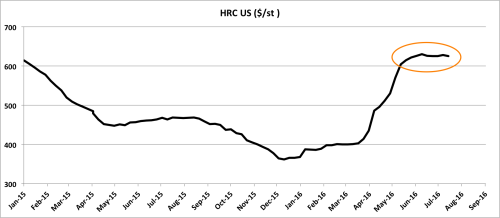

U.S. steel prices have had a spectacular run this year. Three main developments caused the price rally:

- U.S. trade cases which produced a decline in U.S. imports

- China’s commitments this year to cut steel capacity

- Steel demand growth thanks to China’s stimulus measures

The second one is still based on expectations because, so far, we have yet to see those capacity shutdowns in China.

Despite commitments and trade friction with several of China’s trading partners, China’s June trade data surged, raising more questions on the validity of China’s commitment to cutting steel production.

China’s Exports Are Up in June

In June, China exported 10.9 million metric tons of steel, a 21% increase from June 2015 and the second highest total ever. The data raises questions on whether global steel markets will be able to absorb this much steel coming from China without it weighing on prices.

So far, the U.S. steel industry has managed to keep the oversupply from entering the country thanks to trade enforcement and tariffs. According to the latest data, U.S, imports have been falling 31% during the same 5 months of the year. But, will the U.S. steel industry remain immune to the excess material coming from China?

Yes, in the short term, but over the medium- to long-term the U.S. won’t be able to prevent buyers from accessing lower-priced steel in international markets

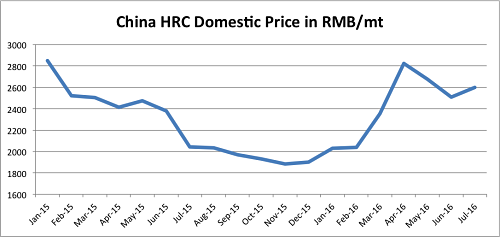

China’s Production Up, Prices Fall

China, which produces about half the world’s steel, has been ramping up output since March as rising prices and improved demand encouraged mills to make more steel. China’s steel output rose 1.7% in June versus a year ago.

Meanwhile, prices in China have come down. Hot-rolled coil prices in China have fallen more than 20% from their April peak, widening the gap between Chinese and U.S. prices.

US Steel Prices Flatten Out

So far, domestic prices have been immune to the decline in Chinese steel prices, but they have flattened. It’s hard to tell if this loss of momentum means prices are just digesting this year’s gain before they continue higher or if this is actually the end of the year’s rally as global overcapacity remains an issue. After this pause, will domestic prices go up or down? That’s something we will monitor closely.