Chinese data over the weekend has pushed Asian assets higher this morning as the market comes to terms with the results of the Australian general election and the latest political machinations around the conflict in Syria.

Chinese exports rose by 7.2% on the strength of local Asian demand. However, the imports component of the latest trade update disappointed with growth of only 7.0% against an expected 11.3%. This will further embolden those who believe that the demand component of the Chinese economy is something to be worried about through the end of the year. Chinese inflation was also stable at 2.6% year on year – this follows a 2.7% reading in July and shows that price pressures may be stabilising, i.e. one less thing to worry about and a lack of a pull one way or the other in monetary policy terms.

Japanese assets are also happier this morning following the news that they will host the 2020 Olympics in Tokyo. The yen has weakened over the Asian session as traders price in increased public works around construction and infrastructure. One was hoping that London would get it back to be honest.

Landslide political wins are good for a currency and that is what has strengthened the AUD so far today. Tony Abbott was elected as the Australian PM on Saturday and his Liberal Party, the conservative party of Australian politics, are expected to help business interests in their first 100 days by cutting taxes and regulation. AUDUSD is back above the 0.92 level this morning.

Angles around Syria are becoming increasingly more acute as time rolls on. Congressional approval is one caveat to action from President Obama and we expect he will seek it early this week. He is scheduled to speak on American TV on Tuesday evening with a possible Senate vote on action possible in the early hours of Wednesday. That would be Wednesday September 11th. This will remain the real event risk over the course of the week and will cap gain on EM currencies and losses on havens.

Friday’s jobs report was a bit of a nightmare for those who are banging the drum of a strong US recovery. The payrolls data disappointed across the board, we think taking the chances of an immediate tapering of Fed assets with it. Only 169,000 jobs were added in July – below the year-to-date 182,000 average – and below the 180,000 consensus. Revisions to previous releases knocked 74,000 jobs off as well and the participation rate fell to the lowest since 1978. If you were looking for a poor jobs release this was it.

US growth remains weak as well. Capital expenditure is poor, while housing growth and consumption has remained relatively flat through the summer months. Pop in the chances of a budget battle in Congress, further spending cuts to raise the debt ceiling and growth in that part of the world is by no means near where it needs to be a for a reduction in stimulus.

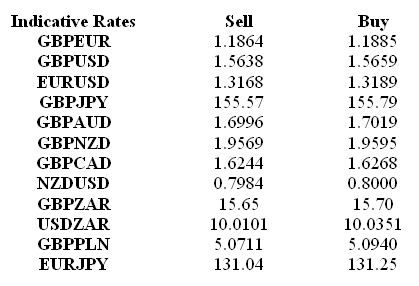

USD fell off heavily in the aftermath with GBPUSD back above 1.56 on the news. GBPEUR also benefited as well as markets decided to leave EURUSD alone following comments from Draghi on Thursday that hinted at further downside risks in the Eurozone and maybe, another rate cut to the ECB base rate. GBPEUR hit a 7½ high on the news.

Today should see sideways action from the main pairs as the world waits on what the US decides to do in the Middle East again. The data cupboard is somewhat bare through this European and US session.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Chinese Data, Aussie Elections Open Markets Higher

Published 09/09/2013, 06:07 AM

Updated 07/09/2023, 06:31 AM

Chinese Data, Aussie Elections Open Markets Higher

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.