Credit splash and metal prices suggest stimulus is making its way to the economy

High-level trade talks get more specific, stable CNY to be part of a deal

Is the US losing the battle over Huawei in Europe?

As I will be travelling in China next week, the next release of China Weekly Letter will be on Monday, 4 March.

Big jump in January credit adds to signs of a growth bottom

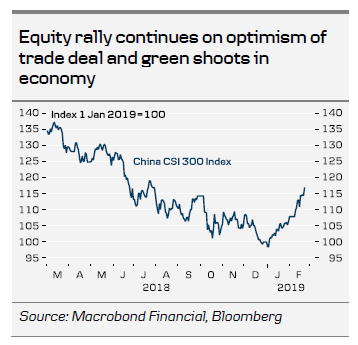

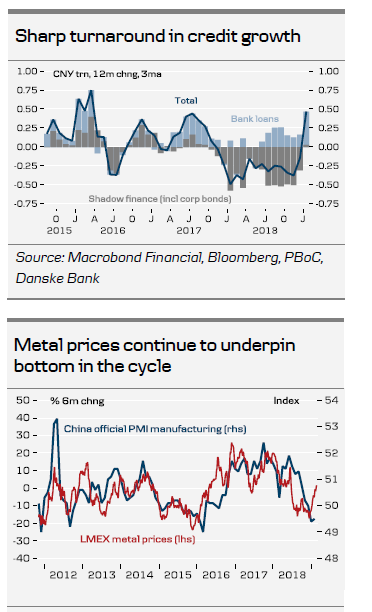

Both bank lending and shadow finance jumped higher in January in a sign that Chinese stimulus measures are kicking in with more force (see chart to the right). Corporate bond credit increased at the fastest pace in two years. The data added to optimism in the Chinese equity market, which rallied further this week, putting gains at close to 15% this year.

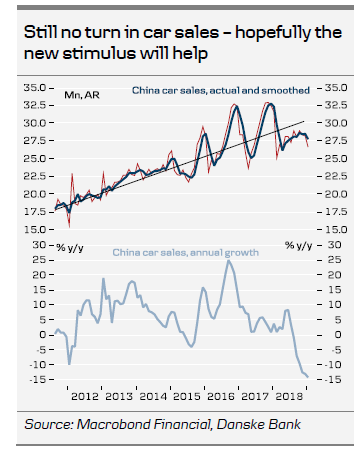

On a less positive note, M1 growth continued to decline from 1.5% y/y to 0.4% y/y. However, it was actually the lowest level since 1989. M2 growth rose from 8.1% to 8.4%. Data on car sales for January disappointed again as 14.2% fewer cars were sold compared to 2018 (see chart next page).

Comment. The jump in credit has been long awaited following the string of monetary easing measures over the past year. The bank Reserve Requirement Ratios have been cut four times, bond yields are sharply lower, targeted lending programmes towards the private sector have been launched and rules on issuing corporate bonds have been relaxed. We have argued that the stimulus measures would start to kick in with more force this year and we believe this is what we are starting to see. There may be some front loading due to the timing of the Chinese New Year in the data. But, overall, it looks like the trend is turning.

We also continue to see metal prices moving higher , which is normally a good sign of a bottom in the Chinese business cycle (bottom chart). Copper prices are now trading at the highest level since July 2018.

The weak car sales go against our predictions of a turnaround soon (see China Notes - Weak car sales should be taken with a grain of salt , 16 January 2019). The talk about stimulus for car sales may have held back some pending buyers (why buy now if cheaper in two months?). However, if this is the case, we should see a decent pickup in coming months, as new stimulus was announced on 29 January (see China Daily , 18 February) .

Our baseline scenario continues to be a bottom in the Chinese business cycle in Q1 followed by a moderate recovery . The main drivers behind our forecast are (a) a US-China trade deal coming in March or April and (b) that stimulus measures gradually kick in with more force, as many of them work with a lag of up to a year.

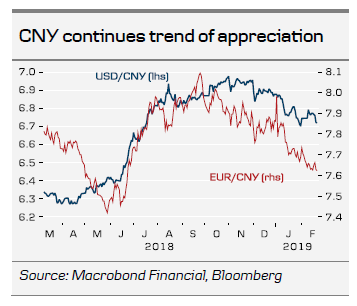

High-level trade talks more specific, stable CNY part of a deal High-level trade talks continue for third consecutive week with a Chinese delegation in Washington on Thursday and Friday. Reuters reported on Thursday that the two sides are getting more specific in the talks and work on a memoranda of understanding that includes issues on (1) forced technology transfer and cyber theft, (2) intellectual property rights, (3) agriculture, (4) services, (5) non-tariff barriers, (6) currency, (7) bilateral deficit reduction and (8) an enforcement mechanism. Earlier this week, markets focused on headlines that the US is pressing China for a stable yuan as part of a trade deal (see Bloomberg). The message from both sides is still fairly optimistic. Trump tweeted this week that there was ‘big progress on soooo many different fronts!’ and on Tuesday he stated the 1 March deadline is not ‘a magical date’. He is scheduled to meet China’s chief negotiator Vice Premier Liu He today.

Comment: With high-level teams travelling back and forth between Beijing and Washington for the third consecutive week, it is clear that both sides are very keen on making a deal as soon as possible. However, we doubt they will make the 1 March deadline. Many details need to be agreed upon and Trump has also made it clear that a deal will be closed between him and Xi Jinping at a meeting soon. We believe the deadline will be extended and that Xi and Trump will meet either at the end of March or in April to close a deal. Things could also get a bit noisier towards the end, as China is unlikely to meet all US demands. Ultimately, however, we believe Trump wants his deal soon and before the 2020 election campaign really kicks off.

Is the US losing the battle over Huawei in Europe?

British intelligence has concluded that it can mitigate risks from Huawei equipment in 5G networks (see BBC, 18 February). The UK’s National Cyber Security Centre’s decision has dealt a blow to the US after touring Europe and Eastern Europe to warn about the risks of using Huawei. German Chancellor Angela Merkel opened a door for 5G Huawei earlier this month in Germany, as she set out conditions for Huawei to participate in building its 5G network (see Reuters, 5 February). Italy recently denied it planned to ban Huawei 5G as it had found no critical issues.

Even Trump himself cast some doubt over a US ban on Huawei when he in a tweet yesterday stated that he wanted the ‘United States to win through competition, not by blocking out currently more advanced technologies’. One of Huawei’s three rotating chairmen Ken Hu Houkun was quick to reply saying, ‘Mr. President. I cannot agree with you more. Our company is always ready to help build the real 5G network in the US, through competition’ (see SCMP, 22 February). The executive order on banning Huawei in the US, which unconfirmed reports suggested has been signed last week, has still not surfaced.

Comment. It is frustrating Washington that European powers are not jumping on board and joining forces with the US in the tech war against China. Secretary of State Mike Pompeo issued a stark warning to allies on Thursday on Fox News, saying that the US would not be able to work alongside countries that adopted Huawei equipment (see Reuters, 21 February). The challenge for the EU is that Huawei is ahead of Western competitors in 5G development and that a ban on Huawei would put European companies at a disadvantage to Chinese competitors in the development of AI products etc. It is unclear what to make of the Trump tweet but he may just be trying to ease the negotiating climate in the trade talks. It is also still unclear whether or not he could intervene and stop the extradition order of the Huawei CFO as part of a deal with China.