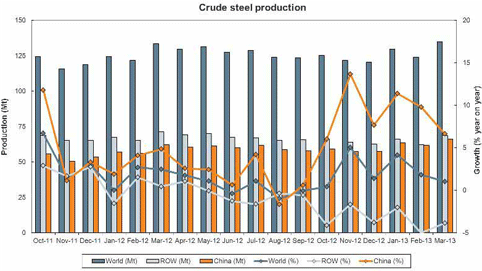

Data released by various state bodies in China contrasts with that published by the World Steel Association (WSA), recently highlighting how even in a depressed market, China’s steel producers have continued to boost production year on year while much of the world falls.

Firstly, the WSA report for March shows the rest of the world has been contracting. Europe was down 6.6%; the CIS was 4.5% lower; North America fell 6%; South America dropped -7.8% with only Japan and India showing any gains among the major producing countries outside of China.

Nevertheless, China’s economic data is not particularly rosy.

According to a Standard Bank note to clients, the government’s China Federation of Logistics and Purchasing PMI reading eased from 50.9 in March to 50.6 in April. New orders fell from 52.3 to 51.7, largely due to export orders dropping from 50.9 back into contraction territory again at 48.6.

PMIs for the steel industry were not any better. This week’s official steel manufacturing sector PMIs remained firmly in contraction for the second month in a row, suggesting the worst conditions witnessed since last July-August’s massive destock. April’s contraction in steel activity, however, saw slightly improved momentum, shifting up from 44.6 in March, up to 45.1; implying, the bank says, that the worst of this year’s downstream destock might be over.

China’s steel output PMI fell from 45.7 to 44.9, suggesting some weakening in production rates, while finished goods fell from 58.9 to 49.0.

Underlining the fact services are now said by the PBOC to be larger at 47% of GDP than manufacturing in China, power consumption grew while manufacturing activity has stalled. Electricity production in Q1 is said to be up 4%, with the China Power Association predicting a rise of 8.5% in 2013 over 2012.

Services includes construction, where new home sales and resales have fallen in response to recent property curbs, is down 57.3% and 88.1% respectively in Beijing, according to Standard Bank. Not surprisingly, finished steel prices are down, and inventory continues to be run down as well, but the bank believes this is close to running its course and we could see an uptick soon.

Threats by Beijing that the CISA and the Ministry of Environmental Protection have teamed together to root out the steel industry’s chief polluters are not causing anyone too much concern, given China’s steel industry has installed capacity of >1 billion, relative to output of about 750 million tons. Any cut to steel capacity or steel output forced upon “the polluters,” the bank believes, will quickly be filled by alternative producers, should market demand allow.

For now, both domestic Chinese steel prices and seaborne iron ore prices probably have further downside. When the trend reverses will depend on the domestic construction market and international export markets – the former is, for now, looking a more likely source of salvation than the latter.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

China Steel Industry In De-Stocking Mode

Published 05/06/2013, 02:53 AM

Updated 07/09/2023, 06:31 AM

China Steel Industry In De-Stocking Mode

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.