At the root of much of the market turmoil in the first quarter of 2016 was fear that China would be a major force dragging the world into recession, as its economy dramatically slowed after decades of growth led by manufacturing.

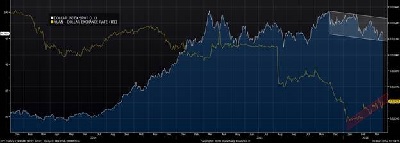

One “tell-tale” sign referred to by anxious pundits was the “depreciation” of the Chinese yuan -- a prelude, so they thought, to a massive, one-off devaluation looming in the near future. Such a competitive devaluation would have had a dramatic effect on China’s foreign exchange reserves as holders of yuan-denominated assets who had the ability to get them out of China all ran for the exits. Many observers were already nervous about the decline in China’s foreign reserves since their peak in the second quarter of 2014, which accelerated markedly at the end of 2015:

China's Foreign Exchange Reserves

Source: Bloomberg

To many doomsayers, China was the barometer of a global economy on the brink of recession. A drastic Chinese slowdown would spread deflation far and exacerbate the havoc wrought in the economies of its trading partners and the world’s commodity producers.

Those recession fears have faded, although they have not dissipated entirely. The first quarter of 2016 has changed the psychological landscape, particularly with regard to the fear of a Chinese hard landing. Why?

First, China’s hemorrhaging of foreign reserves has stabilized. This stabilization is being driven by a few factors. First, the U.S. dollar has stabilized on a trade-weighted basis; and second, this has allowed the Chinese government to modestly strengthen the yuan versus the dollar.

White line: U.S. Dollar index; yellow line: Chinese Yuan/U.S. Dollar exchange rate

Source: Bloomberg

This is a similar pattern to the one observed beginning in August last year, just before the yuan’s decline that reversed in January. Another reversal is not impossible, but the recent trend has been psychologically helpful.

Second, the actions of the People’s Bank of China have become somewhat more transparent. August’s small surprise devaluation was a shock because global market participants are used to central bankers who, in the post-crisis world, have come to take enormous pains to communicate their policy intentions clearly. PBOC officials perhaps had not gotten that memo, and their intentions (and policy path) were unknown. But since, it seems they have, with the bank’s governor and other offices appearing frequently in the press to reassure markets that no big devaluation was in the offing. This communication has helped.

Third, Chinese officials are enforcing capital regulations more stringently. China’s foreign-exchange outflows occurred primarily through two channels, repayment of dollar-denominated debt, and transfer payment abroad for things like pre-payment of imports. The latter has been a primary way that corrupt officials are able to get their ill-gotten gains out of the country -- with fraudulent invoicing being used to cover their trail. Reports from the China analysts we follow suggest that the regulatory environment has become much more aggressive, with trade invoices being audited and other means being used to slow down transfers by closer adherence to existing regulations.

Repayment of Dollar-denominated debt, according to analysts, has accounted for about a third of China’s foreign-exchange outflows since the end of 2014; the drawdown has now brought the level of foreign bank claims back to the levels of three years ago. Thus, such outflows are likely to moderate moving forward.

China Paying Off External Debt

Data Source: Bloomberg

And fourth, as we have said in recent letters, economic indicators improved during 2015 and are continuing to improve -- allaying fears that a sharp yuan devaluation would be necessary to stimulate growth.

All of the above have improved market psychology about China and about the global economy, and have allayed fears that China was facing an imminent growth hard landing, or an imminent competitive yuan devaluation that would wreak havoc in global markets.

Nevertheless, as we have noted several times so far this year, China has bought stabilization and recovery at a price: officials have apparently given up on trying to gradually deflate the country’s huge and growing domestic debt and liquidity bubble. Eventually, on the current trajectory, this bubble will burst and generate a domestic financial crisis -- but according to the analysts we follow, this crisis is still at least three years away. Any investors who dip their toes in the waters of Chinese risk assets should be aware that the arrival of near-term stability does not necessarily give an “all clear” for the foreseeable future. Still, we think that for those with a quick trigger finger, Chinese stocks could be a way to participate in 2016’s emerging-market recovery theme -- although we still prefer the resource exporters most heavily beaten down in the recent commodity down-turn.

Investment implications: Bears betting that China’s economy would crash and take the global economy with it, that the Yuan would be devalued, and that the People’s Bank of China would be crushed by foreign-exchange outflows, have been confounded. The Chinese economy has continued to evade a hard landing; foreign exchange outflows have been stanched; and no big Yuan devaluation has appeared, with Bank officials communicating much more openly to global market participants about their policy intentions. With a potential financial crisis taking shape in three to five years, the present stabilization is not an “all clear” for Chinese risk assets -- but for those who want to dip their toes in the waters of Chinese stocks, this could be a way to play an emerging-market recovery in 2016.