In April this year, the commodities market saw some very good fortune.

The S&P GSCI Index soared by 10.1%, and 20 of the 24 components rose in value – thus making it the second-best April on record.

The iPath Bloomberg Commodity (NYSE:DJP) Total Return Index rose in a similar fashion in the same month, experiencing a rise of 8.5% – the largest jump since December 2010.

These are all good signs, aren’t they? The “reflation trade,” as Wall Street terms it, shows that the global economy is growing again, right?

Unfortunately, no.

Instead, April’s record numbers simply offered false hope to a continually troublesome commodities market.

China Takes a Gamble

Far and away, China was the major force that was driving commodity prices higher in April. But it wasn’t a growing Chinese economy that pushed steel prices 50% higher in the country.

It was Chinese retail investors.

China’s speculative investing community had been burned by the property and stock market – thanks, in large part, to Chinese authorities clamping down on excessive speculative activity – leaving the commodities market as the one area where authorities had yet to rein in speculation.

In turn, speculators set their sights on commodities as the latest place to gamble. In effect, the commodities market was suddenly China’s hottest new casino, seeing high stakes bets being placed left and right.

At the peak of this speculative fever, the number of steel rebar contracts traded in Shanghai actually exceeded the volume on West Texas Intermediate (WTI) and Brent crude oil contracts combined.

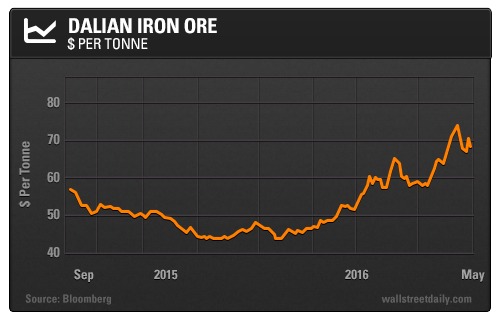

A similar pattern was evident in the trading of iron ore contracts in Dalian. Frenzied trading in Dalian drove prices up 50% from the January low to almost $70 per ton. The normally placid iron ore futures market saw trading volume surge to seven million trades a day at its peak.

Other commodities had also been bid up to prices far higher than their supply/demand fundamentals would dictate as necessary.

Regulators Step In

Finally, the Chinese regulators stepped in. They raised fees and margin requirements and sent out dire warnings about the dangers of speculation.

The consequences were inevitable…

Resulting in the biggest weekly loss for coking coal since the launch of trading. Coke futures plunged 11% last week and coking coal futures fell 10.2%.

Plus, steel rebar futures just suffered their worst week (down 9.5%) since 2009 on declining volume.

Iron ore prices are crashing, as well, experiencing their seventh straight day of decline. The current price is around $55 per ton and still falling.

The knock-on effect was felt in other industrial metals too, such as copper, nickel, and zinc. The recent gains in these metals have all pretty much reverted to pre-speculation rates.

Plunging Chinese imports of copper – down 21% in April – have reinforced the reality that there is plenty of the metal to meet demand.

In fact, the world’s largest producer of copper – Chile – announced that supply is exceeding demand and expects the price to be about $2.15 per pound this year – not the recent $2.30 per pound valuation.

Future Shock?

The outlook, however, isn’t so bleak for the commodities market.

With some time to undo the damage that China has enacted, commodities will eventually trend back toward trading on fundamentals – particularly for the industrial metals where the fundamentals are majorly lacking.

Demand has barely increased while mining companies continue ratcheting up their output.

The base metal industry will probably – like oil in the United States – require external resources to play a role in the resurgence of the market. U.S. hedge funds, for instance, became majorly influential in the oil trade, playing the role Chinese retail investors did with base metals. Eventually, fundamentals – vast oversupply – will re-assert itself in that market, as well.

Precious metals, meanwhile, continue to retain a solid bid on the global scale, as fears over central bank policies have some investors looking for a security blanket.

Reacting to Rarities

There’s a lesson to be learned from this bout of Chinese speculative fever: Get used to it.

These kind of over-reactions from China’s market are now a permanent part of the financial landscape.

According to Morgan Stanley, 18 of the top 25 most actively traded commodity futures contracts now trade on Chinese exchanges.

This will only continue to increase in the future. Within a year, China’s first oil futures contracts will begin trading on the Shanghai Futures Exchange.

And just last month, China launched a gold price benchmark that will compete with London’s gold twice-daily price fixing.

Adding to that will be a number of exchange-traded funds based on commodities, which are set to hit the markets in China over the next year or so.

The bottom line? Commodity pricing power is shifting away from the West and into the hands of the Chinese. Thus, the ever-changing mood of Chinese speculators is more important than ever, no matter how regulators might try to take control.

Good Investing,