With the end of February, China puts itself in the spotlight with the first major PMI results of all the major economies, and major economy is the key word as China's influence across global markets only grows by the year. The February manufacturing PMI came in at 50.3 (51.2 expected, 51.3 previous), and the non-manufacturing PMI at 54.4 (55.0 expected, 55.3 previous). So, some pretty soft results. The timing of the Chinese new year no doubt played some role (taking place in the middle of February - and hence shutting things down for a couple of weeks around the 1-week national holiday), so we'd need to see March data to confirm, but it still a weak result nonetheless.

On the details, within the manufacturing PM, large firms were down -0.4pts to 52.2 vs small firms down a sharp -3.7pts to 44.8 - highlighting the pressure facing smaller firms which receive less support from the government and are generally more sensitive to changes in economic activity. Within the non-manufacturing PMI, the Services PMI was down -0.6pts to 53.8, while the Construction PMI was down -3.0pts to 57.5 - which lines up with the slowing in property price gains.

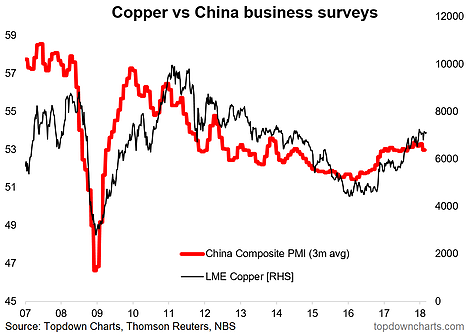

So overall, within the data there was not much to get excited about. And looking at a key China-sensitive market, the outlook for copper prices is left with some looming questions...

The key takeaways from the February China PMIs are:

- The February China PMI data was materially weaker vs January and consensus expectations. Chinese New Year likely had some impact, but it was still a weak result.

- The soft data, even if it proves to be temporary, leaves question marks looming on the outlook for copper prices.

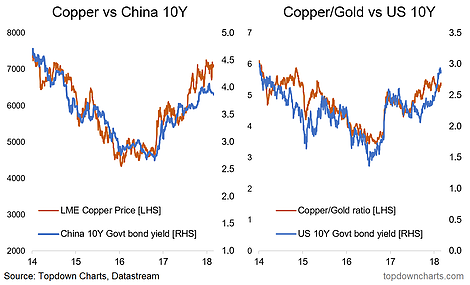

- Looking at the copper and government bond markets there are a couple of key divergences, which highlight double-edged risks in copper prices and bond yields.

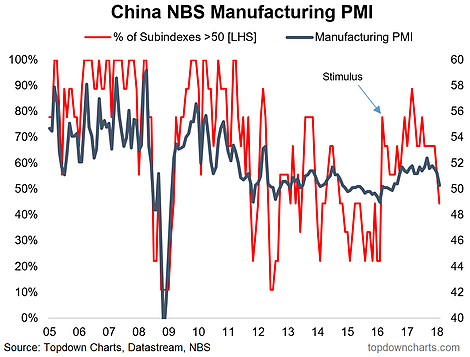

1. China Manufacturing PMI: This chart shows the breadth of the components that make up the NBS China manufacturing PMI. You can clearly visualize the moment China stepped up stimulus measures in early 2016, while the rebound in global trade and commodities and weakening CNY also helped. Whereas now you can see the impact of waning stimulus tailwinds (which were already in play) and with the latest results accentuated to the downside by Chinese new year distortions.

2. China PMI vs Copper Price: This chart was a key one in picking the medium-term bottom in copper prices, so it's one to keep watching - with China still the number one worldwide consumer of copper, any change in the cyclical outlook in China is going to ripple across copper markets (and industrial metals). The latest results show a blip down in the composite smoothed PMI (the 3-month rolling combined manufacturing + non-manufacturing PMI). Even though Spring Festival effects likely accentuated the weakness in the data, it does leave some questions around the outlook for copper prices.

3. Copper and Bonds: Any chance to talk about 10-year bond yields—looking at 2 key intermarket analysis charts there are some slightly mixed signals. The first one, Copper vs the China 10-year Government Bond Yield is showing a slight but noticeable divergence. Either copper is wrong and the conclusion is bearish copper, or the bond market is wrong and Chinese bond yields are set to rise. By contrast the copper/gold ratio has lagged behind the rise in the US 10-year bond yield, and in this one either bond yields have gone too high or copper is due some upside. Given the softness in the PMIs, it may well be that copper and bond yields take a breather.