The Chinese economy is weakening on several fronts and not just because of the US-China trade war. In response, the government is looking for ways to boost consumption. Tax cuts may not be enough to avoid a softening in the labour market.

At the end of January 2019 there were two major events in China that caught our attention. The first was the trade negotiations with the U.S., which ended without a major breakthrough. The second was the announcement of a Targeted Medium Term Liquidity (TMLF) by the People’s Bank of China.

Under this facility, the central bank will lend to commercial banks at a lower interest rate, provided the commercial banks increase lending to smaller private firms. These two events highlight that the Chinese economy continues to face uncertainty from the trade war, and the government will continue to support the economy through this period.

Chinese vice premier and lead trade negotiator Liu He returned from Washington with some progress made, but without a final deal with the U.S. Negotiators have agreed some concessions on agricultural exports, but not resolved the key issues around intellectual property rights, the transfer of technology, and the role of state-owned enterprises. We think this makes it unlikely the trade war will end by 1 March 2019.

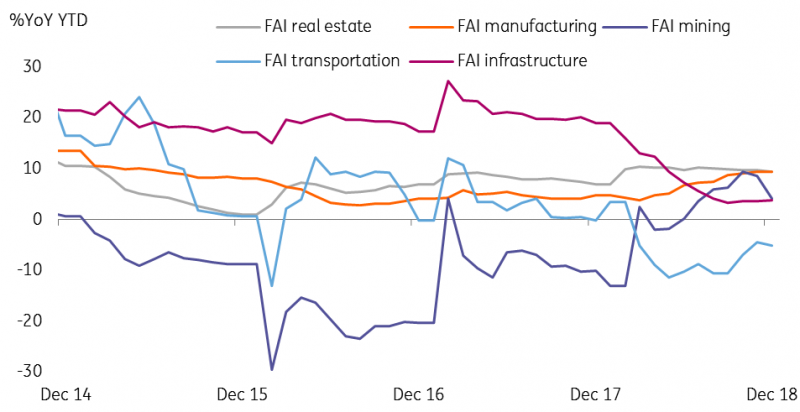

The Chinese government relies on infrastructure again

President Xi emphasises that the government will protect the economy from key risks. Apart from fiscal stimulus, with more metro lines built at the city level, there will be ample funding for private firms to avoid another wave of defaults, which amounted to around CNY100 billion in 2018.

Funds from the TMLF are likely to be used by private firms to repay maturing debts. These funds will therefore not do much to spur further growth, but without them, China would face a series of private firms closing down, seriously hurting the job market.

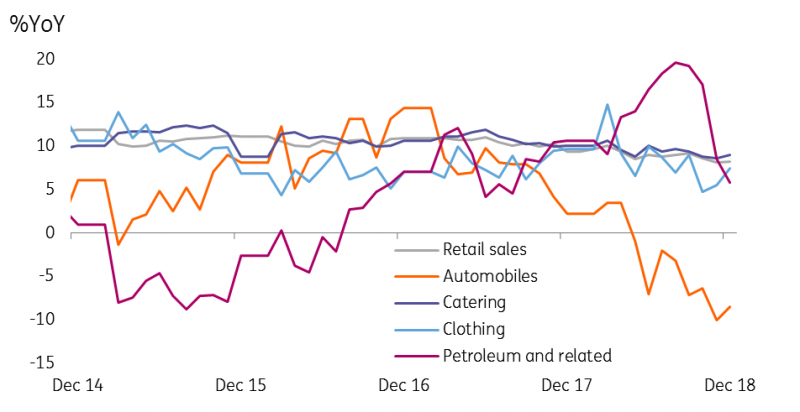

Retail sales have already been slowing down in some segments, with sales of automobiles particularly hard hit. Cars could be a special case as they are still considered a luxury item. But the falling trend of clothing consumption makes us worry that consumers are tightening their belts.

Falling retail sales and even worse for cars

This suggests that tax cuts for salary earners may not yield a proportional rise in consumption. Individuals are likely to save some of the tax rebates during bad times. Corporates will behave in a similar way and are unlikely to invest as much as they do in good times, even with tax cuts.

Local government officials are turning to similar stimulus measures used in 2009. For those who remember, local governments in rural regions boosted consumption successfully in 2009 by promoting consumption on household electronic goods and cars. Now in 2019, the same measures are being used again to prop up spending in the rural regions. We doubt if this project will yield the same successful result because households already own those goods.

Without growing domestic demand, the trade war damage to the export and manufacturing sectors could be passed on to service sectors, such as retail sales.

We believe the trade war is not over yet, but the PBoC is reluctant to change its exchange rate policy (i.e. allowing USD/CNY to follow the dollar index). As such, we are revising our USD/CNY forecast to 6.75 from 7.3.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more