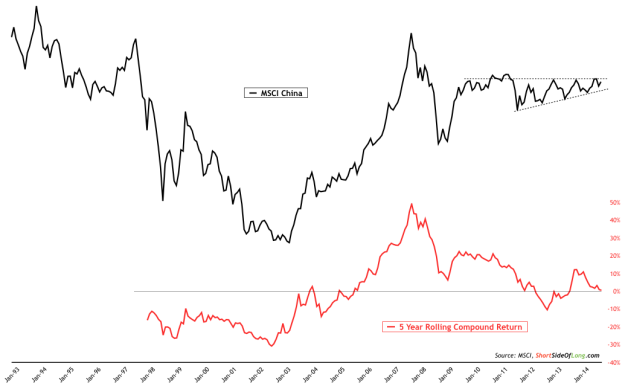

Chart 1: Chinese equities are poised for a huge move very very soon…

I’ve discussed Chinese equities for a few months now. Their valuations look extremely cheap, especially relative to their peak in 2007. Chinese stocks also look very cheap relative to other developed stock markets such as the United States. The Red Dragon’s stock market, priced in US dollars has done absolutely nothing since the middle of 2009, which makes it flat on a 5 year compound rate of return.

Fundamentally since at least 2011, just about every trader, investor, analyst, strategist and economist has been talking about the possibility of a Chinese hard landing. To say sentiment on China has been bearish is an understatement. In my newsletter I discussed how during my Asian trip in May, almost every single investor I met up with was negative on the country.

Furthermore, many have called the Chinese equity price rise in 2007 a bubble from which the stock market will not recover. I believe this is far from the truth. A sharp rise in 2007 was essentially a restoration of prices back to levels we saw during middle of 1990s. One could make a claim that Chinese equities are forming a huge rounding base, from which a breakout towards early 1990s prices could occur.

However, none of this really matters… until it does. Fundamentals are useless until the market decides to price them in. I believe that time is now for China. Technically the price (via MSCI China) could be breaking out on the upside over the coming months and there is a possibility that Chinese equities could have a stellar performance in 2015 and/or 2016.