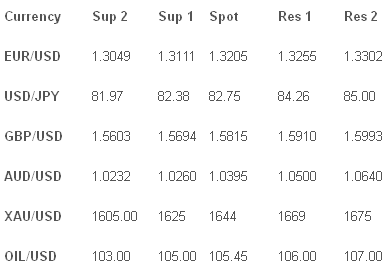

U.S. Dollar Trading (USD) a weak HSBC Chinese PMI print for March at 48.1 vs. 49.6 previously added to the developing concern that the world’s largest manufacturer was slowing down faster than expected. US Weekly Jobless Claims came in better than expected at 348k vs. 353k previously. The USD gained heavily on safe haven demand but lost ground against the other safe haven in the YEN which used the ‘risk off’ trading environment to pare back its recent losses. Looking ahead, February New Home Sales forecast at 0.325mn vs. 0.321mn previously. FED Chairman Bernanke speaks.

The Euro (EUR) the EUR/USD fell to 1.3150 as the losses mounted overnight after both the Chinese and Eurozone manufacturing surveys fell sharply and stock markets slumped. EUR/AUD was the exception using the commodity pullback to gain against the risky Aussie and this helped contain the major’s losses. Concern is turning towards Portugal and Spain with a Major Portugal strike highlighting popular opposition to government austerity measures. The Sterling (GBP) weak Retail sales in February at -0.4% vs. 0.8% forecast put a dampener from the start of the European session with GBP/USD falling sharply under 1.5800. GBP/JPY has fallen from Y133 to Y130 in the last 48 hours. The uptrend is still in place but starting to come under pressure and a break below Y130 would damage prospects.

The Japanese Yen (JPY) USD/JPY had a major pullback yesterday as the crosses add too much weight to the major which broke below Y83 hitting Y82.60. The outlook is a little mixed with the recent USD/JPY rally on hold as US interest rate expectations are tempered by Fed Chief Bernanke refusing to bring the timeline forward. Australian Dollar (AUD) the China linked currency fell heavily on the China PMI miss and is firmly in a downtrend breaking below 1.0400 and hitting new month lows. Support was found later in the day at 1.0350 before a small relief rally in the US session.

Oil & Gold (XAU) fell heavily on the USD strength down to $1630 and looking heavy now recent lows have broken. Oil traded with the rest of the market under profit taking pressure falling back to $105.40.

Pairs to watch

OIL/USD to fall more as range has broken?

AUD/USD the downtrend to continue?

TECHNICAL COMMENTARY

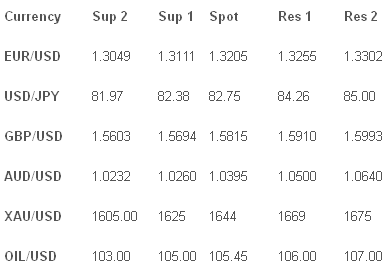

The Euro (EUR) the EUR/USD fell to 1.3150 as the losses mounted overnight after both the Chinese and Eurozone manufacturing surveys fell sharply and stock markets slumped. EUR/AUD was the exception using the commodity pullback to gain against the risky Aussie and this helped contain the major’s losses. Concern is turning towards Portugal and Spain with a Major Portugal strike highlighting popular opposition to government austerity measures. The Sterling (GBP) weak Retail sales in February at -0.4% vs. 0.8% forecast put a dampener from the start of the European session with GBP/USD falling sharply under 1.5800. GBP/JPY has fallen from Y133 to Y130 in the last 48 hours. The uptrend is still in place but starting to come under pressure and a break below Y130 would damage prospects.

The Japanese Yen (JPY) USD/JPY had a major pullback yesterday as the crosses add too much weight to the major which broke below Y83 hitting Y82.60. The outlook is a little mixed with the recent USD/JPY rally on hold as US interest rate expectations are tempered by Fed Chief Bernanke refusing to bring the timeline forward. Australian Dollar (AUD) the China linked currency fell heavily on the China PMI miss and is firmly in a downtrend breaking below 1.0400 and hitting new month lows. Support was found later in the day at 1.0350 before a small relief rally in the US session.

Oil & Gold (XAU) fell heavily on the USD strength down to $1630 and looking heavy now recent lows have broken. Oil traded with the rest of the market under profit taking pressure falling back to $105.40.

Pairs to watch

OIL/USD to fall more as range has broken?

AUD/USD the downtrend to continue?

TECHNICAL COMMENTARY