There were further signs that the Chinese economy is stabilising the path of its recovery overnight, following yesterday’s better than expected trade numbers. Industrial production swelled by 9.7% compared to a 9% estimate, and retail sales rose by 12.8% against a previous figure of 12.7%. This leaves the ratio between retail sales and industrial production at 1.36 – strongly above the 1.00 level that denotes whether the Chinese economy is rebalancing.

Much like with several pieces of Chinese economic data, there are reasons to believe this data may have been manipulated to show a better picture than is currently taking place. As someone commented to me on Twitter today, are we to expect a 9.7% increase in industrial production for a country that it showing us manufacturing PMIs in contractionary territory? As much as the improved consumer picture in the US and Europe may have helped a bit, something doesn’t smell right. Even so, the bulls have taken the numbers to heart.

Once again it is the AUD that has gained the most on the release, despite further bearish comments on the state of the Australian economy by the Reserve Bank of Australia. The caveat to the belief that mining investment may fall faster than had previously been expected is that the depreciation of AUD will do nothing but help the economy. We believe that there is the real chance that we see another cut by the monetary authorities, possibly in November, if the rate of economic decline in Australia continues and the depreciation of the AUD does not continue at the pace they desire.

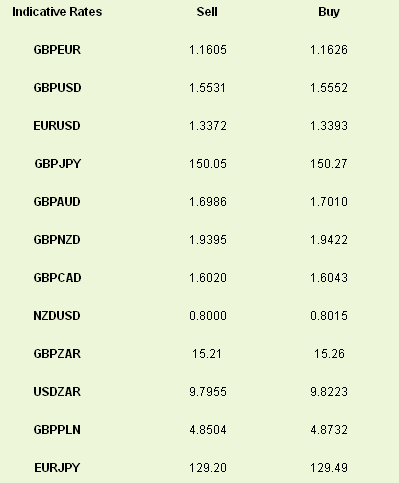

The dollar fell to a 6 week low against a fair few of its crosses yesterday, despite data reaffirming the chance that a September taper may be forthcoming. USDJPY crashed through the 96.00 level, EURUSD touched 1.34 and GBPUSD pushed to the top of its recent range after holding its post-BOE gains.

Given the week it’s had, it may be unwise to bet against GBP making further gains but construction output numbers (out at 0930) have proved to be an Achilles heel in the past. The market is looking for a decline of 1.9% month-on-month. Euro is slightly weaker this morning after French industrial production missed the mark in June – falling by 1.4% against an expected gain of 0.3%. The sound you hear is the market revising French Q2 GDP estimates further into negative territory.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Chinese Numbers Allows Asian Bulls To Breathe A Sigh Of Relief

Published 08/09/2013, 10:14 AM

Chinese Numbers Allows Asian Bulls To Breathe A Sigh Of Relief

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.