In several high profile meetings,Chinese policy makers have stressed the need for higher quality rather than faster growth. While this is a common refrain in China, the actions the authorities have taken over the past year suggest it will be a reality in 2018. Policymakers have to strike a delicate balance between supporting economic growth, mainly through increasingly less effective debt stimulus, and tackling the long-term challenges of a large debt burden and excess capacity. An uncertain global environment in the past few years has forced the authorities to prioritise growth through stimulus to counter fears of a hard slowdown. With the global economy now on firmer footing, the pendulum is swinging towards reforms. Short-term growth will be negatively impacted but this should still be a welcomed development. Curtailing financial stability risks now will ensure more durable long-term growth for China and the global economy.

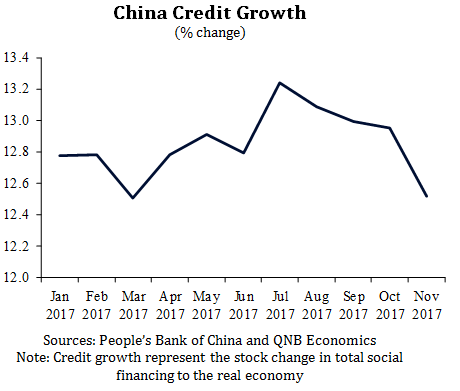

There are two main areas of reform the authorities have engaged in. The first are measures to reign in credit accumulation and manage the large debt burden. In this respect, Chinese authorities have implemented gradual but important measures such as tighter borrowing requirements in the property market, higher interbank rates to curb short-term lending and a crackdown on shadow bank lending. There has also been discussion around measures to limit local government borrowing. All of these actions have contributed to slowing total credit growth,which has been declining since July.

Adding to this are the increased powers and resolve of authorities to tighten banking and other regulations as needed. In 2016, the People’s Bank of China (PBoC) established a macro prudential assessement framework (MPAF) to monitor virtually all asset classes, including bank loans, bonds and stocks, as well as the efficacy of investments in these assets. The PBoC’s powers have been expanded further in 2017 under the MPAF and a new joint committee with other government agencies was recently formed to monitor and coordinate action on financial stability risks. Moreover, several senior officials, including the PBoC governor, have recently stated the immense challenges and risks China faces if it fails to properly defuse its credit dependency. We view these as important signals that policymakers are gearing up to increase pressure on credit provision in 2018.

China Credit Growth (% change)

Sources: People’s Bank of China and QNB Economics

Note: Credit growth represent the stock change in total social financing to the real economy

The second set of reforms relate to overcoming the significant excess capacity in China’s state-owned enterprises (SOEs).A by-product of the rapid credit boom, excess capacity in SOEs presents a major risk to the economy because they hold more than half of China’s total debt or 167% to GDP. Hence, improving SOE revenue and debt service capacity is critical to overcoming China’s debt problem. In 2017, the government has significantly increased its efforts to this end.Output cuts of 5% were imposed on the steel and coal sectors and enforcement of environmental regulations on large-scale industrial emitters in excess of emission requirements. The net result has been significant supply cuts, which in turn, have boosted industrial prices and helped cash flow for SOEs. The improved profits have helped stabilise leverage in SOEs. 2017 was the first year since 2011 where the corporate debt-to-GDP ratio did not increase.

We foresee these measures increasing in 2018. The successful reductions in steel and coal are likely to prompt targeted cuts in other overcapacity sectors and Chinese President Xi has emphasised environmental regulations in his speech at the 19th Congress in October, China’s signature political event that occurs at five year intervals.

Collectively, both sets of reforms imply lower real GDP growth in 2018. We estimate growth will slow from 6.8% in 2017 to 6.4% in 2018.However, the short-term growth impact is small.China is still comfortably on pace to double nominal GDP by 2020. But far more important than growth is reducing the risk of a debt crisis which could have significant spillover effects on the global economy. The implementation and effectiveness of reforms to achieve that will be a gradual process. But China and the rest of the world will be better because of it.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.