• We expect 2012 to be a year of improvement for the global economy. Given current very downbeat sentiment, we believe this will be a positive surprise. The significant headwinds that derailed the recovery in 2011 have partly faded and some even become tailwinds.

• In particular, we expect the Chinese engine to start pulling again and join the US in driving the world economy forward. The euro area recession will likely be short and euro growth resume from Q2.

• That said, we look for growth rates in the western economies to remain subdued for a long time, whereas emerging markets are still expected to see solid growth.

• Downside risks are still predominant and mainly stemming from the euro debt crisis. We expect this crisis to be with us for a long time – and continue to see bouts of financial turmoil. However, we do not expect to see a collapse of the euro.

• Inflation is expected to fall sharply in 2012 due to lower commodity prices. This leaves room for policy to be eased further, not least in emerging markets.

2009 Déjà vu

2012 has started with widespread concerns of another global recession. Equity market valuation in terms of price earnings ratios in all big markets is not far from the low levels seen at the peak of the financial crisis in 2008/2009. Fears of the crisis moving to Asia as well due to a housing collapse in China have intensified. Sentiment is not far from the lows seen at the start of 2009, when markets feared a depression following the collapse of Lehman Brothers in late 2008.

However, as in 2009, while the world is far from being a bright place at the moment, we believe current fears of a global recession will turn out to be excessive:

• First, we believe the euro debt crisis will not spiral out of control and lead to a euro break-up. Volatility will likely continue to be high and we could move to the edge of severe crisis occasionally. But we expect action from politicians and central banks will keep the world from falling into a similar financial crisis to that seen in 2008/09. We believe the world cannot risk “another Lehman”, as the room for manoeuvre in such a situation is much more limited this time due to very high budget deficits at the starting point. Hence, all efforts will be made to avoid such a situation.

• Second, while the Chinese property market is a threat, we do not believe the situation is severe enough to cause substantial damage. And the authorities have wide room to manoeuvre to fight a collapse should that happen. In fact, we believe China will be one of the engines starting to pull the world economy again after a quite extensive slowdown in 2011.

In 2012, we believe the world economy will surprise to the upside. While risks are still high and the world economy is fragile, we believe current fears of a global recession are excessive.

Growth in 2011 was hampered by severe headwinds from a strong rise in oil and food prices and the earthquake in Japan. All of these headwinds have now reversed, however, and turned into slight tailwinds. This is giving a positive impulse to the global economy, which should recover once production has been adjusted adequately to get rid of excessive inventories.

We believe we are close to that stage now from a global stand point. We expect the global economy to move from being driven by one to two engines as China is expected to join the US economy in recovering from the low levels of growth seen in most of 2011. The euro area is expected to be in recession until Q1, but see a gradual increase in growth thereafter.

In 2013, we expect the global economy to grow close to trend growth around 4%. While there is still plenty of pent-up demand in the western world with investment levels low, structural headwinds from fiscal tightening, high debt levels and banking sectors under pressure (especially in Europe) is likely to keep growth around trend and thus leave a substantial negative output gap

and high unemployment levels in the Western world.

China to start pulling again

The Chinese economy slowed down significantly during 2011. GDP growth declined from close to 12% in late 2010 to 6.5-7% in Q2 and Q3 2011. This is clearly below Chinese trend growth estimated at around 9.5% and the lowest pace of growth since the financial crisis in 2008, when growth dipped below 6% for two quarters.

We believe China is close to the bottom, however, and look for growth to rebound to 8% in Q1and rise further to a peak of around 10% in Q3. The Chinese growth engine is thus expected to start pulling again, and will be an important driver for the global economy in 2012.

A key factor behind the slowing of the Chinese economy has been a significant headwind from higher food prices leading to a sharp rise in inflation. Food constitutes 33% of private consumption in China and changes in food prices therefore have a strong impact on economic growth. The rise in inflation squeezed growth in two ways. Firstly, real income growth was hit significantly, reducing real consumption growth. Secondly, monetary policies were tightened in response to the rise in inflation, which in turn put a further dampener on growth.

