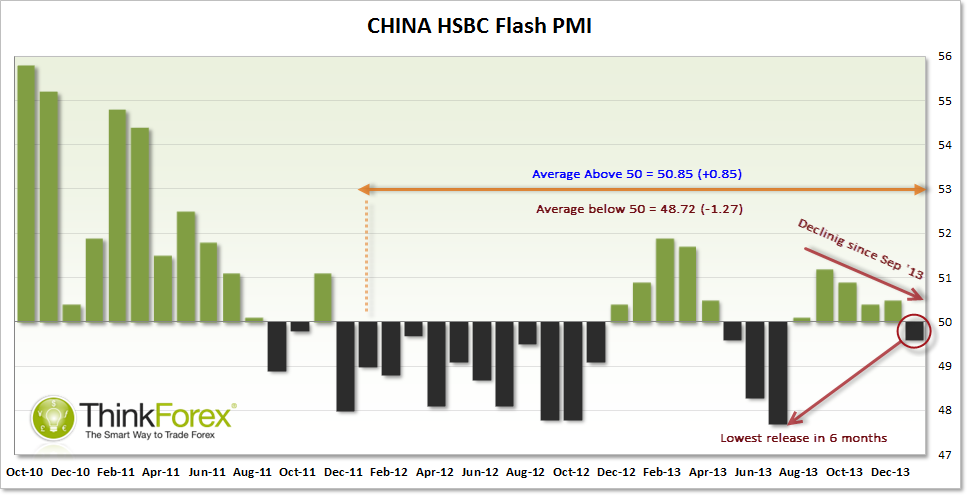

The HSBC PMI is the earliest available indicator of manufacturing sector operating conditions in China. A reading above 50 denotes industry expansion whereas a reading below 50 denotes contraction. With January's release coming in well below expectations at 49.6 vs 50.6 (and the lowest in 6 months) we can be assured tonight's release will be closely watched with potential for some big moves.

Whilst January's release was quite a shock to the market, the larger picture for that release should also be kept in mind. Yes, it was the lowest in 6 months and the forecast was also above 50, but we have spent 60% of the time since January 2011 with releases below 50, so this doesn't necessarily suggest a contraction within Manufacturing.

SNAPSHOT STATS:

- Since Jan 2011 we have only seen 10 releases above 50 (or 40%)

- 40% of the 'Expanding Manufacturing' figures average 50.85 (0.85 above 50)

- 60% of the 'Contracting Manufacturing' releases average 48.72 (1.27 below 50)

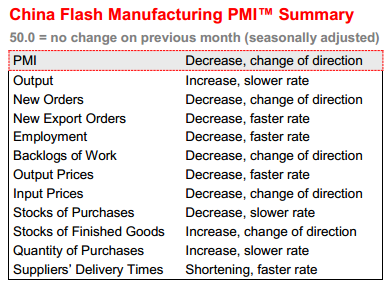

Taking a closer look, we can break down the Index to see where the PMI is beiing dragged down. With new orders, input (raw materials) and output decreasing it further highlights a slowdown of Chinese manufacturing index.

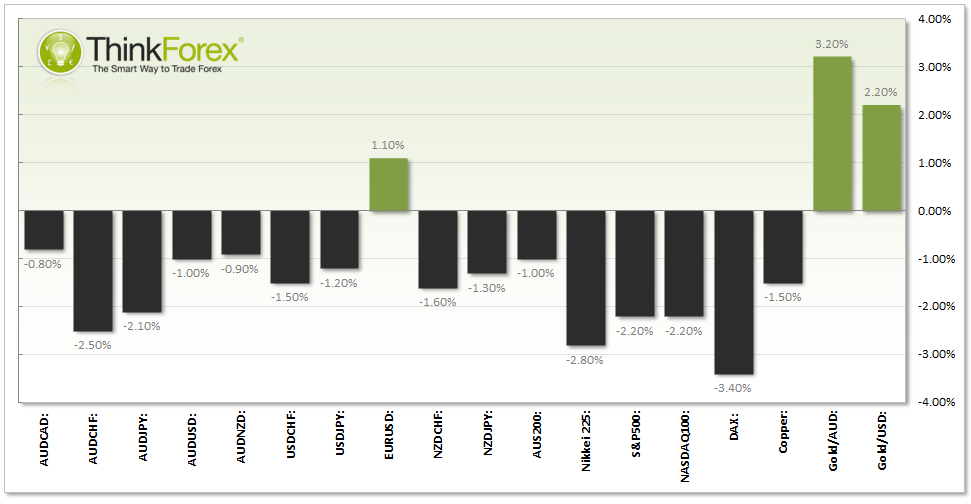

How did the markets react last time?

The chart below shows how this release can shake the markets and have a knock-on effect throughout the day. Each pair is the % change from open to close on the day of the PMI (with the exception of US and European Indices, which shows following day as these markets were closed during the release).

With the Australian and New Zealand economies being very dependant upon Chinese trade, it is no surprise there were some big movements across these pairs.

- Money flowed out of AUD, NZD and USD into safe haven markets such as EUR, CHF, JPY and Gold.

- Indices (being a real-time barometer of risk) sold off across Europe, US and Asia to denote global risk-off

Interesting to note the biggest mover below was the Gold/AUD cross, so this is a pair you should consider if you want to trade at, or around this release tonight.

Here is the 5 minute chart of AUD/USD, with the price action looking very similar to all markets which sold off in the chart above. With AUD/USD trading near resistance levels, we have a clear line in the sand for any breakout or resistance rejection, dependent upon tonight's release.

AUD/USD 5-Minute Chart" title="AUD/USD 5-Minute Chart" height="242" width="474">

AUD/USD 5-Minute Chart" title="AUD/USD 5-Minute Chart" height="242" width="474">

What Can we expect tomorrow? (49.40 forecast)

Take note that tonight's consensus is below January's actual, which was also less than expected. So the consensus has shifted somewhat to the negative side, which may already be factored into any subsequent price movements at tonight's release.

However, it is also worth noting that the forcast tends to be nowhere near the actual release, so statistially we can expect some movement tonight.

Above 50: Will provide positive sentiment and Risk-On for the week

Bullish: AUD, NZD, USD and Global Indices

Bearish: Gold, Silver, CHF, JPY, EUR

- Gold/USD is looking overbought and this may provide retracement back down to 1307.

- AUD/USD to break above 0.908

Below 49.40: Confirms China slowdown fears and market shifts to Risk-Off for the week

Bearish for: AUD, NZD, USD and Indices

Bullish for: Gold, Silver, CHF, JPY, EUR

AUD/USD to remain below 0.908 and break below 0.90 and target 0.893 initially. As we are bearish on this pair we are seeking reasons for the larger bearish picture to unfold and eventually test 0.85 and 0.80 later this year.

Between 49.40-50:

Similar outlook to 'above 50' but not as significant to the markets, so smaller moves can be expected.

DISCLAIMER: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market. If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade.

A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au .The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.