yet, no cash flow. Competing biodiesel companies in Canada are not making an equivalent product, and they all receive government subsidies. Cielo can operate subsidy-free, making any comparison misleading. Nor is it possible to peg a traditional net present value on the company which, for a mining company, is derived from the resource estimate then factors in commodity prices and a discounted cash flow model. Cielo has no resources to mine and its “commodities” – landfill waste – are feedstocks that produce renewable diesel, not cash. The derivatives of renewable diesel may include cash but other uses maybe conversion to electricity for power generation as an example.

“We are not looking at valuing Cielo from a cash flow multiple perspective,” stated Yeung.“We believe that the investment propositionvalue of Cielo would be based more on an IP (intellectual property) and growth basis than other methods.”

Leo Pulverts, an early LinkedIn (NYSE:LNKD) engineer who also worked at Google (NASDAQ:GOOGL) before joining a venture capital fund, provided a few guidelines for evaluation pre-revenue generating tech companies in an article in Forbes.

“Deciding how much a start-up should be worth is like deciding how much a one-of-a-kind painting should be worth: there are guidelines to move you in the right direction, but in the end you’re basically making an educated guess,” he writes.

Some of the guidelines he suggests are:

- Founding team. Are the founders your neighbors, great engineers, or multi-millionaires like Jeff Bezos and Larry Page? The answer will influence the company’s worth.

- Expected near-term revenues. Who are the customers and how many of them are likely to become paying users?

- Growth and engagement. How much is the customer base likely to grow? Will the customers engage with the product often, or just once in a while? (more applicable to software)

- Market size. How big is the market for the product, based on number of customers and how much each contributes in revenue?

Applying these principles to Cielo gives a better indication of how much the company should be worth, versus its current (Oct. 10) $17-million market value.

Cielo’s management team has spent the last few years de-risking the technology to the point where, unlike a lot of tech companies (think Twitter, which for its first few years had no revenue source) the technology is proven.

“Investors have an ability to get into a corporation that is growing. And we've already eliminated the R&D risk for you,” said Yeung, noting that the financial risk has also been mitigated. With the final documentation of its $3.5 million credit facility, Cielo will have enough cash to build its first commercial refinery at High River, which will generate a constant revenue stream.

In terms of the market for renewable diesel, Cielo has already secured a buyer for its initial product – Elbow River Marketing, which is owned by Parkland Fuel Corporation. (TSX:PKI) The Calgary based company is Canada’s largest fuel marketer – distributing billions of litres a year of fuel and petroleum products. On Oct. 1, 2017 Parkland acquired Chevron (NYSE:CVX) Canada’s downstream fuel business in B.C. and Alberta, meaning that Parkland will be the exclusive distributor of Chevron Canada’s fuels and will also acquire its Burnaby refinery.

Looking further down the road, Yeung says Cielo has had expressions of interest in its refineries from the Middle East to St. Kits, in the Caribbean.

The numbers get really interesting when potential market penetration is realized. If 10 refineries each produce 2,000 liters an hour, with each generating revenues of $20 million a year, or roughly $10 million in EBITDA (earnings before interest, taxes, depreciation and amortization), with a conservative EBITDA multiple of only 10 it would give Cielo a market value of $1 Billion. And Cielo is planning on potentially building 20 plants on the Edmonton site alone.

How much is the market for renewable diesel expected to grow?

“The Global Advanced Biofuels Market is expected to grow from $8.64 billion in 2016 to reach $99.74 billion by 2023 with a CAGR of 41.8%.” Statistics MRC

Currently the market is driven by government mandates on fuel producers, but if the value of renewable diesel catches on with other municipalities that see it as a way to reduce or almost eliminate landfills, the demand could become very large indeed. Add to that the potential for off-take agreements with mining or large agricultural machinery companies who see the advantages of using Cielo’s renewable diesel for year-round operations. The Company says it can adjust the mixture to produce any diesel application. “By blending kerosene and high-grade diesel, we can sell into almost any market,” said Yeung. That includes power generation. For example in St. Kits, the island is looking at using lower-grade biodiesel for producing electricity, and higher grades to fuel highway vehicles, boats and airplanes.

Yeung’s message to potential Cielo investors? Now is a good time to get into the Company, with construction underway on its first commercial refinery, a proven technology, and a treasury that will carry them through to start building a second, higher-output plant.

“At the end of the day, our waste to energy technology will generate a ton of revenue fast. The recipe to our proprietary catalyst will be guarded closely and never be shared The Company is now in a position where it can be blue sky valued and not valued based on an earnings per share model. Those earnings per share will come a lot quicker than other technology companies. I see Cielo as being a quick path to being over a billion dollar corporation. Once the technology is validated that it can produce on a continuous flow basis multiple refineries can be rolled out globally.”

Conclusion

The amount of garbage humans throw away is rising fast and isn’t predicted to peak within the next 80 years. By 2100, a growing global urban population could be producing three times as much waste as it does today.

Many experts think our global trash troubles are already at a crisis level - plastic clogs the world's oceans and rivers and solid-waste management is one of the greatest costs to municipal budgets.

The threat all this garbage poses to the environment and our health and safety is massive.

Cielo Waste Solutions (CSE:CMC) should be on all our radar screens.

Is Cielo, and the elimination of landfills, on yours?

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard owns shares of Cielo Waste Solutions (CSE:CMC)and CMC is an advertiser on his site.