However, the strong headwind has turned into a tailwind. Food prices are falling and inflation is coming down fast. This affects the Chinese economy through the same channels as mentioned above but with the opposite effect: it raises real income growth and it creates room for easing of economic policy. Another factor that has dampened activity in China has been a cooling of the housing market. Tightening measures from the government and central bank have reduced activity in this sector and led to falling house prices. Housing market activity is expected to stay subdued but not to become a stronger drag – see also China: Property market monitor. We do not share the concerns over a housing collapse in China as: a) income growth is very high and underpinning housing demand, b) leverage in housing is low, c) urbanisation continues at a high pace and can absorb excess supply fairly quickly, and d) China has a substantial amount of savings and policy room for manoeuvre which can be used to avoid a housing collapse.

US recovery taking hold

The US economy has finished 2011 on a strong note and is so far the only region in the world to have recovered from the downturn earlier in 2011. Growth has recovered from less than 1% in H1 to 2% in Q3 and is tracking around 3% in Q4. Private consumption has recovered and very lean inventories point to a positive contribution from this factor in coming quarters following a drag in most of 2011. Housing activity is also starting to show signs of improvement and private investment has stayed fairly robust in H2, although losing some momentum towards the end of the year.

The rise in economic activity follows a period of significant headwinds in early 2011 from a sharp rise in oil prices and supply disruptions from the Japanese earthquake, which derailed the recovery. Financial conditions and political uncertainty have also weighed on economic activity due to the euro debt crisis and the turmoil related to the increase in the US debt ceiling and subsequent downgrade of the US sovereign rating.

The headwind from oil prices and the Japanese earthquake has turned into a tailwind in the second half of 2011, though, as oil prices have declined and car sales and production recovered again.

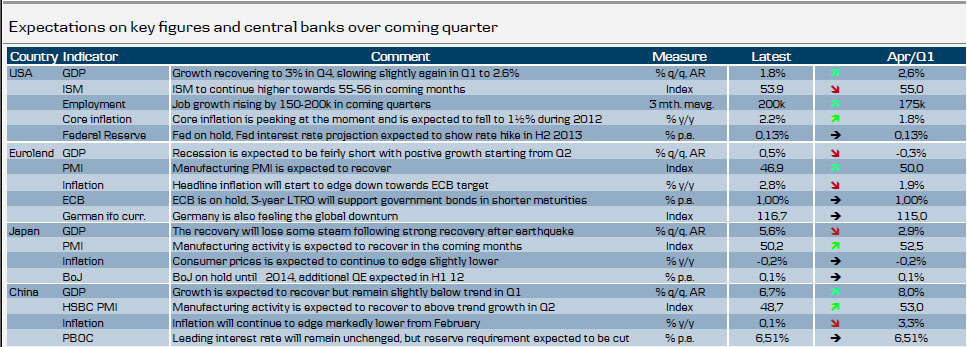

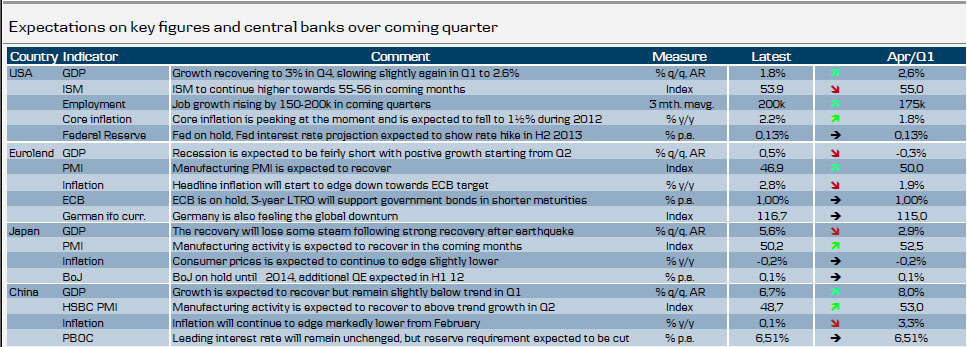

Going into 2012 we expect the US economy to continue with moderate recovery, and expect growth at 2.5% for the year as a whole. The labour market has gained some momentum and should provide the foundation for decent income growth. The rise in incomes should be dented by subdued wage increases, though, as there is still substantial slack in the labour market with the unemployment rate close to 9%. Rising growth in Emerging Markets and an end to the euro recession is expected to lift export growth during the year. The corporate sector is very lean and with decent profit growth should support robust growth in corporate investments. Finally, housing looks to be providing a positive contribution for the first time since 2005, as housing starts and home sales now point to a pick-up in housing activity. Fiscal policy is likely to be a small drag in 2012, as some of the stimuli made in 2009 will run out in 2012 despite the government’s measures to postpone some of the fiscal tightening.

