China’s yuan devaluation moves this week will not make it easy for the Fed. The People’s Bank of China (PBoC) currency policy change has the potential to complicate the timing of a rate liftoff stateside. Despite US policy makers making it abundantly clear that they look beyond global changes, deterioration in the US domestic picture could call into question the possibility of a rate hike in 2015, token or not.

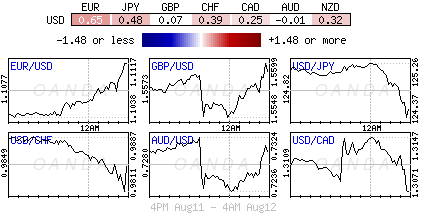

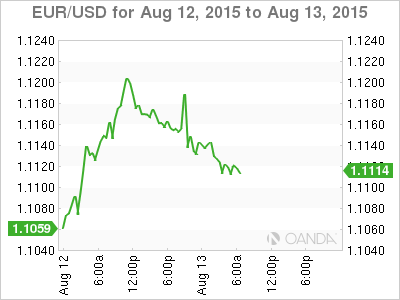

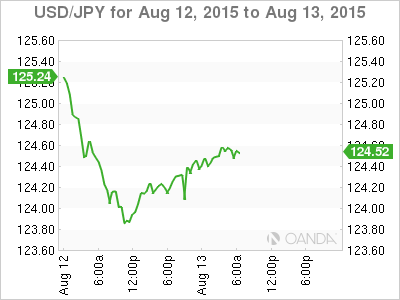

As to be expected, any challenge to the US’s rate hike story will have the US dollar struggling, and raising concerns as to why the dollar has been under-performing against many of its peers this week. So far, the fixed income market has been dialing back expectations for a Fed rate hike next month as the -3% yuan devaluation raises concerns about Chinese growth and global inflation expectations. Late yesterday, Fed-funds futures showed that the market sees a +39% possibility for a rate increase in September, down from +54% pre-yuan devaluation.

China Attempts To Calm Markets

Nevertheless, dollar bulls may have caught a break from the PBoC. The initial panic from Chinese currency devaluation and the fears of a more pronounced currency war in the Far East have subsided, somewhat, in the overnight session.

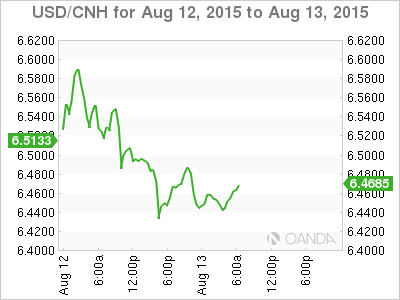

The PBoC fix, which has acquired immense significance over the past three-trading sessions, once again set the yuan notably lower. Yet, the PBoC’s manipulation of it own currency value has slowed to -1.1% today from -1.6% yesterday, and the -1.9% initial devaluation move on Tuesday. The PBoC’s slowing down the devaluation pace has given the dollar some renewed support.

All of this is relatively new territory for the PBoC. Despite the devaluation, the PBoC has also been intervening to smooth trading of the yuan and to manage market expectations about how quickly and how far their currency could fall. It’s the central banks intention that the yuan will become more market driven while giving it the ability to keep the market in check, as is the role of a true central banker.

Yuan Devaluation of 10% “Nonsense”

In an attempt to restore calm, the PBoC held a press conference overnight to explain its policy moves. Deputy Governor Yi Gang indicated that the “adjustment is almost complete” and that the speculation on devaluation running as steep as -10% was “nonsense”. Instead, Yi said the currency shift would be positive for international confidence in the yuan as it allows a more market-driven determination for exchange rate value.

However, despite the PBoC considering other factors, such as foreign exchange moves, supply and demand factors, it’s still the central bank who sets the exchange rate and only it knows what significance it will be giving to each variable—this does not make it that transparent!

China’s actions has the market expecting further push back from other Asian Central Banks. Yesterday, Vietnam’s central bank widened its VND trading band to +2% from +1%, while India’s central bank reportedly intervened against an INR selloff. Today, as widely expected, the Bank of Korea (BoK) held rates steady at +1.50% in a unanimous decision, but acknowledged devaluation posing a risk to global growth.

The PBoC is defending its actions by stating that continued intervention is “being rooted in analysis of economic data.” Their natural disclaimer is that China’s fundamentals still do not support “continuous” depreciation. Has the bulk of the depreciation already taken place?

Will US Data sway the Fed?

Today’s US retail sales print, which has been slow to gain traction, could be the data dependent variable that may put further pressure on the Fed to wait.

The market whisper is that retail sales are expected to reveal some solid gains for last month, especially from the motor vehicle sector. Dollar bulls expect a gain of +0.6% for July after the -0.3% drop in June. A print in focus should see the dollar take back most of this week’s losses, assuming that stateside investors buy into China’s calming responses. There are similar expectations for US industrial production tomorrow, but there is a distinct possibility that the manufacturing component could underachieve.

Even though US inflation may be somewhat benign, any upward gains from either US retail sales or industrial production should have the last of the Fed and market doves on the run for next month’s FOMC meeting.