The Peoples Bank of China (PBOC) announced yesterday, that they would be loosening the reserve requirement ratio (RRR) for all financial institutions by 100 basis points. The regulatory cut potentially increases liquidity within Chinese markets and analysts at Goldman Sachs estimate the total capital release to be in the range of 1.2 trillion RMB. Lacklustre Chinese GDP, softening activity rates, and FX outflows have sought to drain the local market of liquidity and are the likely drivers behind the move.

News of the Chinese stimulus caused the swap curve to steepen and rates to fall by up to 10bps with the 7-day repo rate also falling to 2.81%. It is likely that further steepness to the swap curve is yet to come andthat, with the additional liquidity within the market, sequential growth should eventually lift. Chinese GDP is likely to see more favourable results moving into Q2, 2015, as looser quantitative policies and a potentially resurgent US economy drive growth. The fading out of the effects of China’s seasonal anti-corruption campaign, which is strongest in the early parts of the year, is also likely to provide additional growth.

Although the RRR cut signals the PBOC’s resolve to support the economy, economic data will dictate whether further stimulus is needed. Despite some analysts, promoting the view that further cuts in the range of 150bps to RRR are probable, it will largely depend on Q2’s GDP result. It is likely that the PBOC will give the policy change time to provide its full impact to the market.

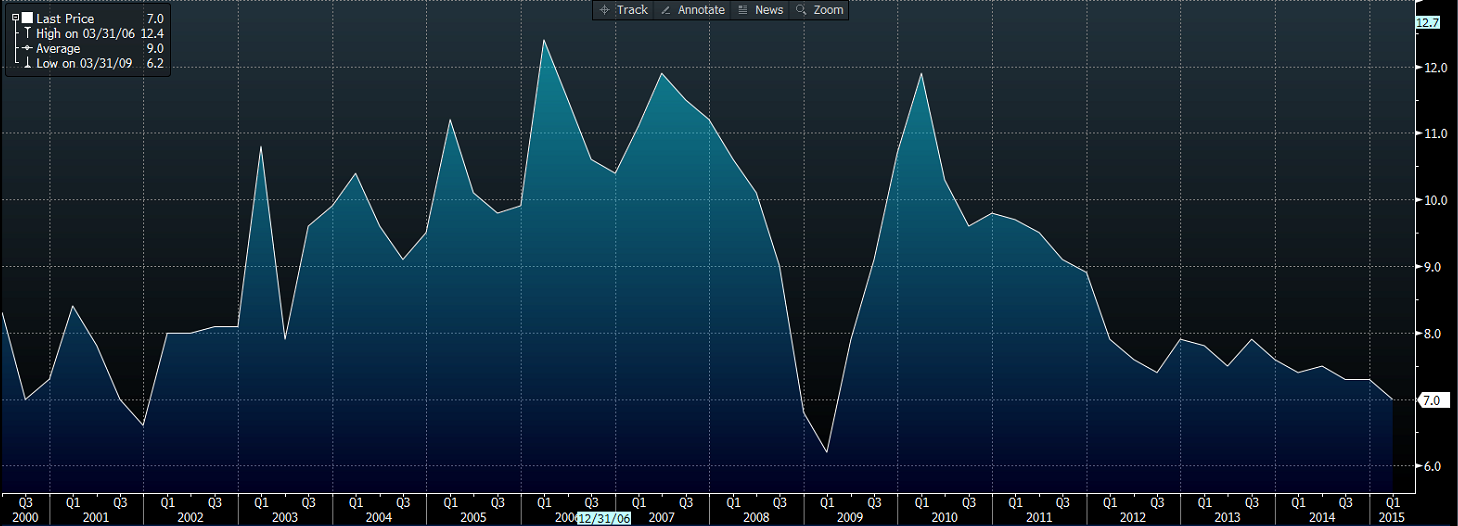

Chinese GDP YoY

Source: Bloomberg

The impact of the additional liquidity within China’s economy is likely to have several effects on Asian currencies, mostly positive. The full value of the RRR cuts is yet to be priced into currency markets and this was mainly due to surprise over the value of the cuts. It is therefore probable that some regional currencies will appreciate over the coming days.

The Hong Kong dollar, in particular, is likely to benefit from increased southbound capital flows as money continues to flow into the Hang Seng. The HKD is likely to trade near the upper limit within the convertibility range causing the Hong Kong Monetary Authority to continue intervention through the purchase of USD.

The Australian Dollar is also likely to receive significant benefit from continued stimulus in China. Australian economic growth has suffered recently due to a downgrade in Chinese growth and subsequent reduction in commodity demand. Additional capital within the Chinese economy is likely to be positive for the AUD and Australian mining stocks.

Arguably, the net effect of any RRR cut is difficult to forecast and the market will need to view the economic data in Q2, 2015, before pricing in the probability of further stimulus by the PBOC. Any subsequent economic weakness is likely to bring substantive and decisive action by China to support the economy.