The Chinese economy is struggling to regain momentoum following the induction of the new Xi JingPing government last year. The petering out of the local property market which was supported by the government has put pressure on growth.

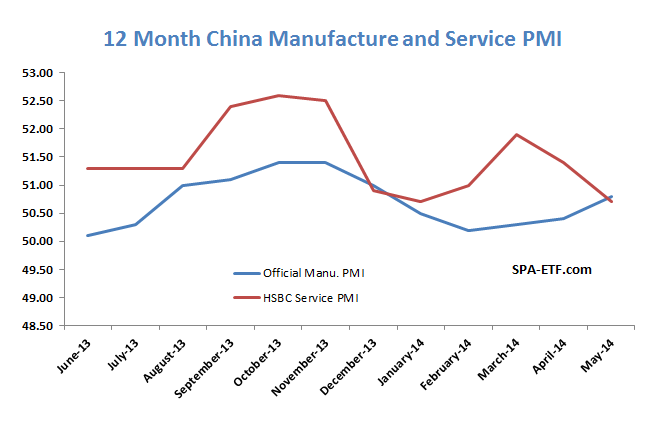

The latest HSBC Services PMI came in at 50.7 falling from 51.4 in April. The year-on-year trend is pretty much flat, from 51.3 same time last year. Over the weekend, the offical China Manufacturing PMI for May was 50.8, the highest level since November. With these mixed numbers and no clear trend from the last 12 months, we can infer that a hard landing is not yet on the cards as some have gathered.

While the PMI activity shows no marked trends, on the one hand, commodity prices—which can be seen as a second derivative on the Chinese economy—are clearly struggling. Last Friday, iron ore prices fell to 20 month lows, down 30% since the end of 2013 and below psychological level of $100 per tonne.

AUD/USD, year to date below, looks to be immune to the economic weakeness. After AUD/USD hit a low of 0.83c in mid Feburary, it has trended back up to 93c. Strong speculation in residential housing has kept pressure on the RBA from further lowering the interest rates. This has supported the AUD/USD we feel that baring overwhelming negative sentiment and change of tone from the Chinese economy, the Aussie will be supported in the near term. For those that see AUD/USD as a leading indicator, investors can play the upside through the iShares FTSE/Xinhua China 25 Index (ARCA:FXI).

Our preferred play on the Aussie is through the AUD/JPY. Throug long Aussie and shorting yen, we are long one central bank with a neutral or even tightening bias and shorting another that is expected to go all-out in fighting deflation. Further monetary easing is not out of the cards in Japan. The BOJ is learning from past mistakes such as withdrawing too early, and they are in no mood to repeat the same mistake. This is not likely to happen anytime soon either. In the event of an upturn in the global economy, the RBA will lead the rate cycle just like after the financial crises.

AUD/JPY is a carry trade play so will be a positive carry position. However, traders and investors should be conscious of the swift turnaround if sentiment or data turns for the worse. Always keep an eye on the exit unless you have conviction.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Chinese Economy Treading Water; AUD Looking Up

Published 06/05/2014, 07:42 AM

Updated 07/09/2023, 06:32 AM

Chinese Economy Treading Water; AUD Looking Up

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.