Low volatility period begets high volatility and vice versa. Price charts when going through those low volatility periods form one of the classical chart pattern (symmetrical triangle, rectangle, flag/pennant, H&S continuation, right angle triangle) and alert us for a possible breakout. Breakouts from lengthy and low volatility consolidation periods are usually followed by strong breakouts and directional movements. We would like to capture those strong directional movements.

One of the best example for the cyclicality of volatility is the China SSE (LON:SSE) 50 Index. Strong directional move that took place in the first half of 2018 is now being followed by a tight consolidation (low volatility period) which is likely to be followed by sharp price action in the following weeks/months. Past 5 month’s price action formed a channel in a tight range. Breakout from the 5 month-long channel can either reverse the downtrend that has been intact since the beginning of the year, or resume the downtrend. In either case we are likely to see a strong directional movement. Resistance stands at 2,565 levels.

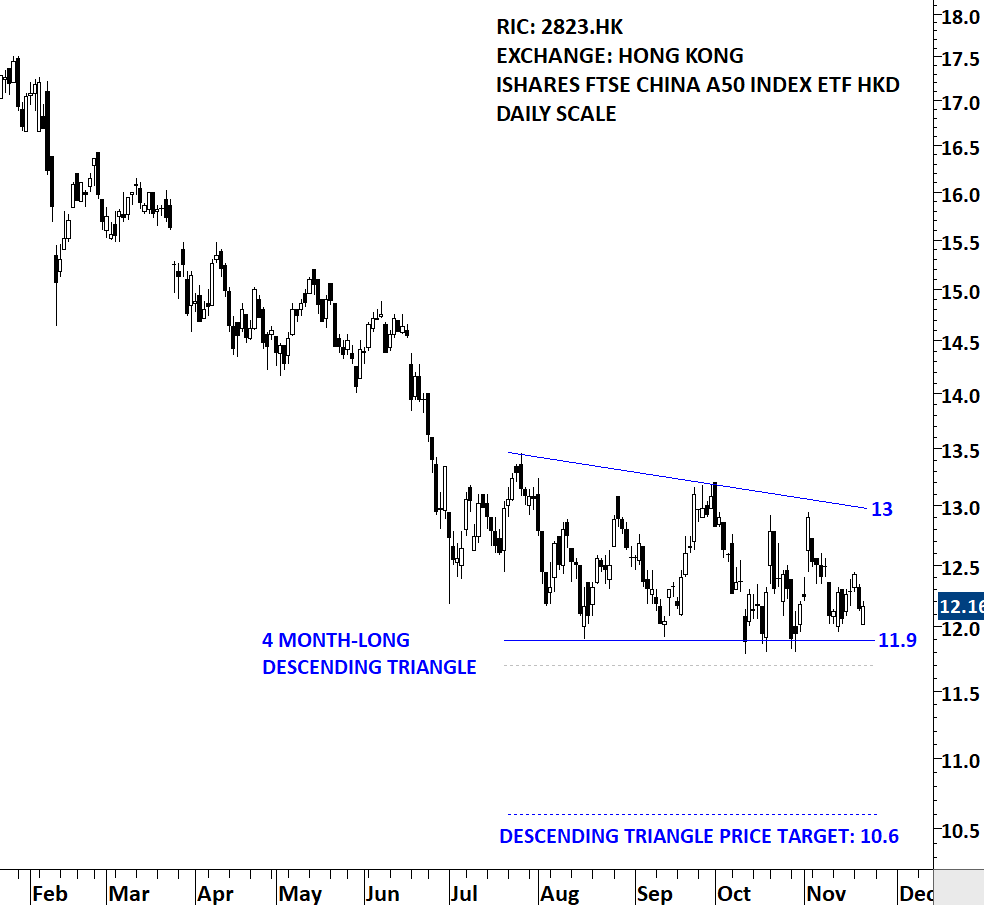

For those who would like to take advantage of a possible breakout/breakdown on China SSE 50 Index, I feature below the iShares FTSE A50 China Index ETF that is listed on the Hong Kong Stock Exchange.

iShares FTSE A50 China (HK:2823) (2823.HK)

The Ishares FTSE A50 China Index ETF aims to provide investment results that, before fees and expenses, closely correspond to the performance of the {{28930|FTSE ChChina A50 Index.The ETF is listed on the Hong Kong Stock Exchange. Price chart formed a 4 month-long descending triangle with the horizontal boundary acting as strong support at 11.9 levels. The horizontal boundary was tested several times over the course of the chart pattern. A daily close below 11.7 levels will confirm the breakdown from the 4 month-long descending triangle with the possible chart pattern price target of 10.6 levels.