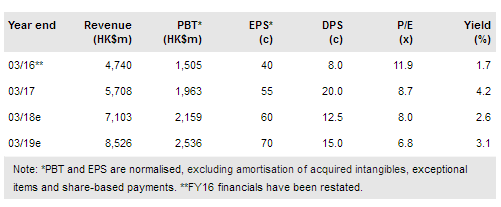

China Water Affairs (HK:0855) (CWA) delivered a CAGR of 24.7% in top-line growth and a CAGR of 23.4% in EBITDA in FY12-17. We expect its growth story to continue with volume/price increases in the Chinese market and the opportunity to acquire underperforming assets from local governments. We forecast revenue to increase 25% in FY18 and 20% in FY19 (vs consensus of 19% and 14%, respectively), on the back of a 50% increase in capex in FY17 under service concession contracts. Its net debt of HK$6.2bn and net debt to equity ratio of 70% are at a historical high.

The management of capex spending and the pace of acquisitions will be a delicate balancing act against the level of leverage. We reduce our fair value by 6% from HK$7.12/share to HK$6.71/share based on sum-of-parts EV/EBITDA valuation as we lower our revenue forecasts for FY18 and FY19 by 6% and 7%, respectively (given CWA’s reported FY17 sales were 9% below our previous estimates).

FY17: Growth and profitability on track

CWA posted 20% growth in revenue and 34% growth in EBITDA in FY17. Operating cash flows increased by 25% y-o-y to HK$1,454m. Meanwhile, capex increased 50% to HK$1,910m, mainly on water supply capacity expansion under service concession agreements as the sole water supplier in different regions. Net debt increased by 48% to HK$6.2bn, bringing CWA’s net debt to equity ratio from 50% in FY16 to 70% in FY17, a level comparable to HK-listed peers.

To read the entire report please click on the pdf file below: