A ceasefire tomorrow is widely expected but the path to a trade deal is likely to be rocky. Renewed escalation in H2 is still a risk if both sides stand firm.

Markets are caught between the threat of escalation and belief in a trade deal.

There are still no signs of a hard landing in China, with profits rising 1.1% y/y in May.

Note: China Weekly Letter is taking a break in July. Have a great summer.

Xi and Trump to restart talks but no quick fixes

A delay in additional tariffs on China is now widely expected. According to media reports, the US and China tentatively agreed to a trade war truce in the meetings conducted by US Chief negotiator Robert Lighthizer and China's Vice Premier Liu He ahead of G20.

According to some sources, Chinese president Xi Jinping demanded Donald Trump delay the tariff increases as a condition of holding the meeting. In addition, The Wall Street J ournal reported that Xi will demand the removal of Huawei from the blacklist as a condition of a trade truce. On Friday, a foreign ministry spokesperson repeated the message that China hoped the US would meet China halfway in the trade talks. China has also noticed that the trade war is unpopular among US businesses. The international state media China Daily wrote on Friday that 96% of 314 business representatives stated their opposition to additional tariffs on China during last week's hearings.

However, Reuters reported earlier this week that the US will not come with concessions to the talks. Instead, it wants China to go back to the deal that was on the table before the breakdown of talks. In an interview with Fox News, Trump said that unless China was able to get talks back on track, he was ready to go ahead with the so-called phase 2 and put tariffs on another USD300bn worth of goods. He could start with 10%, he said.

The Xi-Trump meeting is scheduled to take place on Saturday at 11:30 local time, corresponding to 04;30 CEST . The plan is for the meeting to last 90 minutes.

Comment: While a ceasefire seems highly likely, we expect the path to a deal to be difficult. The mood up to this G20 meeting has been much worse than prior to the previous G20 meeting and both sides continue to stand firm.

We should have statements from both sides on Saturday morning European time. Some of the things to look out for are (a) will tariffs be delayed?, (b) will Trump put a deadline on a deal before lifting tariffs?, (c) if so, will he put the tariff rate at 10% or 25% and (d) will the blacklisting of Huawei be removed? We expect a delay in tariffs but believe that Trump will set a deadline for a deal, possibly three months as he did previously. We also expect the blacklisting of Huawei to be removed . Otherwise, China might retaliate through restrictions on rare earth exports to the US . If we fail to get a ceasefire, then we expect uncertainty to increase sharply again and then we believe we would be in for a sell-off in equity markets

Financial markets too complacent

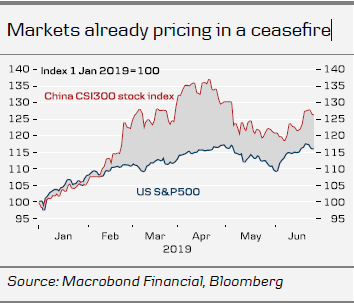

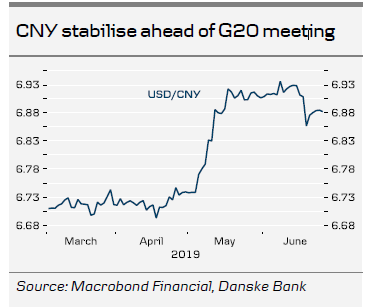

As a ceasefire started to look increasingly likely, equity markets have rebounded in the month of June. However, as the ‘good news’ was priced in, stocks traded with more hesitance this week – not least because the signals from both sides have shown little sign of softening. The CNY has shown the same pattern. Following the initial sell-off after the trade war escalation in early May, the CNY regained a bit of the lost terrain. This week FX markets have treaded water awaiting the signals from G20.

Comment: Equity markets seem caught between on the one hand a risk of further escalation, which would spell renewed sell-off, and on the other a belief that a trade deal will come eventually, leading to a stock market rally.

However, we have one concern when it comes to the short-term stock market outlook. Equity prices seem to be complacent about the risk of a further escalation, which could push both the global economy and the Chinese economy into an even deeper slowdown. If Trump gets impatient and there is no real market pressure to make the necessary compromise, he might hit the tariff button once again to pressure China even harder. This in turn could result in Chinese retaliation involving restrictions on rare earth minerals and a US consumer boycott is looming in the background in the event of further escalation.

Thus, we see a higher risk that equity markets have to go lower before they go higher again, as the pressure from a market sell-off may be necessary to push Trump into making the necessary compromise to strike a deal.

The same pattern holds for our outlook for USD/CNY. We expect USD/CNY to move higher still before the parties eventually strike a deal and USD/CNY turns lower again.

Still no signs of a hard landing in China

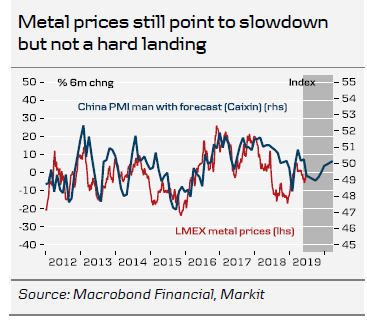

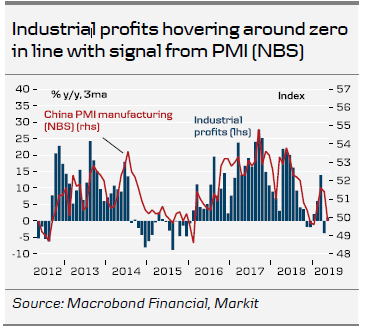

The economic news was limited this week. Industrial profits for May rose 1.1% y/y after a 3.7% fall in April. This is broadly in line with other data, which point to weak growth but not a hard landing. Metal markets suggest this picture is intact in the short term (see chart).

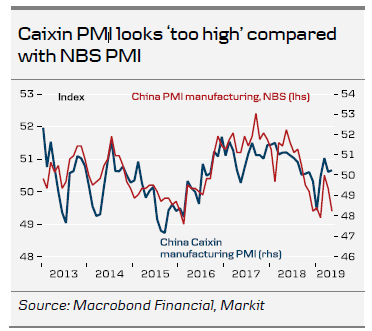

Comment: We expect China’s economy to stay soft but avoid a hard landing. Chinese authorities are ready to ease policy more if there are any signs the economy is deteriorating further. Taxes have already been cut and lending measures to the private sector been implemented. Rules for local government bond issuance have also been loosened to allow more infrastructure projects to go ahead. Next week, PMIs for June will provide more information on the state of the economy. We look for a big decline in Caixin PMI manufacturing, which seemed ‘too strong’ compared with NBS PMI manufacturing, which fell sharply. We expect the latter to be broadly unchanged.

Other China news over the past week

US expands blacklist to super computers and AMD partners.

Micron (NASDAQ:MU) resumes some chip shipments to Huawei.

Singapore’s Prime Minister calls for united ASEAN amid US-China tensions.

Vietnam and India see an explosion in FDI from China as production moves.