After several months in the doldrums, China’s economy is stabilizing as it starts to respond to fiscal and monetary stimulus. The impulse is also being amplified by improved sentiment as a trade deal with the US becomes more likely. Our analysis delves into China’s leading economic indicators and discuss how recent changes in the policy mix also bode well for long-term growth.

Last year, China’s aim to sustain both rapid growth and financial de-leveraging became ever more challenging amid several external headwinds. In fact, weakening global demand and heightened policy uncertainty associated with international trade conflicts have prompted the Chinese government to reverse course and gradually loosen monetary and fiscal policies. The results are starting to show as recently released Q1 GDP growth figures surprised on the upside, suggesting that the deceleration in growth has bottomed out for the recent cycle. GDP growth read 6.4% y/y in Q1, the same pace as in Q4 but beating consensus forecasts of 6.3%. On a seasonaly adjusted quarter-on-quarter annualized growth basis, the outcome looks more promising as the figures imply a 7.1% growth in Q1 2019 versus 6.0% in Q4 2018. This is in line with recent positive surprises in industrial production (IP) and retail sales data.

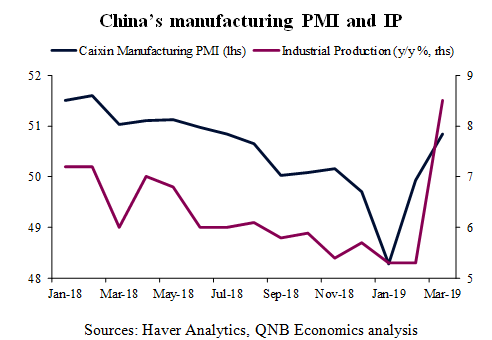

Leading indicators such as PMIs, lending activity and investments are pointing to further strengthening over the coming months. The manufacturing Purchasing Managers’ Index (PMI) figure bounced back to expansion mode or over 50 in March, after three months below 50 or what is generally considered contractionary territory. The improvement was even more pronounced for manufacturing small and medium enterprises (SMEs) and for forward looking new orders. Moreover, a positive stream of data started to also come from both broad credit growth and infrastructure fixed asset investment spending. Even exports to China from early-reporting Asian manufacturers are showing strong signs of stabilization. After being severely affected by the reversal of the so-called front-loading effect in US-China trade, i.e., US based companies increasing imports from China earlier last year to stock up before new tariffs come into effect. This is also reflected on a meagningful 2 point increase in the new export orders’ PMI in March, edging closer to expansion territory after falling into deep contractionary territory between October 2018 and February 2019.

Importantly, this recovery is taking place on the back of a new round of policy stimulus in which the target is mainly the private sector, not the highly leveraged real estate and government-related entities (GRE) sectors.

China’s manufacturing PMI and IP

Sources: Haver Analytics, QNB Economics analysis

On the fiscal front, the bigger than expected stimulus package announced at the annual session of the National People’s Congress late last year is centered on corporate tax cuts rather than infrastructure spending. The USD 300 Bn tax cut amounts to more than 2.1% of the projected 2019 Chinese GDP and is the biggest in a decade. The measure is set to help reduce the heavy tax and fee burden of the Chinese private sector, which is one of the key factors depressing investment growth in more productive sectors and overall business sentiment.

On the monetary front, policy easing this time around is also specifically focusing on increasing credit availability to the private corporate sector rather than simply to real estate construction or GREs. While the Chinese private corporate sector accounts for over 70.0% of economic activity and an even larger chunk of urban job creation, it has always been a marginal borrower in China’s state-dominated banking system. According to the China Banking and Insurance Regulatory Commission (CBIRC), private sector businesses accounted for only around 1/4 of total bank loans. Authorities are signalling their willingness to wage formal and informal regulatory controls to deliver credit growth to the private sector while reining in credit to GREs and curbing riskier off-balance sheet or “shadow” lending activity.The CBRIC has recently floated an informal target to increase lending to the private sector.

The background to these easing steps is the delicate balancing act that the Chinese officials have been attempting to pull off for much of the last three years. After a long period of debt-fuelled economic growth that risks long-term financial stability the longer it continues, the authorities have been trying to rein in excessive credit growth and cut debt levels.

In our view, growth in the non-GRE corporate sector is key to produce the gradual rebalancing of the Chinese economy from investment-led and credit intensive growth to consumption-led growth. Reasons for that include the fact that the private corporate sector is more efficient using and allocating capital and that it employs the bulk of the urban population.