The quality of Chinese economic data has long been questionable. Last year in May, the government launched new rules to crack down against speculative capital inflows disguised as trade payments, which boosted the exports data. I assume that the data are more accurate now. However, I am amazed that it is always available one month ahead of the other major economies. We already have August readings for China.

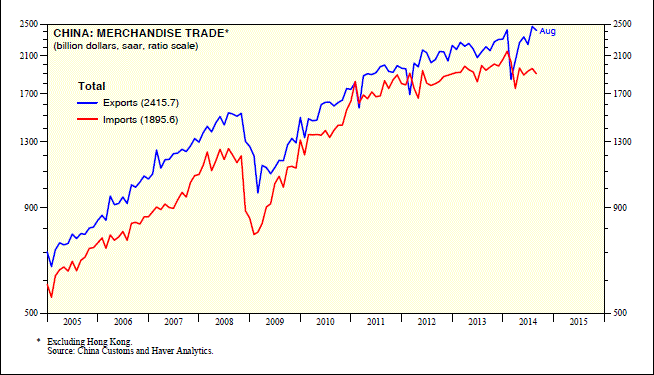

They show that China’s merchandise trade surplus remained at July’s record high of $520 billion (saar) during August. However, the seasonally adjusted data show slight downticks in both exports and imports during August. On balance, exports remain near July’s record high, suggesting global growth remains solid. On the other hand, imports seem to have stalled over the past three years, confirming that China’s domestic economy isn’t as hot and spicy as it had been in the past when imports were growing rapidly.

Today's Morning Briefing: Good Trade. (1) Most reliable indicators. (2) Volume of global exports up 3.4% y/y. (3) US exports at record high, fueled by petroleum. (4) Surprising strength in German orders, output, and exports during July. (5) Canada, France, and Italy exporting more. (6) Abenomics isn’t working for Japanese exporters. (7) Mexico and India are EM export leaders. (8) China isn’t so hot and spicy anymore. (9) Transportation’s forward earnings at record high. (10) Focus on overweight-rated S&P 500 Transportation.