China's export growth beats consensus but slower import growth signals that future exports will be tough.

Slower imports a bad sign for future exports

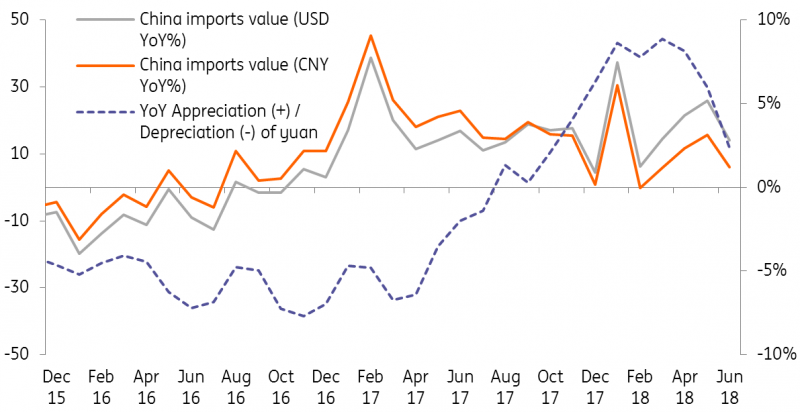

Imports only grew 14.1%YoY in June, lower than the consensus of 21.3%. Almost all import items shrunk from the previous month except copper sands and coal, which means that projected manufacturing is slowing.

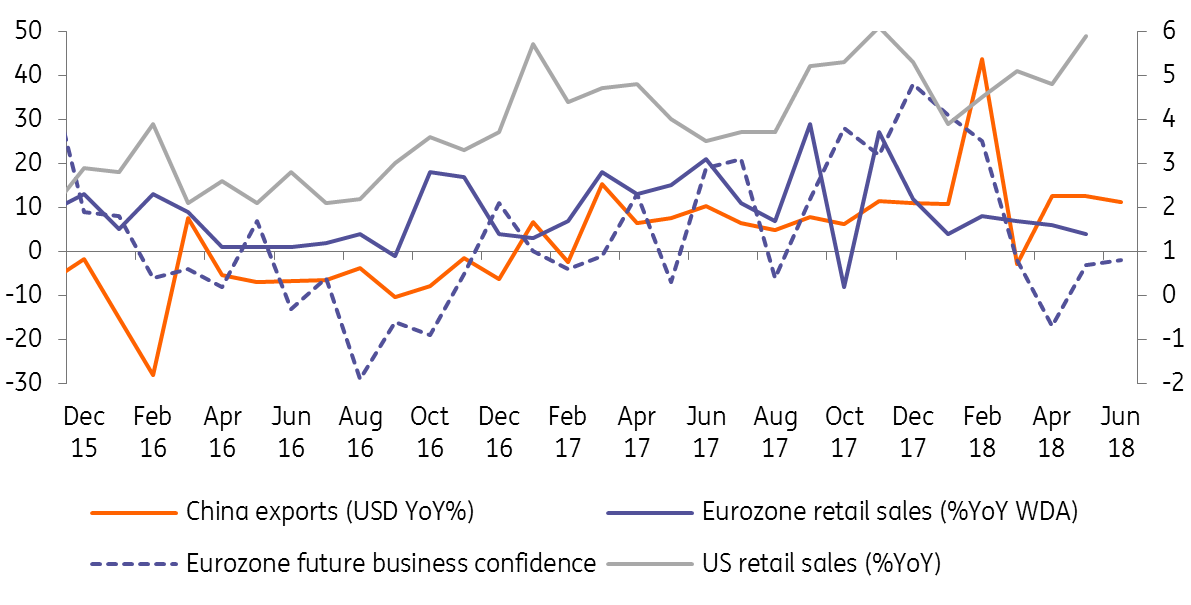

However, exports grew at 11.3%YoY outperforming the consensus forecast of 9.3%. Export items under tariff threats seem to front-run tariff charges. That may explain why integrated circuits grew 9% MoM.

We believe that future exports are unlikely to extend sustained growth.

Don't blame yuan for import decline

Trade war impact implications

It is just a matter of time before trade volumes shrink, directly impacting manufacturers that rely on the global supply chain.

While a softer yuan may cushion Chinese exports, the best it can do is to reduce the tariff effect by around 7% based on our USD/CNY forecast of 7.0 by end-2018.

The Chinese government will also use fiscal and monetary policies to stimulate the economy, and the coming activity data on Monday will provide us insight into the extent of policy support needed.

Good global demand supports June's export but will not stop tariff damage in 2H18

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. For our full disclaimer please click here.