Is the tiny island with nothing on it but some goats worth damaging the fragile economy of Japan? Apparently so. China is now squeezing Japan economically in retaliation for staking claim to this tiny piece of land. The rising tide of nationalism in China is becoming a major headache for Japan.

AP: Sales of Japanese cars in China are in a free-fall. At the China Open last weekend, a representative of Sony Corp., which is a sponsor of the tennis tournament, was loudly booed at the title presentation for the women's final. Chinese tourists are cancelling trips to Japan in droves. And some analysts say Japan's economy will shrink in the last three months of the year.

The business and economic shockwaves come after Japan last month nationalized the tiny islands, called Senkaku in Japan and Diaoyu in China, which were already under Tokyo's control but are also claimed by Beijing. The move set off violent protests in China, and a widespread call to boycott Japanese goods.

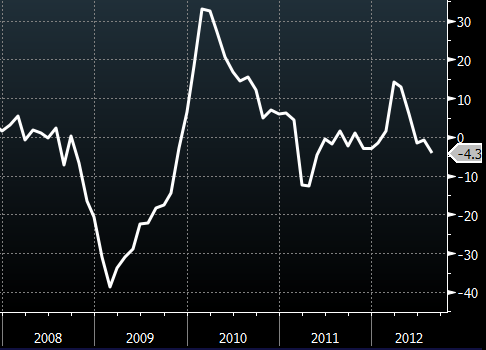

Toyota Motor Corp. and Honda Motor Co. dealerships were burned down in one city. This could not have come at a worse time for Japan, which is already running a trade deficit due to fuel imports (that replaced lost nuclear power). The nation's industrial production is in decline.

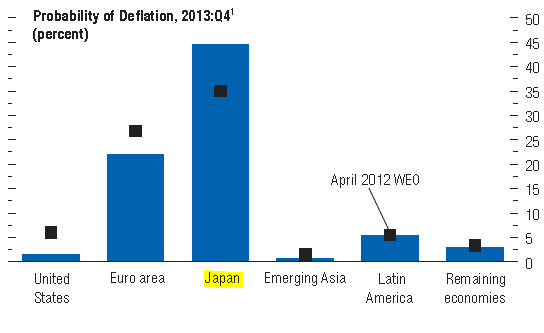

And yesterday's IMF report (see discussion) has increased it's projected probability of Japan entering a deflationary environment - again. In response BOJ will continue its balance sheet expansion, as the nation - just as the other developed economies - looks to its central bank to fix its structural problems.

In the mean time hostilities against Japanese businesses in China are continuing. It's a market Japan can not afford to lose - particularly now. But that is the cost of national pride.

AP: Japanese supermarket chain Aeon Co. said damage at one of its stores had totaled 700 million yen ($8.8 million) as looters smashed windows, broke in and ran amok, toppling shelves and kicking merchandise. That doesn't account for the loss of sales from the store's closure or boycotting consumers.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

China Punishes Japan Over The Disputed Island

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.