The current bull run in Chinese equities underscores the conundrum of China for investors: the Chinese stock market is still basically a creature of psychology. The “fundamentals” of the Chinese stock market are not those fundamentals that investors from the developed markets are used to considering -- return on capital and cost of capital, revenue and earnings growth, and so on. The critical “fundamental” for Chinese stocks is the support of the government for stock markets. With that fundamental in place, Chinese markets remain a momentum trade -- and not an investment.

So why think about “fundamentals” at all with regard to Chinese stocks and sectors of the Chinese economy? Simply because many of the Chinese government’s reform efforts are aimed at more deeply opening Chinese stock markets to the outside world, so that global capital will flow in. China is eager, for example, for the yuan to be included in the global currency basket of the International Monetary Fund, so that foreign banks will demand yuan to hold. China is also eager for mainland stocks to be included in major global indices such as the MSCI World Index -- because that inclusion would mean that ETFs and mutual funds around the world would be demanding Chinese stocks so they can track the index.

As this process of opening continues over the coming years, China will face some fundamental conflicts; having open currency and capital markets can be disruptive, and exposes an economy to the vicissitudes of international capital flows. These flows can be devastating during economic crises. China will struggle to balance the benefits of open capital markets against the economic control the central government will lose.

However, right now, the direction is clear. With anti-corruption efforts vigorous and ongoing, and concerted efforts being made to gradually bring Chinese capital markets up to better standards of freedom and transparency, fundamentals will start to matter more as time goes by. Investors in China will begin to benefit more from the kind of fundamental research that can allow patient investors elsewhere to find superior returns from strong business- and sector-level fundamentals.

Chinese Tourism -- Big and Growing Faster

From that perspective, we want to point out one particular sector of the Chinese economy that’s experiencing strong growth fundamentals as China shifts from an industrial-led to a consumer-led economy: tourism.

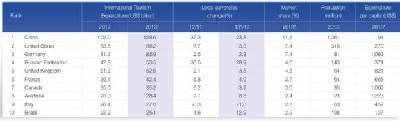

In 2012, Chinese tourists vaulted into first place globally in terms of spending. The growth of that spending is blisteringly fast, up 21 percent from 2012 to 2013 Americans, the next biggest spenders, managed a 3.2 percent growth in international tourism expenditures. Without Chinese growth, global international tourism spending would barely be showing any growth at all.

This large and rapid growth is causing some “cultural” hiccups; by some accounts, Chinese tourists are replacing Americans in the stereotypes of rude travelers, and government monitors are beginning to admonish Chinese travelers returning from abroad when they have been noticed being especially disruptive. But most Chinese newly able to travel abroad are of course polite and curious adventurers, increasingly eager to get off the beaten path and manage their travels themselves. This is the introduction of China’s new middle class to the world.

Only five percent of Chinese citizens have passports, however. This means that not only will there be fuel for the growth of international tourism from China for many years to come, there will continue to be strong growth of tourism within China as Chinese become more affluent.

Investment implications: Burgeoning arrivals of international travelers from China will be a strong tailwind for the global tourism industry in coming years. Tourism within China will also be growing quickly -- and may be an excellent way for investors to gain exposure to the rise of China’s middle-class consumers. As mainland capital markets continue to become more open and transparent, the growing tourist trend suggests to us that regional and bargain airlines, as well as airports and hotels, could be good picks in China in the mid-term. For now, though, we prefer to express our belief in China’s stock market momentum through broad-based index funds and through select Hong Kong listed securities. Several Chinese travel related companies trade in the U.S. -- Ctripcom International Ltd (NASDAQ:CTRP) is the most well-known. We do not own this stock, but might purchase it if the price falls into a buying range as a result of the current Chinese market correction.