We told you it would be volatile! Month-end fixes pushed currencies around yesterday, technical levels were breached, with the euro the main loser with GBP/EUR hitting a 2 week high in the afternoon session while EUR/USD moved lower and back towards the 1.30 level. The moves fit nicely with our expectation that both GBP/EUR and GBP/USD will remain range bound over the coming weeks, data surprises aside.

The Asian session has seen a further move lower for risk as traders seemed disappointed by the news that China’s latest manufacturing PMI number was higher than expected and above the 50.0 level that demarcates the line between expansion and contraction. While it reduces the belief that a “hard landing” in China is just around the corner, equities have tripped lower as traders have priced out the effect of further monetary easing by Chinese authorities in the short-term. It seems that domestic demand has picked up to offset the fall-off in demand from the Eurozone although with Chinese New Year part of this month’s survey a revision lower could be forthcoming.

Risk has also slid on a trio of rough data from the US yesterday. At the beginning of the year it seemed that US could do no wrong with good data coming from every survey. Yesterday, however, we saw weaker than expected numbers from the housing market with the influential Case-Shiller survey showing that 18 of the 20 largest metropolitan areas saw house prices fall in the year between Nov 2010 and Nov 2011. Only Detroit, which has seen a horrific crash, and Washington DC were the only areas to show price growth.

US Consumer Confidence was also lower contrasting with the Reuters survey last Friday. Job market pessimism seemed to be primary reason, but this was confined to the short term with future expectations improving. Price increases in oil and gas have not helped matters either and we will see whether this is a one-off or the beginning of a larger dip when the advance retail sales number is released in a fortnight.

So China has started us with a stronger manufacturing number, can Europe carry on the trend? Today is all about the PMIs from Europe and the UK and later on all eyes will be on the ISM from the US. Most of the preliminary 0.2% fall in UK Q4 GDP was as a result of a fall-off in output from the manufacturing sector although this was seen to improve as the quarter went on. Today’s manufacturing number will be the first indicator as to how 2012 has started. It would be fair to say that consumer spending will drop between December and January as the public pay down debt from an expensive Christmas. With a stable consumer sector (at best), we need manufacturing to come back to the party or, we are staring down the barrel of an, albeit very shallow, double-dip recession. The economist fraternity could not be more on the fence today with the estimate sitting exactly at 50.0, no growth but no falls. The number is due at 09.30. Italy’s arrives at 08.45, France’s at 08.50, Germany’s at 08.55 and the EU measure is at 09.00. The US reports at 15.00.

The Greek PSI negotiations continue to rattle on and offer an inherent euro-positive risk but news flow on this matter has been light and we suspect the chances of a deal in the next 24hrs to be slight. Headlines and tape-bombs from various EU politicians cannot be ruled out of course.

Good luck.

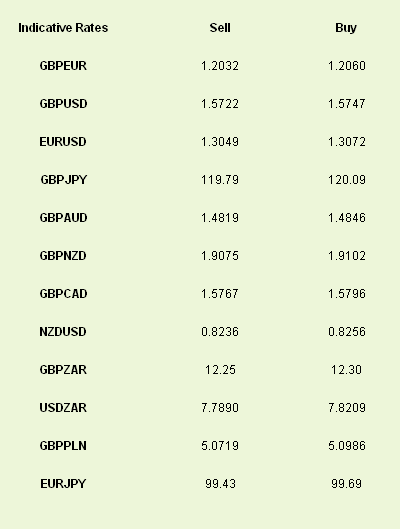

Latest exchange rates at time of writing

The Asian session has seen a further move lower for risk as traders seemed disappointed by the news that China’s latest manufacturing PMI number was higher than expected and above the 50.0 level that demarcates the line between expansion and contraction. While it reduces the belief that a “hard landing” in China is just around the corner, equities have tripped lower as traders have priced out the effect of further monetary easing by Chinese authorities in the short-term. It seems that domestic demand has picked up to offset the fall-off in demand from the Eurozone although with Chinese New Year part of this month’s survey a revision lower could be forthcoming.

Risk has also slid on a trio of rough data from the US yesterday. At the beginning of the year it seemed that US could do no wrong with good data coming from every survey. Yesterday, however, we saw weaker than expected numbers from the housing market with the influential Case-Shiller survey showing that 18 of the 20 largest metropolitan areas saw house prices fall in the year between Nov 2010 and Nov 2011. Only Detroit, which has seen a horrific crash, and Washington DC were the only areas to show price growth.

US Consumer Confidence was also lower contrasting with the Reuters survey last Friday. Job market pessimism seemed to be primary reason, but this was confined to the short term with future expectations improving. Price increases in oil and gas have not helped matters either and we will see whether this is a one-off or the beginning of a larger dip when the advance retail sales number is released in a fortnight.

So China has started us with a stronger manufacturing number, can Europe carry on the trend? Today is all about the PMIs from Europe and the UK and later on all eyes will be on the ISM from the US. Most of the preliminary 0.2% fall in UK Q4 GDP was as a result of a fall-off in output from the manufacturing sector although this was seen to improve as the quarter went on. Today’s manufacturing number will be the first indicator as to how 2012 has started. It would be fair to say that consumer spending will drop between December and January as the public pay down debt from an expensive Christmas. With a stable consumer sector (at best), we need manufacturing to come back to the party or, we are staring down the barrel of an, albeit very shallow, double-dip recession. The economist fraternity could not be more on the fence today with the estimate sitting exactly at 50.0, no growth but no falls. The number is due at 09.30. Italy’s arrives at 08.45, France’s at 08.50, Germany’s at 08.55 and the EU measure is at 09.00. The US reports at 15.00.

The Greek PSI negotiations continue to rattle on and offer an inherent euro-positive risk but news flow on this matter has been light and we suspect the chances of a deal in the next 24hrs to be slight. Headlines and tape-bombs from various EU politicians cannot be ruled out of course.

Good luck.

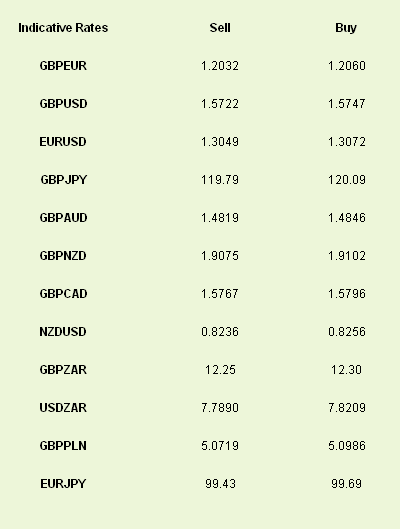

Latest exchange rates at time of writing