Strong export data in October showed that Chinese exporters are worried that US tariffs will increase in January 2019. We expect this front-loading behaviour to continue for the rest of 2018 as we expect that the Xi-Trump meeting during the G20 will not yield positive results. At the same time, China's fiscal stimulus could boost import growth in 2019.

Strong exports due to front-loading activities

Exports grew 21.4%YoY, higher than the consensus of 11.7% but in line with our 23.0% forecast.

We believe that the cause of such strong growth is exporters' concern that the 10% tariffs on $200 billion of exported goods to the US will rise to 25% on 1st Jan 2019, so they front-loaded export activities.

Front-loading can't last long

Front-loading export activities should continue in November and December. So export growth data will continue to be stronger than in previous holiday seasons.

As we expect President Xi's meeting with President Trump at the end of November will not achieve positive results, the increase of the current tariff rate from 10% to 25% on $200 billion of US imported goods from China is a high probability event. We hope that the meeting will not damage the trade relationship further as Trump once said that if the trade talks fail, then he could raise tariffs on all Chinese imported goods.

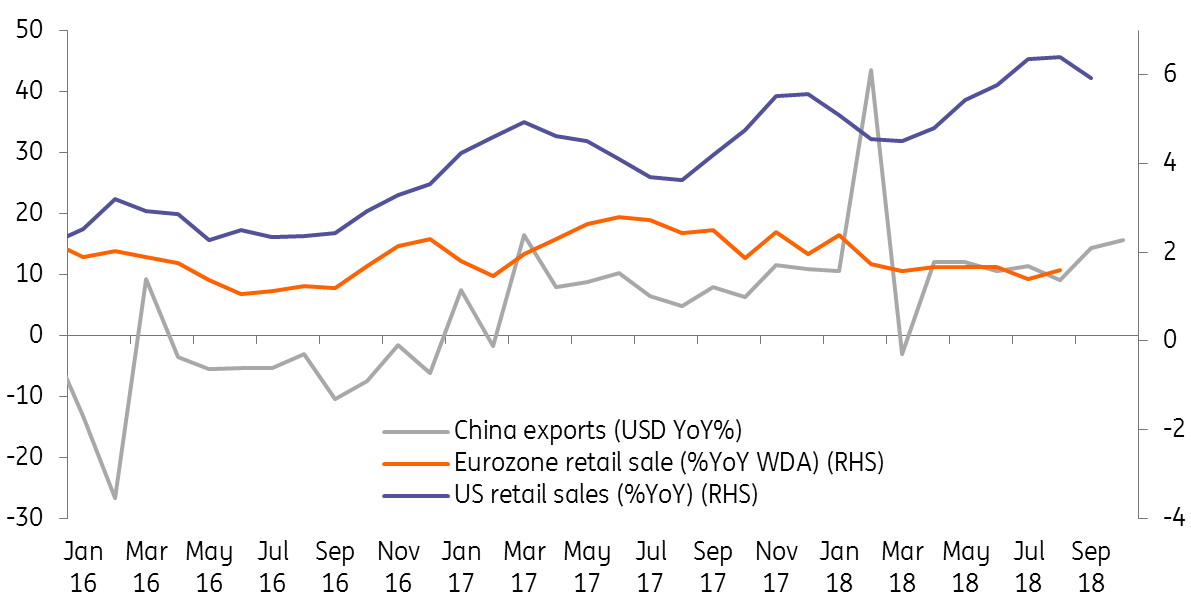

Though US demand will continue to be strong, import tariffs on Chinese goods could dampen US demand for Chinese goods. We expect that some of these exports will be diverted to Europe. Whether they can also be diverted to other Asian economies depends on the extent ton which those economies are themselves affected by the trade war.

So strong export growth may not last very long. Export growth should slow under higher tariff rates. As such, we are not particularly optimistic on China export growth in 2019, especially in 2H19.

Imports could grow faster

Front-loading is also the reason for strong import growth (at 15.6%YoY) however to a lesser extent as importers worry that future export growth will decline.

But as China's fiscal stimulus has kicked off, we expect that imports of building materials for infrastructure projects, and imports of consumables due to tax cuts, will partly offset the slower demand for import materials for export manufactured goods.

Imports could therefore grow faster than exports in 2019.

Will China appreciate the yuan to facilitate cheaper imports

We do not think so as we believe that the USD/CNY and USD/CNH largely follow the direction of the dollar index. We believe under this trade war China will passively follow the dollar index to avoid being labelled a currency manipulator by the US, and to avoid further possible damage on trade and investments.

Our forecasts on USD/CNY and USD/CNH at 7.0 and 7.30 by end of 2018 and 2019, respectively, are still intact.