Everybody needs clothes. It’s one of our three basic needs.

China, a nation of 1.3 billion bodies, needs a lot of clothes.

Yes, we’re back with another piece on “what’s in with China’s middle class.” Our last article focused on the country’s expanding outbound tourism market.

This time, we’re talking fashion.

Chinese consumers spend more of their disposable income on clothes than folks in the United States. The Chinese middle class, in particular, spends around 10% of its income on clothing. That’s roughly twice the percentage of income that Americans spend.

In the last two decades, Chinese entrepreneurs have rolled out many homegrown fashion brands, such as Chow Tai Fook. They’ve captured a respectable share of their market, too. But American luxury goods remain a status symbol.

As a result, the rising incomes of China’s middle class consumers are great news for clothing importers.

This trend should translate into rising profits for U.S. retailers. We’ve rounded up three ways for American investors to cash in on Chinese fashion spending.

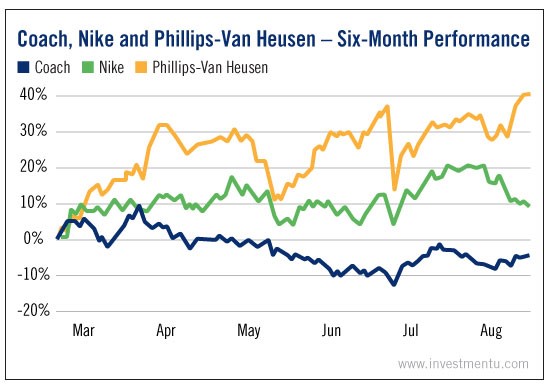

First is Coach Inc (NYSE:COH). The luxury handbag maker has had lots of success among Chinese socialites. You can see this in the brand’s extensive China-oriented marketing efforts. It even has a designated “china.coach.com” website.

Another heavy hitter in the Chinese fashion market is PVH Corp (NYSE:PVH). It’s the maker of several globally-known fashion brands. Most notably, it owns Tommy Hilfiger and Calvin Klein. Both lines rank among the most visible brands in China today.

Finally, there’s Nike (NYSE:NKE). Its products can be found almost anywhere there are athletes. China is no exception. Among China’s urban elite, Nike doesn’t have quite the same luxury flair as the other brands listed here, but it’s still a popular fashion statement in poorer rural areas and small cities.

As you can see, “Made in the USA” is a powerful label for Chinese consumers. In fact, it seems to evoke the exact opposite emotion that “Made in China” conjures up here.

American fashion brands remain distinctive symbols of luxury and social capital in China. Stay tuned for the next segment of our series on Chinese spending patterns. We’ll be discussing the recent rise of a powerful entertainment market: professional sports.