Chinese Rate Cut:

With so much to digest over the weekend, I’ve split today’s Asian Session Morning blog into 2 so I can get them out and shared as quickly as possible.

With all eyes focused on the capital controls imposed on Greece, we also got an interest rate cut from China. The PBOC cut its benchmark lending rate to a record low, while also lowering the reserve requirement ratio (RRR) for banks. The RRR is important because it is the portion of deposits that a bank must have on hand as cash. This means that a RRR cut effectively encourages banks to loan more than they otherwise would have been able to, thus having a stimulatory effect.

One-year Lending Rate: -0.25% to 4.85%

One-year Deposit Rate: -0.25% tp 2.00%

RRR rates cut -0.50% at some banks.

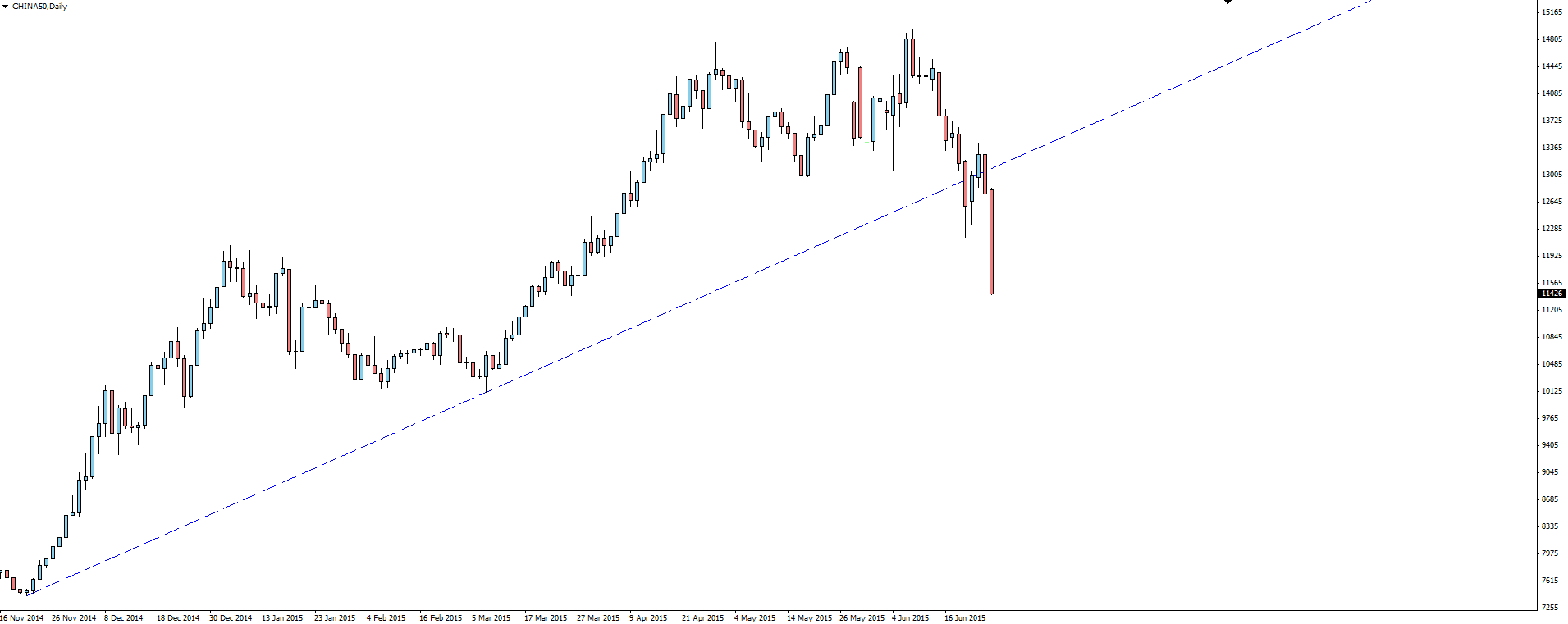

After Chinese stocks took a nose dive to end the week on Friday, there was concern around the potential domino effect of margin calls leading to more and more selling. Panic is never good for markets and the PBOC felt its hand was forced to cut.

China 50 Daily:

Click on chart to see a larger view.

It’s a dangerous way of thinking, and a prolonging of any perceived bubble in Chinese stocks can surely only be a bad thing…

Past cuts have been AUD/USD positive as the Chinese market is flooded with liquidity to boost demand, but with Greece dominating the market narrative to open the week, the Aussie’s reaction has been mixed.

AUD/USD Daily:

Click on chart to see a larger view.

On the daily chart, price gapped down, but was immediately rejected out of the beautiful demand zone that has formed.

AUD/USD Hourly:

Click on chart to see a larger view.

This level is highlighted as we zoom in and offers a great level to manage your risk around.

Don’t forget to also take a look at today’s main Asian Session Morning blog post, “The Looming Greek Default.”

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Chinese Stocks Slump, PBOC Slashes Rates To Record Lows

Published 06/28/2015, 10:04 PM

Updated 01/13/2022, 05:55 AM

Chinese Stocks Slump, PBOC Slashes Rates To Record Lows

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.