With the Greek situation now able to slink off the front pages until at least the elections in April/May, the markets will be looking around for the next story and where to allocate assets accordingly. Following the overnight trade numbers from China, a fair few will be looking at the Asian powerhouse with slightly less awe.

China’s trade deficit was the largest in around 22 years while factory production in Jan/Feb also fell to its lowest since 2009. Demand for Chinese exports has slipped globally as a result of the European debt crisis whilst faltering inflation may now allow further monetary policy loosening to occur.

The weak trade numbers overnight have hurt CNY but also the currencies of those Pacific rim countries that depend so heavily on the Chinese growth machine. AUDUSD nearly broached the 1.05 level and looks heavy, whilst NZDUSD was off following the large milk co-op Fonterra’s decision to cut their 2011/12 pay-out forecast as a result of the strong kiwi dollar.

That being said, we have not seen too much movement in the overnight Asian session. GBPUSD has managed to remain above support at 1.5650 with EURUSD now above the 1.31 level. GBPEUR was boredom personified last week and remains locked in that 1.1930/2030 range still. News out of Europe today is thin on the ground with only the final reading of Q4 GDP from Italy to concern prices. It’s due at 09.00 and expected to show a decline of -0.7%.

News from the UK and sterling is pretty non-existent through the week with Wednesday’s unemployment numbers the real harbingers. Tomorrow’s rate decision from the FOMC is obvious in one matter i.e. that a rate rise is still ways off, but following Friday’s slightly better than expected jobs number from the US, does it mean that another round of quantitative easing is still on the cards? They announce tomorrow at 18.15.

The euro crisis – are you protected? World First has teamed up with Charles Russell and haysmacintyre to host a unique event for business leaders. The seminar will feature a series of short presentations taking a closer look at the Eurozone crisis and how this will affect your business in 2012, before exploring some of the ways you can protect yourself from any potential fallout. Register for our free seminar on 29 March or ask for a copy of our whitepaper here

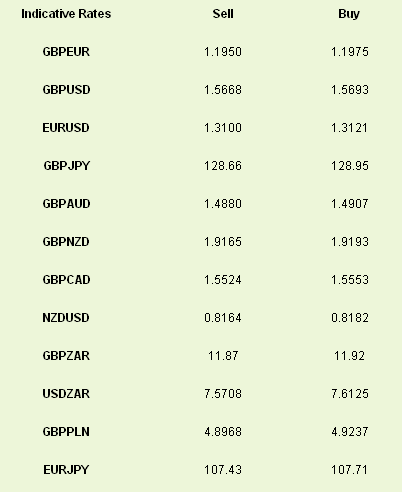

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Chinese Trade Data Extends Belief of Further Easing

Published 03/12/2012, 12:39 AM

Updated 07/09/2023, 06:31 AM

Chinese Trade Data Extends Belief of Further Easing

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.