Some had written off China’s housing market last year, saying the super-cycle, fueled in part by the housing market, was over and China was more likely to experience a hard landing than a bounce-back.

Meanwhile, commodity bulls clung to the statistics, saying 150 million farm workers heading towards the cities would fuel the construction sector for years to come.

Well, it would seem the bulls may have been closer to the truth than the bears.

The China Daily reported this month that land sales figures in China’s 10 key cities almost tripled in the first month of 2013, fueled by property developers’ improved cash flow and expectations of a stronger real estate market this year.

The 10 key cities tracked by Shanghai E-house Real Estate Research Institute saw a land remise fee of 56.2 billion yuan ($9.02 billion) in January, up 263 percent from the same period last year, the institute’s statistics showed on Sunday.

Moreover, the area of land sold in those cities last month was 26 million square meters, an increase of 77 percent year-on-year. The 10 cities include Beijing, Shanghai, Guangzhou, Shenzhen and Tianjin.

The two sets of figures also showed that the price of the land grew at a much faster rate. New home prices in China rose 1 percent in January, the paper reported, the eighth straight month-on-month increase since June.

The average new-home price in 100 Chinese cities increased to 9,812 yuan per square meter ($146/square foot), according to sources quoted. According to a report by the World Bank, China’s large-scale urbanization and related development projects are likely to drive GDP growth to 8.4 percent in 2013.

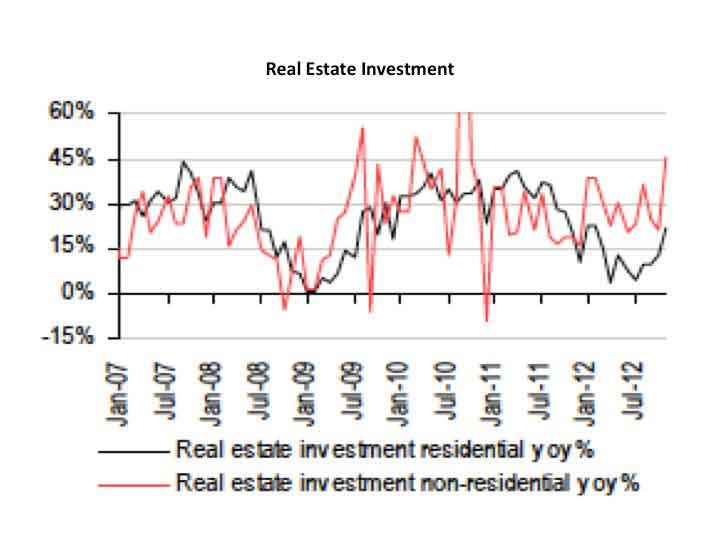

HSBC recently released a range of measures for the Chinese economy that show the trend lines turning upwards in the latter half of 2012, with an improvement in both residential and commercial sectors.

by Stuart Burns

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Chinese Construction Sector, Housing Market Leading Recovery

Published 02/07/2013, 02:54 AM

Updated 07/09/2023, 06:31 AM

Chinese Construction Sector, Housing Market Leading Recovery

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.