The improvement should also pave the way for a further rise in the ISM manufacturing index and underpin more positive sentiment about the global

economy and underpin risky assets.

In 2013, we expect growth to continue at a moderate pace at 2.6% - slightly

above trend. Structural headwinds from high debt and rising oil prices will keep activity muted despite a big output gap and plenty of pent up demand from corporate investment, housing and car sales.

Five reasons why euro recession will be short

The euro economy has been faced with severe headwinds in 2011. The global

downturn has hit exports, and the euro debt crisis and rising pressure on banks have hit domestic demand. Data now suggests that the euro area entered a recession in Q4. However, we believe the recession will be fairly short. In a research note just before Christmas, we highlighted five reasons for this (see Research - Euroland: A rising tide lifts all boats):

1. US recovery normally leads the euro area. We have already seen higher growth rates in the US. In the past, the euro area has often reacted with a lag seen in recovery within 1-2 quarters.

2. Emerging markets to drive stronger export growth. Emerging markets have become the most important export market for the euro area and the rise in activity here is expected to support stronger export growth.

3. The recession is partly due to inventory build-up. European companies have built up inventories over the summer as demand faded while production kept rising. Production is therefore expected to reduce temporarily to be better aligned with demand and to reduce inventories.

4. Fiscal headwind is significant but is not getting stronger. There is no doubt the fiscal tightening is dampening activity strongly. This headwind is unlikely to become stronger, though, in 2012, as fiscal tightening is not becoming more intensive but just continuing at the same pace.

5. Financial headwinds expected to ease slightly during 2012. Equity markets are expected to rise and credit markets to ease slightly during the second half of 2012.

We expect euro growth to be negative in both Q4 and Q1, but after that we look for a gradual pickup in growth rates toward 1½% by the end of the year. Growth is expected to stay in that neighbourhood also in 2013.

The euro debt crisis continues to be the main headwind risk for the euro area – and the global economy. In the short run, a real credit crunch in the euro area could make the recession worse as banks have to meet stricter capital requirements by the middle of 2012.

Inflation to fall sharply – and make room for easing

Inflation rates are peaking globally as the effect of lower commodity prices is kicking in now. Both oil and food prices peaked about six months ago but base effects have kept annual inflation rates from falling. Base effects should start pushing inflation lower, though, in early 2012. This is expected to be a global phenomenon – but since commodity prices are more important in emerging markets, where food takes up much more of consumption, the effect will be more significant here. Core inflation should also start to ease soon – as pass-through from previous commodity prices increases also contributes to lower core inflation. The decline will increase the room for manoeuvre in monetary policy and we see further easing from the ECB and in many emerging markets. It will also increase the scope for more easing in the US, but our main scenario is that the Fed will refrain from further easing as the economy improves.

General Disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a solicitation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.

• In particular, we expect the Chinese engine to start pulling again and join the US in driving the world economy forward. The euro area recession will likely be short and euro growth resume from Q2.

• That said, we look for growth rates in the western economies to remain subdued for a long time, whereas emerging markets are still expected to see solid growth.

• Downside risks are still predominant and mainly stemming from the euro debt crisis. We expect this crisis to be with us for a long time – and continue to see bouts of financial turmoil. However, we do not expect to see a collapse of the euro.

• Inflation is expected to fall sharply in 2012 due to lower commodity prices. This leaves room for policy to be eased further, not least in emerging markets.

2009 Déjà vu

2012 has started with widespread concerns of another global recession. Equity market valuation in terms of price earnings ratios in all big markets is not far from the low levels seen at the peak of the financial crisis in 2008/2009. Fears of the crisis moving to Asia as well due to a housing collapse in China have intensified. Sentiment is not far from the lows seen at the start of 2009, when markets feared a depression following the collapse of Lehman Brothers in late 2008.

