Another very choppy week for stocks who are quite oversold and began to show the needed bounce Thursday which saw me get long a few stocks, but then it wasn’t to be Friday and I had to take a few small losses.

The market continues to act poorly and show no direction, rhyme or reason to its actions, but there isn’t much we can do about it.

The metals continued to consolidate well as they setup for breakouts higher as early as late in the week to come.

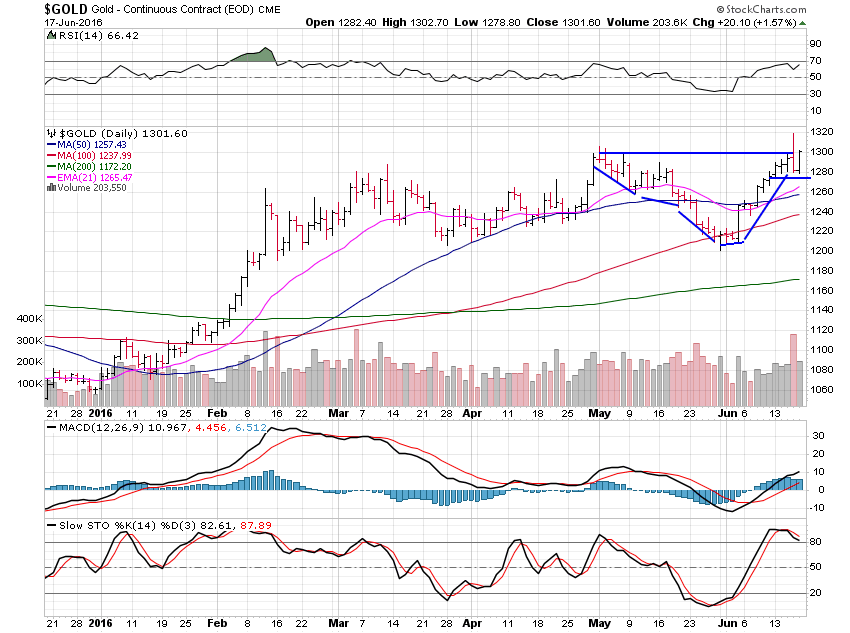

Gold gained 1.98% as it chops around well to potentially finish the handle part of the cup and handle pattern which is so far looking good.

The $1,300 area remains the breakout of this very powerful cup and handle pattern for now but at least a few more days of consolidation is best first to really form a handle.

Silver gained 1.10% as it also continues to setup a powerful cup and handle pattern.

$17.75 is the breakout area if we can complete this pattern with a sideways handle for a few more days to a week or so.

We do need to see large volume accompanying these potential coming breakouts or chances are they will quickly fail.

It’s not ideal to see failed breakouts as we saw on the Fed news this past week but the metals often move strongly on Fed news and it rarely lasts so I’m dismissing it a bit.

Platinum fell 2.31% this past week after being rejected at the downtrend line.

Looks like we may see an undercut of the $960 support area down to the 200 day moving average at $940 which would form a double bottom if it holds.

As always platinum will follow gold so we need to see strength there for a potential double bottom to work.

Palladium lost 1.75% on the week and looks set to move lower now.

We may see a break to the $510 area to give us a double bottom here as well and palladium will follow gold and silver as always.

So, things remain very choppy and dangerous in terms of stocks while metals seem to be setting up well for higher, at least in terms of the gold and silver charts.

Enjoy the sunshine and be careful in this market.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.