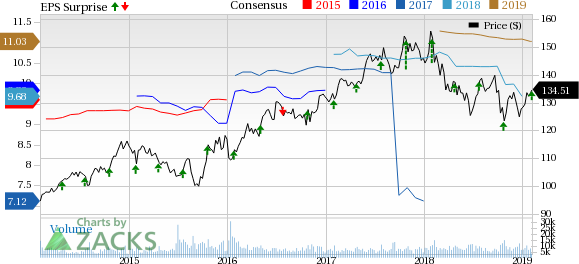

Chubb Limited (NYSE:CB) reported fourth-quarter 2018 core operating income of $2.02 per share, which outpaced the Zacks Consensus Estimate of $1.93 by 4.7%. However, the bottom line deteriorated 36.3% from the year-ago quarter.

Despite higher level of catastrophe loss, the company displayed more than decent performance reflecting solid premium revenue growth, globally improved commercial P&C pricing and record net investment income.

Including one-time integration and merger-related expenses of 3 cents, amortization of fair value adjustment of acquired invested assets, long-term debt of 9 cents and net realized loss of $1.14, net income of 76 cents per share plunged 76.8% from the prior-year quarter.

Full-Year Highlights

For 2018, Chubb delivered core operating income of $9.44 per share, beating the Zacks Consensus Estimate by 0.9%. Moreover, the bottom line improved 17.6% from the year-earlier quarter.

Quarter in Detail

Net premiums written improved 4.2% year over year to about $7.4 billion in the quarter under review. Net premiums earned rose 3.4% year over year to $7.5 billion.

Net investment income was $848 million, up 6.4% from the comparable quarter last year.

Property and casualty underwriting income was $476 million, down 23.6% from the year-ago period. Combined ratio deteriorated 240 basis points (bps) to 93.1%.

Chubb reported after-tax catastrophe loss of $506 million in the reported quarter, wider than the year-ago quarter’s loss of $331 million.

Segment Update

North America Commercial P&C Insurance: Net premiums written increased 4.8% year over year to $3.1 billion. Combined ratio improved 440 bps to 87%.

North America Personal P&C Insurance: Net premiums written dipped 2.5% year over year to $1.1 billion on account of the addition of California to the homeowners quota share reinsurance treaty effective Oct 1, 2018. Combined ratio improved 1370 bps to 93.8%.

Overseas General Insurance: Net premiums written rose 3.4% year over year to $2.2 billion. Combined ratio deteriorated 780 bps to 92.1%.

North America Agricultural Insurance: Net premiums written surged 56.3% year over year to $197 million. Combined ratio deteriorated 2510 bps to 49.5%.

Global Reinsurance: Net premiums written increased 11.4% year over year to $117 million on the back of strength in new business and reinstatement premiums collected associated with catastrophe events in the quarter under discussion. However, lower renewals partially offset this upside. Combined ratio of 166.9% deteriorated 5670 bps from the year-ago period.

Life Insurance: Net premiums written nudged up 1.5% year over year to $957 million.

Financial Update

Cash balance of $1.2 billion as of Dec 31, 2018 soared 71.3% from 2017 end. Total shareholders’ equity slipped 1.7% to $50.3 billion as of Dec 31, 2018.

Book value per share was $109.56 as of Dec 31, 2018, down 0.7% from the level as of Dec 31, 2017.

Core operating ROE was 8.7% for 2018.

Operating cash flow was $1.6 billion for the quarter under consideration.

Share Repurchase Update

In the reported quarter, the company bought back 2.5 million shares worth $318 million.

Zacks Rank

Chubb carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other P&C Insurers

Among other players from the same space having reported fourth-quarter earnings so far, the bottom lines of MGIC Investment Corp. (NYSE:MTG) and RLI Corp. (NYSE:RLI) beat the respective Zacks Consensus Estimate while that of The Progressive Corp. (NYSE:PGR) missed the same.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

MGIC Investment Corporation (MTG): Free Stock Analysis Report

Chubb Limited (CB): Get Free Report

The Progressive Corporation (PGR): Free Stock Analysis Report

RLI Corp. (RLI): Free Stock Analysis Report

Original post

Zacks Investment Research