However, as in 2009, while the world is far from being a bright place at the moment, we believe current fears of a global recession will turn out to be excessive:

• First, we believe the euro debt crisis will not spiral out of control and lead to a euro break-up. Volatility will likely continue to be high and we could move to the edge of severe crisis occasionally. But we expect action from politicians and central banks will keep the world from falling into a similar financial crisis to that seen in 2008/09. We believe the world cannot risk “another Lehman”, as the room for manoeuvre in such a situation is much more limited this time due to very high budget deficits at the starting point. Hence, all efforts will be made to avoid such a situation.

• Second, while the Chinese property market is a threat, we do not believe the situation is severe enough to cause substantial damage. And the authorities have wide room to manoeuvre to fight a collapse should that happen. In fact, we believe China will be one of the engines starting to pull the world economy again after a quite extensive slowdown in 2011.

In 2012, we believe the world economy will surprise to the upside. While risks are still high and the world economy is fragile, we believe current fears of a global recession are excessive.

Growth in 2011 was hampered by severe headwinds from a strong rise in oil and food prices and the earthquake in Japan. All of these headwinds have now reversed, however, and turned into slight tailwinds. This is giving a positive impulse to the global economy, which should recover once production has been adjusted adequately to get rid of excessive inventories.

We believe we are close to that stage now from a global stand point. We expect the global economy to move from being driven by one to two engines as China is expected to join the US economy in recovering from the low levels of growth seen in most of 2011. The euro area is expected to be in recession until Q1, but see a gradual increase in growth thereafter.

In 2013, we expect the global economy to grow close to trend growth around 4%. While there is still plenty of pent-up demand in the western world with investment levels low, structural headwinds from fiscal tightening, high debt levels and banking sectors under pressure (especially in Europe) is likely to keep growth around trend and thus leave a substantial negative output gap

and high unemployment levels in the Western world.

China to start pulling again

The Chinese economy slowed down significantly during 2011. GDP growth declined from close to 12% in late 2010 to 6.5-7% in Q2 and Q3 2011. This is clearly below Chinese trend growth estimated at around 9.5% and the lowest pace of growth since the financial crisis in 2008, when growth dipped below 6% for two quarters.

We believe China is close to the bottom, however, and look for growth to rebound to 8% in Q1and rise further to a peak of around 10% in Q3. The Chinese growth engine is thus expected to start pulling again, and will be an important driver for the global economy in 2012.

A key factor behind the slowing of the Chinese economy has been a significant headwind from higher food prices leading to a sharp rise in inflation. Food constitutes 33% of private consumption in China and changes in food prices therefore have a strong impact on economic growth. The rise in inflation squeezed growth in two ways. Firstly, real income growth was hit significantly, reducing real consumption growth. Secondly, monetary policies were tightened in response to the rise in inflation, which in turn put a further dampener on growth.

However, the strong headwind has turned into a tailwind. Food prices are falling and inflation is coming down fast. This affects the Chinese economy through the same channels as mentioned above but with the opposite effect: it raises real income growth and it creates room for easing of economic policy. Another factor that has dampened activity in China has been a cooling of the housing market. Tightening measures from the government and central bank have reduced activity in this sector and led to falling house prices. Housing market activity is expected to stay subdued but not to become a stronger drag – see also China: Property market monitor. We do not share the concerns over a housing collapse in China as: a) income growth is very high and underpinning housing demand, b) leverage in housing is low, c) urbanisation continues at a high pace and can absorb excess supply fairly quickly, and d) China has a substantial amount of savings and policy room for manoeuvre which can be used to avoid a housing collapse.

US recovery taking hold

The US economy has finished 2011 on a strong note and is so far the only region in the world to have recovered from the downturn earlier in 2011. Growth has recovered from less than 1% in H1 to 2% in Q3 and is tracking around 3% in Q4. Private consumption has recovered and very lean inventories point to a positive contribution from this factor in coming quarters following a drag in most of 2011. Housing activity is also starting to show signs of improvement and private investment has stayed fairly robust in H2, although losing some momentum towards the end of the year.

