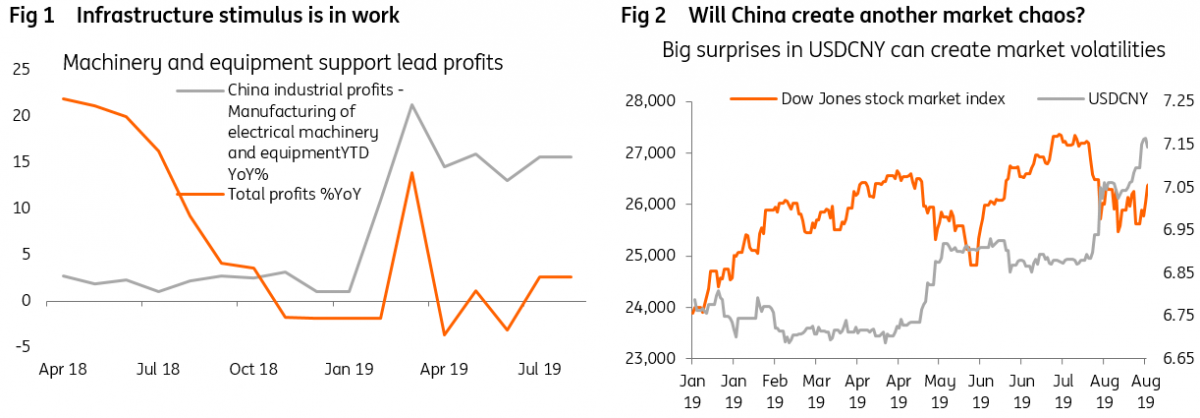

We believe that China has changed its strategy when it comes to the trade war, and that could lead to further market volatility. In terms of economic growth, it seems the strategy of boosting infrastructure projects is also working.

Trade tensions have escalated

As we said in the July monthly note, it was hard to see a summer lull in the trade war. The trade war escalated on 23rd August when China surprised the market by retaliating American 10% tariffs on $300 billion worth of goods. The retaliation came in so late that the market had forgotten that China could retaliate.

China’s retaliation of 5%-25% on $750billion worth of US imports was indeed small, but it definitely caught the market and President Trump off guard, which lead to the Trump Administration hastily reacting with an additional round of 5% tariffs.

Our latest CNY outlook

Even though the two sides have scheduled talks in October, we don’t believe there will be fruitful results from it. As such, we have revised our USD/CNY forecasts from 7.10, 7.00 and 6.90 previously, to 7.20, 7.30 and 7.20 by the end of 2019, 2020 and 2021 respectively. However, we forecast a trading range of 7.05-7.50 for the rest of 2019.

This is partly because we don’t expect meaningful outcomes from trade talks in 2019, so we don’t expect USD/CNY to go back below 7.00. If there is positive news from the trade talks, USD/CNY could possibly return to 6.8-6.9 but the chances are very low.

The 7.50 upper bound of our forecast range could also create further market chaos, just as was the case when USD/CNY crossed 7.00. Creating sudden market chaos could be the Chinese strategy to upset President Trump’s supporters.

Economy receiving support from infrastructure stimulus

On the economy, China’s infrastructure stimulus projects appear to be making good progress. China’s industrial profits turned positive in the latest data, mostly because of the support from infrastructure projects, which pushes up profits in the mining sector and electrical product sector.

We believe that infrastructure projects can support the economy to achieve the 6% GDP target.

The Chinese cabinet has already signaled that the PBoC should cut the required reserve ratio- RRR - to provide more liquidity to suppress the increasing interest rate trend, as there are an increased amount of local government special bonds to be issued.

However it seems that the central bank is reluctant to flood liquidity into the system. It wants to make sure that the liquidity flows to infrastructure projects and smaller exporters. This could only be done via the banks’ tracking after the loans are drawn down.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more