Christmas Week Means Likely Quiet Holiday Emini Trading

I will update around 6:55 a.m.

Pre-Open Market Analysis

The Emini has been in a tight trading range for 5 days. The daily chart is still in a bull trend, despite the 3-week wedge rally. The week between Christmas and New Year’s Day is usually the quietest of the year. Most of the bars will probably be small and most days will spend a lot of time in tight trading ranges. It is an opportunity to work on patience and discipline. Even if a day is small, there will always be some scalps. Traders must be selective and look to buy low and sell high. Unless there is a strong breakout up or down, it is better to scalp.

In general, beginners should not scalp, but they should be able to find at least a couple 1 – 2 point trades every day this week. There might a few swing trades as well. Less likely, there will be a strong trend day up or down.

Overnight Emini Globex Trading

The Emini is down 1 point in the Globex session. Today will therefore be the 6th day in a tight trading range on the daily chart. While this is breakout mode, this week is typically the quietest trading week of the year. Volume is less, and the Emini will spend most of the time in tight trading ranges. If a trading range is less than 3 points tall, most day traders will wait for a breakout before trading.

Breakouts can come at any time, and there will be breakouts on the 5 minute chart this week. However, the odds are that they will not be big and not last long. Instead, they probably with quickly evolve into another tight range. Yet, if one has 2 – 3 big bull bars or lasts 5 – 10 bars, traders will swing trade, expecting a 2nd leg in the trend. Moves like this will be much less common this week. Traders will mostly scalp, and most trades will probably have limit order entries.

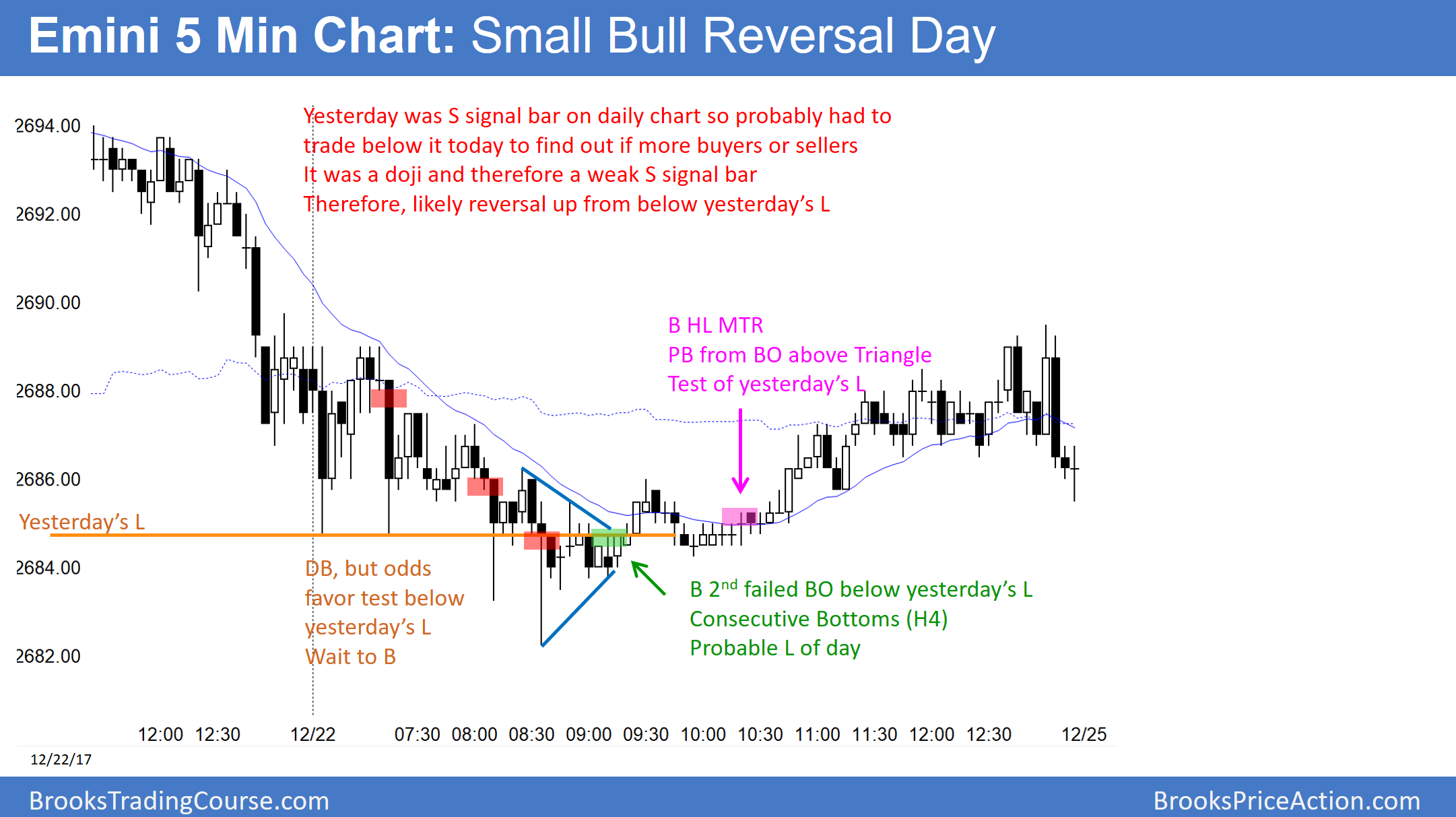

Friday’s Setups

Here are several reasonable stop entry setups from Friday. I sometimes also show limit-order entries and entries on the close of bars.