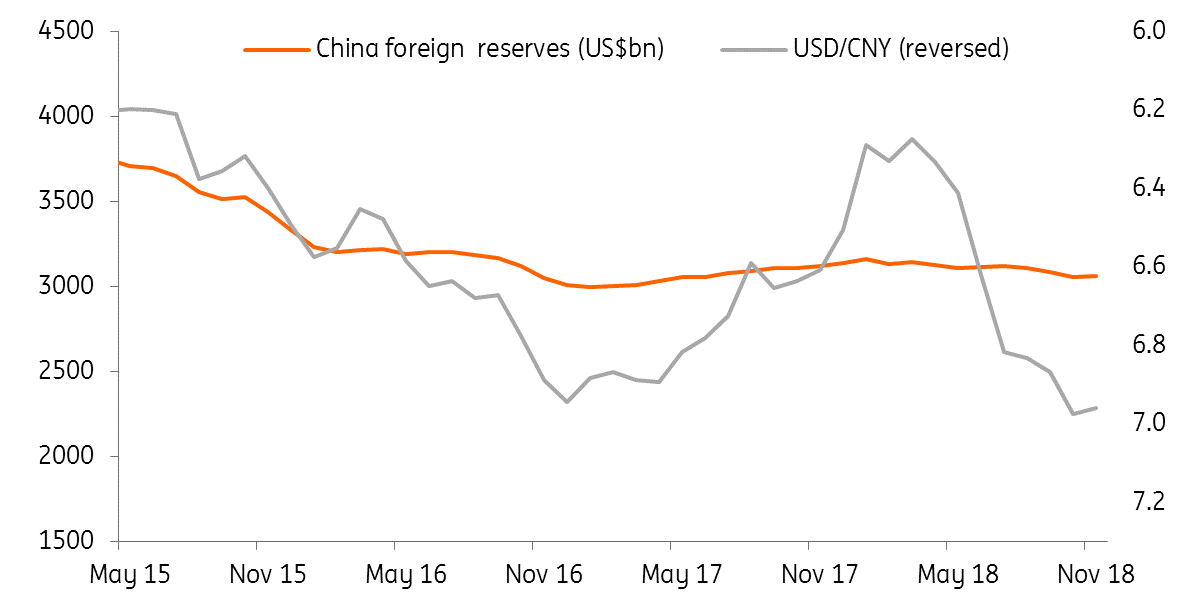

China has surprised us all with higher foreign reserves in November. The bond and stock market inflows have probably more than offset the use of reserves for the yuan interventions.

Chinese foreign reserves rose to $3.0617 trillion in November from $3.0531 trillion in October, surprising us as we expected the interventions preventing USD/CNY from depreciating towards 7.0, and the rise of the dollar in the month to have a negative effect on forex data.

One possibility that comes to mind is that China's bond and stock market inflows in November offset the use of foreign reserves for foreign market interventions. Onshore bonds will be included in the Bloomberg Barclays Index, and A-shares will get more weight in the MSCI index next year. So, it's possible that foreign money went into these Chinese markets to prepare for an increase in demand in 2019 through passive investment indexes.

Unexpected rise in China's foreign reserves in November

Inflows could form a virtuous cycle to stabilise the yuan

If capital inflows are the underlying reason for this unexpected increase, then we expect more to come in the months ahead.

According to media reports, the key issue for the government is to 'firm up' investor confidence during this tit-for-tat trade war. We expect the government to stabilise the A-share and forex market so that more foreign money enters China's onshore markets.

This would result in more exchange from foreign currencies into CNY, so the yuan is supported and could form a virtuous cycle of stabilising the USD/CNY.

If inflows keep rising, it could change our yuan forecast

As such, we will keep monitoring inflows and both Chinese and US actions during the trade truce, which are some of the key factors in our USD/CNY and USD/CNH forecast.

For now, we maintain our forecast for USD/CNY and USD/CNH at 7.0 for the end of the year and 7.30, for the end of 2019.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”