The rise in economic activity follows a period of significant headwinds in early 2011 from a sharp rise in oil prices and supply disruptions from the Japanese earthquake, which derailed the recovery. Financial conditions and political uncertainty have also weighed on economic activity due to the euro debt crisis and the turmoil related to the increase in the US debt ceiling and subsequent downgrade of the US sovereign rating.

The headwind from oil prices and the Japanese earthquake has turned into a tailwind in the second half of 2011, though, as oil prices have declined and car sales and production recovered again.

Going into 2012 we expect the US economy to continue with moderate recovery, and expect growth at 2.5% for the year as a whole. The labour market has gained some momentum and should provide the foundation for decent income growth. The rise in incomes should be dented by subdued wage increases, though, as there is still substantial slack in the labour market with the unemployment rate close to 9%. Rising growth in Emerging Markets and an end to the euro recession is expected to lift export growth during the year. The corporate sector is very lean and with decent profit growth should support robust growth in corporate investments. Finally, housing looks to be providing a positive contribution for the first time since 2005, as housing starts and home sales now point to a pick-up in housing activity. Fiscal policy is likely to be a small drag in 2012, as some of the stimuli made in 2009 will run out in 2012 despite the government’s measures to postpone some of the fiscal tightening.

The improvement should also pave the way for a further rise in the ISM manufacturing index and underpin more positive sentiment about the global

economy and underpin risky assets.

In 2013, we expect growth to continue at a moderate pace at 2.6% - slightly

above trend. Structural headwinds from high debt and rising oil prices will keep activity muted despite a big output gap and plenty of pent up demand from corporate investment, housing and car sales.

Five reasons why euro recession will be short

The euro economy has been faced with severe headwinds in 2011. The global

downturn has hit exports, and the euro debt crisis and rising pressure on banks have hit domestic demand. Data now suggests that the euro area entered a recession in Q4. However, we believe the recession will be fairly short. In a research note just before Christmas, we highlighted five reasons for this (see Research - Euroland: A rising tide lifts all boats):

1. US recovery normally leads the euro area. We have already seen higher growth rates in the US. In the past, the euro area has often reacted with a lag seen in recovery within 1-2 quarters.

2. Emerging markets to drive stronger export growth. Emerging markets have become the most important export market for the euro area and the rise in activity here is expected to support stronger export growth.

3. The recession is partly due to inventory build-up. European companies have built up inventories over the summer as demand faded while production kept rising. Production is therefore expected to reduce temporarily to be better aligned with demand and to reduce inventories.

4. Fiscal headwind is significant but is not getting stronger. There is no doubt the fiscal tightening is dampening activity strongly. This headwind is unlikely to become stronger, though, in 2012, as fiscal tightening is not becoming more intensive but just continuing at the same pace.

5. Financial headwinds expected to ease slightly during 2012. Equity markets are expected to rise and credit markets to ease slightly during the second half of 2012.

We expect euro growth to be negative in both Q4 and Q1, but after that we look for a gradual pickup in growth rates toward 1½% by the end of the year. Growth is expected to stay in that neighbourhood also in 2013.

The euro debt crisis continues to be the main headwind risk for the euro area – and the global economy. In the short run, a real credit crunch in the euro area could make the recession worse as banks have to meet stricter capital requirements by the middle of 2012.

Inflation to fall sharply – and make room for easing

Inflation rates are peaking globally as the effect of lower commodity prices is kicking in now. Both oil and food prices peaked about six months ago but base effects have kept annual inflation rates from falling. Base effects should start pushing inflation lower, though, in early 2012. This is expected to be a global phenomenon – but since commodity prices are more important in emerging markets, where food takes up much more of consumption, the effect will be more significant here. Core inflation should also start to ease soon – as pass-through from previous commodity prices increases also contributes to lower core inflation. The decline will increase the room for manoeuvre in monetary policy and we see further easing from the ECB and in many emerging markets. It will also increase the scope for more easing in the US, but our main scenario is that the Fed will refrain from further easing as the economy improves.

General Disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a solicitation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.