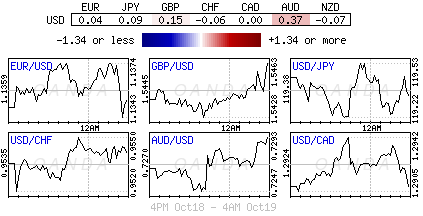

Mixed Chinese data has failed to inspire volatility in the overnight session. Instead, North America equity markets are set to open this week with the VIX index, a proxy for market nervousness, falling to its lowest close since August 18 on Friday, as expectations of “low rates for longer” continues to support equities. In FX, the G10 currency pairs continue to trade in a relatively contained trading range, guided by central bank policies.

China data points having an impact: It’s difficult to argue against the idea that China is probably the single most important issue driving investment decisions at the moment. Last night Chinese GDP release probably asks more questions than anyone is able to answer. The GDP headline numbers (Q3 GDP q/q: +1.8% vs. +1.8% e: y/y: +6.9% (6-year low) vs. +6.8% e; ytd: +6.9% vs. +6.9% e) along with a few other data points are showing sufficient divergence to question the accuracy of China’s growth numbers. Fixed asset investment growth printed a new multi-year low. New home sales value growth also slowed, down 5 ticks to +18.2%, while industrial output (IP) data was similarly downbeat, coming in at a six-month low of +5.7%. Power, steel and oil production growth were soft; but headline GDP beat estimates, sitting atop of a new six-year low print. Nevertheless, Chinese authorities continue to encourage investors to be more realistic when it comes to their growth rates. Premier Li stated it would not be easy for China to achieve +7% (target) GDP, but that it was acceptable for growth to be a little higher or lower than +7% as long as employment remains adequate and incomes continue growing. The headline GDP print has probably tempered some dealer’s expectations for large-scale stimulus from China any time soon.

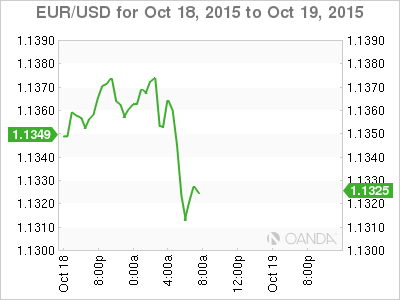

Looking for evidence from Draghi: The Euro focus this week will be on the ECB rate decision on Thursday. The market is anticipating that Draghi mighty use the press statement to keep the door ajar for further ECB action. With so much ECB talk over the past few weeks, dealers have been able to price the possibility of extending QE. Dovish talk alone may not be capable of weakening the EUR significantly (€1.1320). Therefore, the ECB may be required to go deep, cut deposit rate further into negative territory to have a more material impact on the currency, but this time around the market is looking for evidence that the QE debate remains very much alive as downside risks materialize and inflation projections fall again.

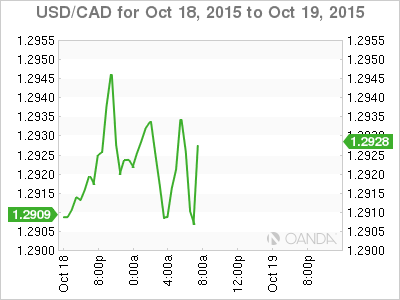

Loonie to fly off course: The CAD (C$1.2915) has taken many of the dollar bulls by surprise over the past two-weeks, flying much higher than anticipated, not necessarily being supported by any fundamental or commodity reasons. The CAD has certainly outperformed on the crosses and continues to lie comfortably below its key USD/CAD resistance point of C$1.3000 for the time being. However, the loonies’ flight faces two key event risks this week, starting with today’s general election. Advance voting stats are pointing to a new Liberal government to take power, unless of course there is a surprise. And second, the Bank of Canada (BoC) meets Wednesday. Despite Governor Poloz having cut rates twice so far this year (+0.5%) there are no changes expected for the remainder of the year.

Turkey’s Central Bank (CBRT) to stand pat: Fixed income dealers are pricing in a no change to the CBRT’s interest rate policy decision on Wednesday. Notwithstanding inflation rising to nearly +8% last month, the market expects policy makers to maintain a steady policy ahead of parliamentary elections on November 1. Investors will expect Turkish assets to rally if a government happens to emerge following voting. Both political uncertainty and an indecisive Fed have had a massive negative impact on EM currency pairs like TRY ($2.8912).

Brazil faces more problems: The fiscal shape of Brazil is expected to get even worse and prompt further credit rating downgrades. Many expect all credit rating agencies to downgrade the country’s sovereign status to well below investment grade before year-end. At +67% public-debt-to GDP, growth projections of -3% to -4%, the BRL will be expected to come under further pressure over the coming months (BRL$3.9279).